News: Microelectronics

23 July 2021

Silicon carbide device market to exceed $4bn by 2026

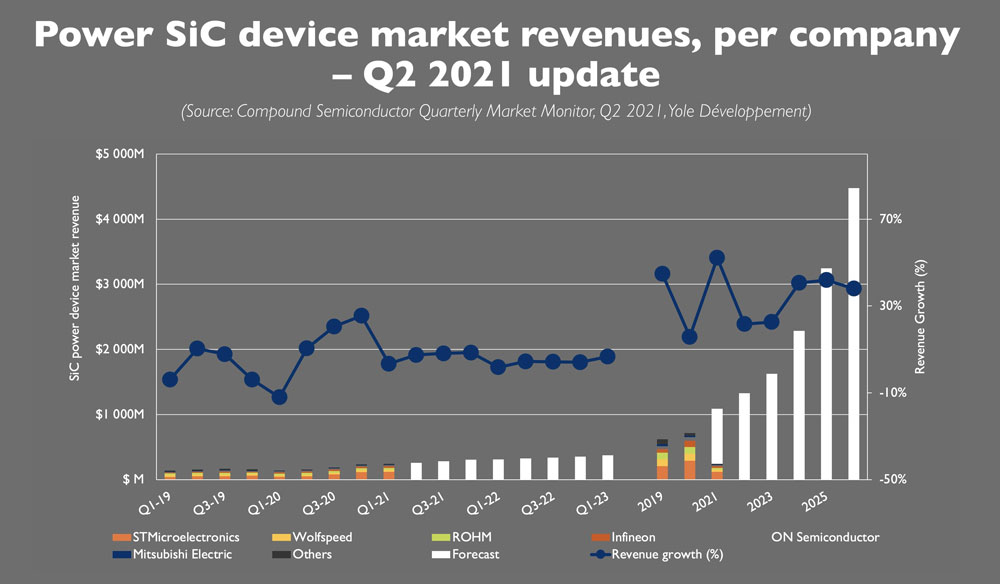

Due to aggressive acquisitions, vertical integration and vast amounts of investment, the silicon carbide (SiC) device market is expected to exceed $4bn by 2026, forecasts market research & strategy consulting company Yole Développement in its Compound Semiconductor Quarterly Market Monitor, Q2-2021.

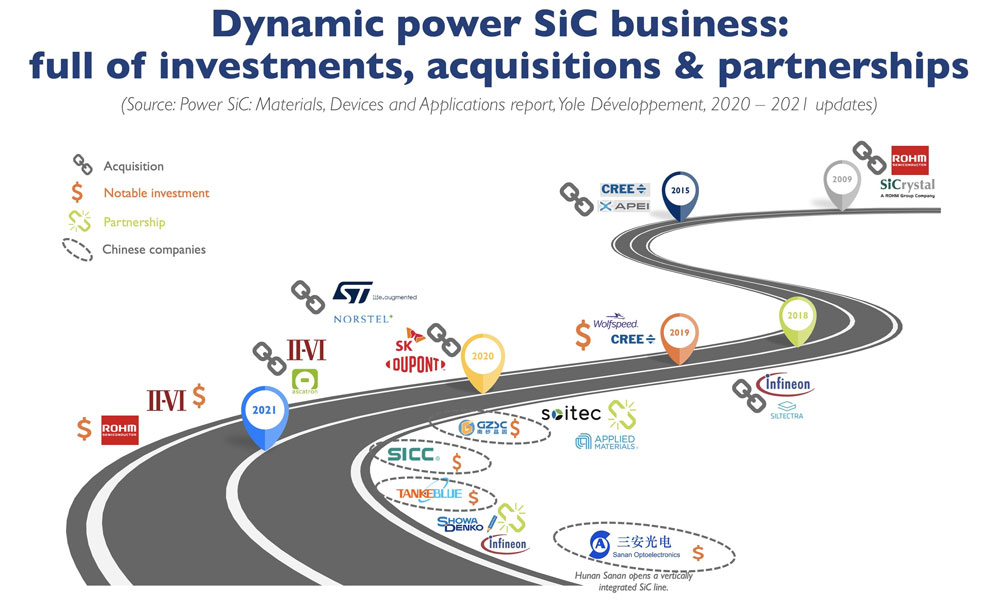

In the last decade, the global SiC arena has been characterized by consolidation, vertical integration, strategic partnerships and cash. Japan’s SiC pioneer Rohm kick-started market activities back in 2009 when it acquired Germany-based SiC wafer manufacturer SiCrystal, and the dynamic market developments have not stopped since.

Rohm has now just completed construction of a $190m SiC wafer and device production plant in Chikugo, Japan. Manufacturing is scheduled to start next year, with up to a five-fold increase in production expected.

Rohm is hardly alone. Like its Japanese competitor, US-based Cree strengthened its position as the leading SiC material and device suppliers and paved the way for the Wolfspeed Power & RF spin-off in 2018. Following the $1bn investment announcement in 2019, Wolfspeed’s 200mm SiC wafer fabrication facility in Mohawk Valley, New York, is well underway, with production of automotive-qualified wafers and devices expected to start in 2022.

Along the way, investment in SiC has been rising from industry players far and wide, with many businesses setting up manufacturing facilities in Asia that will only fuel this dynamic market further, says Yole. This April, US-based SiC wafer supplier II-VI Inc confirmed that it had established a wafer finishing manufacturing line for SiC substrates in Fuzhou, China to increase its overall SiC substrate manufacturing capacity by up to ten times in the next five years. These plans include 200mm SiC wafer manufacturing and underline the importance of the massive Chinese market to II-VI.

Germany’s Infineon has also laid out its intention to increase SiC epitaxial wafer production after signing a two-year contract (including an extension option) with one of the industry’s leading SiC epiwafer manufacturers, Showa Denko of Japan. The partners will develop and supply SiC epiwafers targeting emerging power electronic applications. Following its Siltectra acquisition in 2018, Infineon also intends to ramp up its SiC wafer and boule slicing in the coming years.

China moves

But as investments gather pace around the world, undoubtedly all industry eyes are on China, says Yole. In the last few years, numerous Chinese players have rapidly been preparing to compete on the global SiC stage.

For example, in June Hunan Sanan Semiconductor, a subsidiary of Sanan Optoelectronics, opened China’s first vertically integrated SiC production line that spans the entire supply chain from crystal growth to power devices, packaging and testing. This mighty $2.5bn facility was built in less than a year and can churn out up to 30,000 6-inch SiC wafers per month. And right now, Hunan Sanan’s sister company Sanan IC is producing 650V SiC diodes and qualifying a range of SiC-based devices including 1200V diodes, and 600V and 1200V MOSFETs.

At the same time, myriad Chinese SiC players are either building, or have announced plans to construct, production fabs. In just a few of the many examples, HDSC, GZSC and Tankeblue are each investing more than $100m to build SiC wafer facilities.

But it’s not just the wafer manufacturers that are pouring billions of Yuan into SiC production, says Yole. Chinese OEMs have also been investing in the supply chain to ensure future wafer capacity.

For example, in 2019 Huawei took a 10% stake in SiC materials manufacturer SICC, planning to go public and to build a facility in Shanghai for expanding capacity in the next five years. Industry reports also indicate that the Chinese multi-national has increased its registered capital in SiC epiwafer maker Tianyu Semiconductor from nearly $14m to just over $15m. Both developments signal Huawei’s clear intent to engage more closely with the SiC supply chain.

Similarly, Chinese OEM and car manufacturer BYD recently confirmed plans to raise some $400m from an IPO of its subsidiary BYD Semiconductor. These funds are expected to be ploughed into the semiconductor business, which includes SiC wafers, IGBTs and MCUs. Plans include investing just over $100m in a SiC wafer production line with a monthly production capacity of 20,000 wafers that will target electric vehicle markets.

European developments

Still, as US and Asia players hurry to build more SiC production lines, interesting events are unfolding in Europe. In November 2019, France-based engineered substrate maker Soitec teamed up with US-based equipment maker Applied Materials to install a SiC substrate pilot line at France’s CEA-Leti.

Here, the partners have been developing SiC engineered substrates, based on Soitec’s SmartCut technology, which was pioneered by CEA-Leti and transfers crystalline thin films from a donor substrate to the carrier wafer. Soitec also recently hired CEA-Leti’s CEO Emmanuel Sabonnadière to commercialize this program.

The move to combine Sabonnadière’s intricate knowledge of European SiC supply chains with SmartCut’s potential to slash wafer costs is likely to be a part of a new plan to build a solid European ecosystem. Since its acquisition of Swedish SiC wafer manufacturer Norstel in 2019, it is no longer a secret that the leading European SiC device maker STMicroelectronics is highly focused on internal SiC wafer production to reduce its dependence on external sources.

Could there be a future alliance on the way? If so, how would a European SiC ecosystem develop in the coming years? Many questions arise, but one thing is certain, reckons Yole; the dynamic power SiC industry isn’t going to settle down anytime soon.

Silicon carbide device market growing at 30% CAGR to over $2.5bn in 2025