News: Microelectronics

3 February 2021

EVs/HEVs drive power-module-related patent applications

The last decade has seen electric/hybrid electric vehicle (EV/HEV) applications driving packaging innovation in power electronics and creating new equations to solve for module makers, in particular further downsizing, higher power density, higher reliability and lower cost/higher manufacturability. On top of that, automotive OEMs are asking for highly standardized power modules, while most module makers focus on proprietary module designs through which they can offer more differentiating added value. In this context, automotive OEMs and tier-1s are expected to become more and more intrusive in the power module area, according to patent analysis and technology intelligence firm Knowmade’s new ‘Next-Generation Power Modules Patent Landscape 2021’ report, which covers wide-bandgap (WBG) power modules and generic/IGBT (insulated-gate bipolar transistor) power modules addressing critical challenges for the next generation of power modules (heat dissipation, thermomechanical issues, management of parasitic signals, module miniaturization, etc) and, more specifically, challenges arising from EV/HEV high requirements.

Furthermore, EV/HEV applications are also pushing the adoption of new wide-bandgap (WBG) semiconductor technologies, especially silicon carbide (SiC) metal-oxide-semiconductor field-effect transistors (MOSFETs) whose commercial availability has been increasing continuously. However, to fully benefit from power SiC technology, it is crucial to enable high-temperature operation (at 200-300°C) in SiC modules (for example through new packaging materials) as well as high-speed operation (by minimizing parasitic inductance).

As a result, the last decade was marked by extensive innovation in power module design and packaging, leading to a very high number of patent publications.

Knowmade’s analysts have hence selected and analyzed more than 7000 inventions filed by more than 300 different organizations. The report gives a complete analysis of the next-generation power module competition and technology developments regarding patents, with a focus on EV/HEV modules and SiC power modules, which are driving innovation at the design and packaging levels.

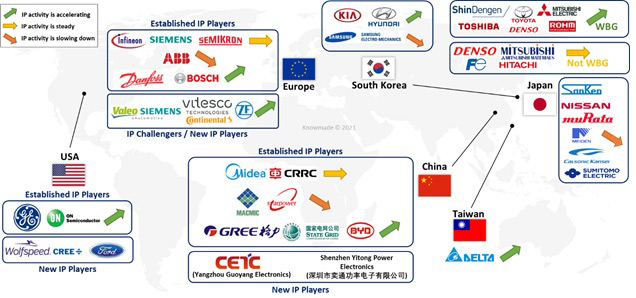

“IP competition is becoming more global and module makers have been progressively joined by competitors from the EV/HEV supply chain,” notes Rémi Comyn PhD, technology & patent analyst Compound Semiconductors and Electronics, at Knowmade. Top module makers in Europe (Infineon, Semikron) and Japan (Mitsubishi Electric, Fuji Electric, Hitachi) have been very active in order to maintain their leadership in the power module patent landscape since 2010. “Interestingly, major foreign module makers are increasingly competing with their counterparts in Europe, by filing more and more European patent applications,” adds Comyn. Certain automotive OEMs (Toyota Motor, Hyundai Motor) and tiers-1 (Denso, Bosch) are now well-established patent assignees. In addition, several notable players from the EV/HEV supply chain have joined the IP competition, including semiconductor manufacturers (Cree/Wolfspeed), OEMs (Ford, BYD) and tier-1s (Valeo, Continental, ZF).

For EV/HEV applications, the difficult challenges have led to several IP collaborations between module makers/automotive tier-1s and automotive OEMs (Hyundai Motor/Infineon, ABB/Audi, Toyota Motor/Denso, Valeo/Siemens, etc. In China, major modules makers (CRRC, Macmic, Starpower) have demonstrated moderate patenting activity as of 2020, while new IP players have stepped up (CETC).

Figure 1: Main patent assignees and their IP dynamics in the next-generation power module patent landscape.

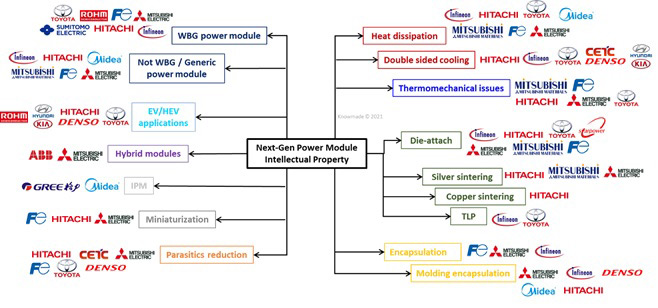

The WBG power module patent landscape is dominated by leading SiC MOSFET IP players. “Numerous IP players in the power module patent landscape have built up a significant portfolio of patents related to SiC MOSFET technologies, especially trench MOSFET technology (Rohm, Infineon, Fuji Electric, Toyota Motor, etc) targeting automotive applications. Accordingly, they now develop their own technology for full-SiC power modules,” notes Comyn. “Most of them already had a foot in power module technology, except Cree/Wolfspeed, which started from APEI’s acquisition filing patents specifically for SiC power modules.”

Knowmade’s anaysts expects the number of patents for SiC power modules to continue growing in the next five years, as development is still on-going for many module makers (at the die and module levels). According to the present segmentation, IP players such as Hitachi, Mitsubishi Electric and Toyota Motor are also developing key technologies (reduction of stray inductance, silver and copper sintering, TLP for die-attach) in order to address WBG-related challenges. Lately, Knowmade has identified several newcomers to the WBG power module patent landscape, including Audi, ON Semiconductor, Danfoss & Shindengen Electric Manufacturing.

Figure 2: IP activity of top patent applicants in the next-generation power module patent landscape.

In the ‘Next-Generation Power Modules Patent Landscape 2021’ report, the body of patents is segmented into the four main challenges that are common to IGBT modules and SiC modules: parasitics, heat dissipation, thermomechanical issues and thermal reliability, and miniaturization. “Overcoming these challenges will be even more critical for SiC power modules to become mainstream, since the added value of the technology depends on their capability to operate at higher switching speed and higher temperature than IGBT modules,” says Comyn.

The patents are also segmented by key technologies that are developed for next-generation power modules, for example die-attach (copper and silver sintering, TLP bonding), encapsulation (transfer molding), and double-sided cooling structure.

Furthermore, the report includes additional segments for patents related to intelligent power modules (IPM), hybrid modules (Si IGBT/SiC diodes or MOSFETs and GaN/Si cascode) and EV/HEV applications.

A significant part of the report is dedicated to the in-depth analysis of the IP portfolios of 40 leading players. Knowmade’s IP analysts provide an overview of the portfolio (IP dynamics, enforceability, protected countries, technology, technical challenges, applications, etc), highlight the noteworthy patents relating new products and technology developments related to WBG, EV/HEV and related challenges, and review the very latest patented inventions.

www.knowmade.com/downloads/next-generation-power-modules-patent-landscape-2021