News: Microelectronics

17 May 2022

Silicon carbide patent analysis shows firms building vertically integrated supply chains

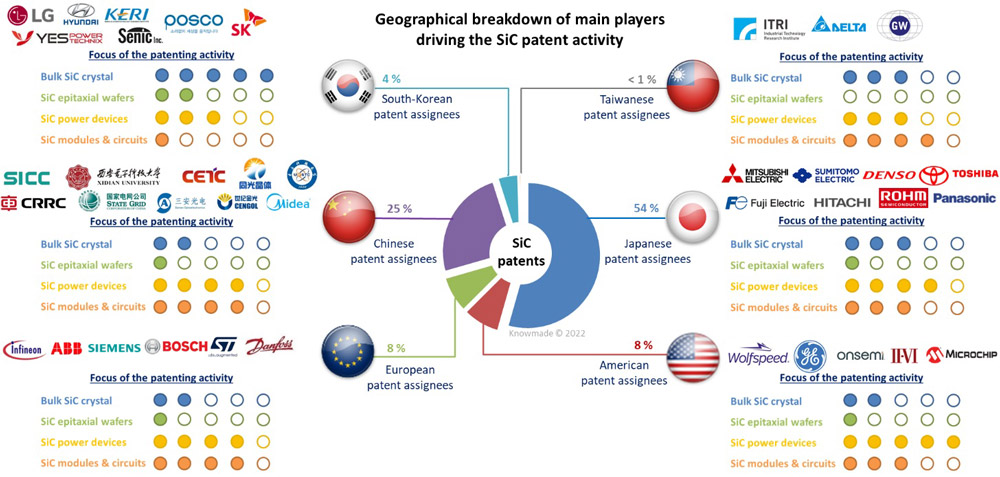

Driven by the adoption of silicon carbide (SiC) technology in electric vehicle (EV) applications, the SiC power device market is growing fast. Earned by companies mainly in Europe (STMicroelectronics, Infineon), the USA (Wolfspeed, onsemi) and Japan (Rohm Semiconductor, Mitsubishi Electric, Fuji Electric), SiC power device market revenues exceeded $1bn in 2021, and are rising at a compound annual growth rate (CAGR) of 34% to more than $6bn in 2027, forecasts market analyst firm Yole Développement.

The semiconductor industry’s other major nations, including China and South Korea, have unveiled their ambitions to develop their own SiC industry. Yet their ability to build the whole supply chain required for power SiC technology in the short- or mid-term has been questioned, especially regarding the establishment of a domestic supply of SiC wafers. Indeed, the entry barrier to the SiC wafer business is remarkably high, as attested by the very limited number of companies currently able to mass produce large-area and high-quality SiC wafers for power device makers, such that they can comply with the stringent device requirements expected from the EV industry.

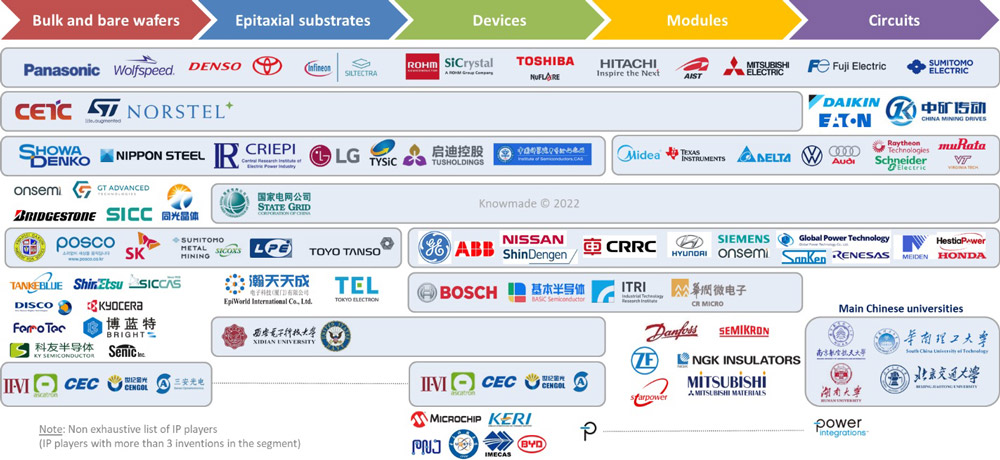

In this context, Knowmade is releasing a new SiC intellectual property (IP) report – based on analyzing more than 13,700 patent families (inventions) filed by more than 500 different entities – that provides a comprehensive view of the power SiC patent landscape along the whole value chain, from bulk SiC and epitaxial SiC substrates to SiC devices, SiC modules and SiC circuits. Specifically, the patent corpus is split into five main supply chain segments and ten main sub-segments: bulk SiC & bare SiC wafers, SiC epitaxial substrates (including growth equipment, finishing), SiC devices (including diodes, planar MOSFETs, trench MOSFETs), SiC modules (including thermal issues, parasitics, die-attach, encapsulation), and SiC circuits.

Figure 1: Main patent assignees along the power SiC supply chain.

“Patent landscape analysis is a powerful tool to identify new players in emerging industries, way before they enter the market, while providing a better understanding of their expertise and know-how in a specific technology,” Rémi Comyn PhD, technology and patent analyst Compound Semiconductors and Electronics at Knowmade. “Overall, the patenting activity (patent filings) reflects the level of R&D investment made by a country or a player in a specific technology, while providing a hint about the technology readiness level reached by the main IP players,” he adds. “What’s more, the technology coverage along the value chain and the geographical coverage of the patent portfolios are narrowly related to the business strategy of IP players.”

Although historical IP players (Wolfspeed, SiCrystal, II-VI) keeps filing new patents, indicating a continuous improvement of their technology, Sumitomo Electric and Showa Denko have taken over IP leadership in the SiC substrate patent landscape. Furthermore, Knowmade’s analysis identifies numerous established IP players in the bulk SiC patent landscape, having the expertise and know-how to join in or spin off new companies in the SiC wafer sector (like SKC establishing Senic in 2021). Especially in China, there is an impressive number of IP players engaged in SiC substrate R&D, and some of them are now stand-out players in the bulk SiC patent landscape (SICC, Synlight Crystal, TankeBlue, San’an).

The patent landscape analysis also identifies the main companies engaged in the development of disruptive technologies addressing the cost and availability issues of SiC wafers (Soitec, Toyota Tsusho/Kwansei Gakuin University, Sumitomo Metal Mining/Sicoxs, Infineon/Siltectra, etc).

While numerous companies are focusing on building a vertically integrated supply chain to secure their SiC business in the long term, few of them have developed strong patent portfolios all along the SiC value chain, the exceptions being Toyota and Denso in Japan.

Figure 2: Geographical breakdown of main players driving SiC patent activity.

Furthermore, many companies may not have anticipated Europe or China as key markets for their power SiC business, and need to strengthen their IP position in these geographic areas. Therefore, most leading companies need to combine internal innovation capabilities with external innovation sources, for example through merger & acquisition (M&A) operations (e.g. onsemi/GTAT, ST/Norstel, Wolfspeed/APEI, Danfoss/Semikron), licensing agreements (e.g. II-VI/GE) or IP collaborations (e.g. Toyota/Denso, Audi/ABB) in order to accelerate the deployment of their SiC technology.

“What’s more, a global innovation strategy is not only important in building vertically integrated manufacturing lines, thereby cutting supplier margins and securing the supply chain internally, it also enables players to not be limited in their development by technological and cost barriers at different levels of the supply chain, from material optimization to module integration.” notes Comyn. “Thus, established players holding key patents at all stages of the supply chain can expect a long-term competitive advantage in the market, while newcomers are facing particularly high barriers to entry in the SiC industry,” he adds. In this regard, the SiC patent landscape report describes the IP strategy of the main players to enhance their access to critical technologies all along the SiC value chain.

Figure 3: Main Chinese patent assignees along the power SiC supply chain.

In the report, Knowmade focused its investigations on Chinese players shaping the emerging SiC supply chain in China. Chinese players are accelerating their patenting activity to support the development of SiC technology and, more importantly, to support the emergence of a complete domestic supply chain and secure their power semiconductor product lines. Chinese patent applicants span the whole supply chain, including relatively well-established IP players in each segment, with a great diversity of players (academic, industrial, foundry, IDM, integrator, pure player, etc) and a dense network of IP collaborations and IP transfers. As a result, the technological gap with foreign suppliers is expected to narrow in most segments of the supply chain. The breakdown of Chinese applicants’ patent portfolios along the power SiC supply chain (as shown in Figure 3) demonstrates that numerous Chinese companies are now present – in terms of IP – in each segment of the supply chain. Comyn recently published an article focusing on the Chinese SiC patent landscape.

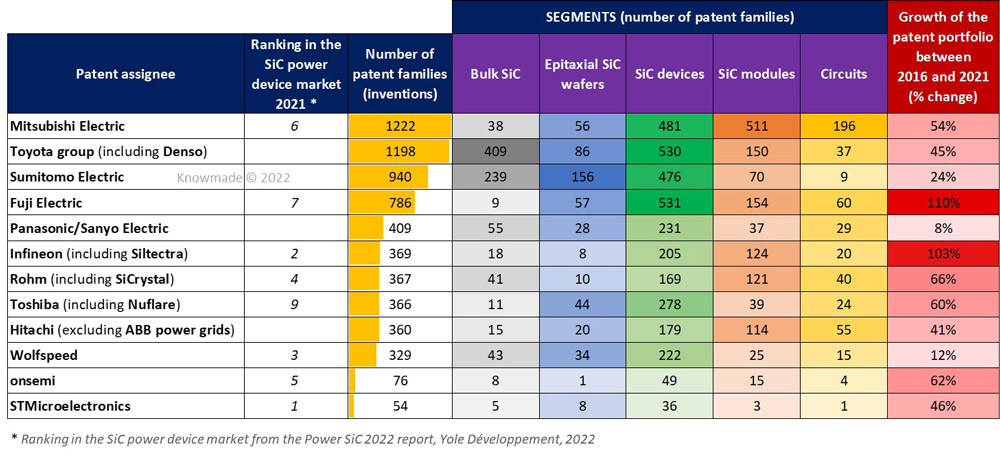

Figure 4: Leading players’ SiC patent portfolio overview.

A significant part of the SiC IP report is dedicated to the in-depth analysis of the SiC patent portfolio owned by the top 10 IP players and top six power device market players: Mitsubishi Electric, Sumitomo Electric, Infineon, Rohm, Toyota/Denso, Wolfspeed, Fuji Electric, Hitachi, Toshiba, STMicroelectronics, onsemi, Panasonic. Knowmade’s IP analysts provide an overview of the patent portfolio (IP dynamics, enforceability, protected countries, technology), highlighting a player’s IP strategy, its strength and its potential for reinforcement. The recent patenting activity of the player is reviewed in the light of recent announcements related to SiC and related challenges.

EVs/HEVs drive power-module-related patent applications