News: Markets

30 November 2021

Smartphone production grows just 5.7% in Q3 due to supply chain-related component shortages

The smartphone market is showing an improvement in demand during second-half 2021 due to the peak season for e-commerce promotional activities and the easing of COVID-19 outbreaks in regions such as Southeast Asia, according to the latest report from TrendForce.

However, there have been significant shortages of components including 4G SoCs, low-end 5G SoCs, display panel driver ICs, etc. The persistent component gaps are constraining smartphone brands from raising device production for second-half 2021.

In third-quarter 2021, smartphone production was about 325 million units, up 5.7% quarter-on-quarter. Even so, not only does the quarter-on-quarter increase in smartphone production for Q3/2021 fall short of that for the same quarter last year, but the quarterly production volume also shows weaker performance compared with Q3/2020 or Q3/2019, prior to the emergence of the pandemic.

For full-year 2021 production, TrendForce has lowered its projection for year-on-year growth from 7.3% (to 1.345 billion units) to 6.5% (1.335 billion units), mainly reflecting the impact of the component gaps on device production.

Going forward, an important point is whether the pandemic will further weaken smartphone demand. Other significant variables that will influence future smartphone demand include geopolitical tensions, distribution of production capacity in the foundry market, and global inflationary pressure, reckons TrendForce.

While Q3 smartphone production reached 325 million units, new models helped Apple reclaim second place

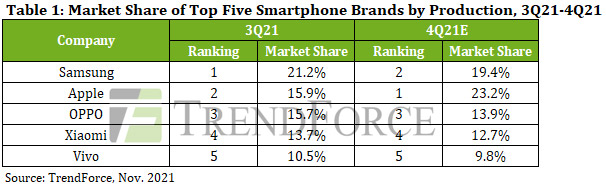

Samsung grew its smartphone production by 17.9% quarter-on-quarter to 69 million units in Q3/2021, attributed mainly to stabilization of capacity utilization rates at its device assembly plants in Vietnam. The firm continued to top the global ranking of smartphone brands with the largest market share in terms of unit production.

Apple launched four new models in the iPhone 13 series in Q3. Thanks to their contribution, total iPhone production for Q3 grew 22.6% quarter-on-quarter to 51.5 million units. Apple hence climbed to second place in the global ranking. In terms of product development, the firm is sticking with its plan to release its third-generation iPhone SE in Q1/2022 and four models under a new series in second-half 2022. The third-generation iPhone SE is expected to be a major instrument in helping Apple to establish a presence in the market segment for mid-range 5G smartphones. Its production volume for 2022 is forecasted to reach 25-30 million units.

OPPO marginally raised its smartphone production by 3% quarter-on-quarter to 51 million units in Q3, capturing third place in the ranking. Xiaomi held fourth place as its smartphone production fell by 10% to 44.5 million units. Vivo’s smartphone production was relatively constant compared with the prior quarter, at about 34 million units, ranking fifth. The production figures of these three Chinese brands include devices under their respective sub-brands (i.e. OPPO’s Realme and OnePlus; Xiaomi’s Redmi, POCO, and Black Shark; and Vivo’s iQoo). Looking at the three brands’ production performances in Q3, TrendForce notes that there is a high degree of overlap in terms of target market as well as a high degree of similarity in their offerings. Hence, their production performances directly hinge on their ability to acquire enough of the components that are now in short supply.

Honor to expand into overseas markets as part of comeback plan

After spending first-half 2021 stocking up on components and undergoing business restructuring, Honor is now on a more solid footing and should achieve annual smartphone production of 43.5 million units, taking eighth place in the global ranking of smartphone brands for full-year 2021.

Also, Honor as an independent brand has obtained access to Google Mobile Services. Therefore, it plans to expand to other markets outside China next year and leverage the sales expertise that it has acquired from Huawei in order gain a bigger share of the overseas markets.

Regarding Honor’s sales strategy as a whole, the main focus is still on the domestic market. As for the overseas markets, Honor will continue Huawei’s strategy and avoid India, where competition revolves around low pricing. Instead, Honor will attempt to establish itself in regions such as Russia, the wider Europe, and South America.

In general, Honor’s rise will likely affect the market shares of the other aforementioned brands. However, how much market share Honor will gain depends on its ability to have sufficient inventory of components that are now in short supply, concludes TrendForce.