News: Markets

1 March 2022

Q4 smartphone production sees 9.5% quarter-on-quarter growth, driven by 66% growth for Apple

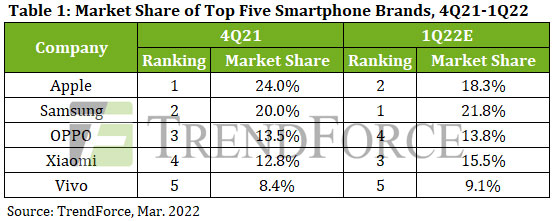

Global smartphone production came to 356 million units for fourth-quarter 2021, showing a quarter-on-quarter (QoQ) increase of 9.5%, according to market research firm TrendForce.

Second-half 2021 saw demand injections related to the peak promotion season for e-commerce platforms and year-end holiday sales. These factors thus bolstered smartphone production and resulted in Q4/2021 seeing the highest QoQ growth rate for the year. Apple’s new iPhones were the primary growth driver. On the other hand, the performance of a few smartphone brands were constrained by the shortage of some key components. Hence, total smartphone production for Q4/2021 was slightly lower than Q4/2020 or even Q4/2019.

Apple took production lead in Q4 with record 85.5 million units

After unveiling the iPhone 13 series in September, Apple started aggressively ramping up shipments of these new devices to meet market demand. Due to its fast-paced sales and marketing rhythms, Apple has been able to take first place in the quarterly ranking of smartphone brands by production market share for many fourth quarters, and Q4/2021 was no exception.

Besides maintaining its top position in the fourth-quarter brand ranking, Apple raised its quarterly iPhone production to a new record of 85.5 million units, a 66% QoQ increase.

Regarding pricing strategy, the prices of the new iPhone 13 models were reasonable for consumers, while the price reductions for the older iPhone models were noticeable as well.

Moreover, the capture of market share left by Huawei can be considered to be the main factor behind Apple’s stellar performance in Q4/2021. Over time, orders for Huawei’s flagship models (i.e. the P and Mate series) have been gradually replaced by iPhone orders.

In terms of annual production, Apple reached 233 million units for 2021, up from almost 200 million units for 2020. Growth was mainly attributed to an expansion of Apple’s market share in China from 10% to 16%.

Samsung took second place in the global brand ranking for Q4/2021 with 71 million units, a 2.9% QoQ increase. In Q2/2021, the spread of COVID-19 outbreaks in Vietnam affected smartphone production facilities in the country and reduced Samsung’s capacity utilization rate. But, apart from that quarter, Samsung’s performance remained stable for the other three quarters of last year. For the ranking of smartphone brands by annual production, Samsung was still the leader for 2021 with 275 million units.

OPPO (including Realme and OnePlus) took third place in the ranking with a quarterly production of 48 million units, a 5.9% QoQ decrease, for Q4/2021. Xiaomi (including Redmi, POCO, and Black Shark) took fourth place with the production of 45.5 million units, a 2.2% QoQ increase. Fifth-ranked Vivo (including iQoo), on the other hand, reduced its smartphone production by 11.8% QoQ to 30 million units. As these three Chinese brands’ target markets and product strategies show significant overlap, their control of key components that are currently in shortage will have a direct impact on their production volumes going forward.

Also, Honor (which was spun off from Huawei in early 2021 and underwent a period of corporate restructuring and component procurement in first-half 2021) experienced a meteoric rise in second-half 2021. Much like other Chinese brands, Honor adopts a sales strategy that primarily focuses on the Chinese market, meaning that its smartphone business will continue to affect OPPO, Xiaomi and Vivo, all of which place a top priority on domestic sales.

Annual smartphone production for 2022 to reach 1.381 billion, despite potential decline

Assuming that the global spread of the COVID-19 pandemic continues to slow, TrendForce expects annual smartphone production for 2022 to see a slight year-on-year increase of 3.6% to 1.381 billion units. Not only is smartphone demand expected to decline in China (the largest consumer market in the world), but other markets will also exhibit only limited growth. Hence, the leading growth drivers will come from both cyclical replacement demand and new demand from emerging markets. Notably, in addition to factors such as foundry capacity allocation, global inflation and energy shortage, whether an economic recovery will bring about positive change for the smartphone market will continue to influence the overall performance of the industry. TrendForce therefore believes that annual smartphone production for 2022 may still face potential downside risks.

Regardless, the recent war between Russia and Ukraine has generated a host of issues including exchange rates, inflation and logistics problems that affect smartphone sales in Eastern Europe. With regards to the market share of smartphone brands in Russia and Ukraine last year, the top three brands by sales included Samsung, Xiaomi and Apple, with a combined 45 million units sold, accounting for 3% of the global total. Preliminary assessments indicate that the ongoing war will not have a drastic effect on smartphone production for 2022, though TrendForce also does not rule out the possibility that the resultant global economic problems may affect overall smartphone demand.

Smartphone production grows just 5.7% in Q3 due to supply chain-related component shortages