News: Microelectronics

16 November 2020

Silicon carbide device market growing at 30% CAGR to over $2.5bn in 2025

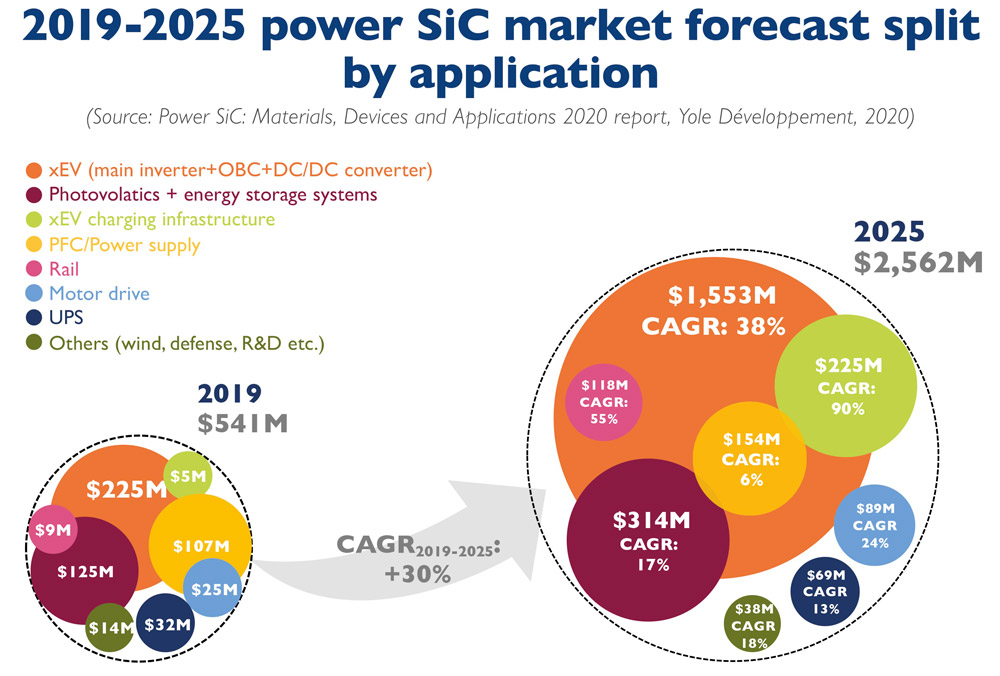

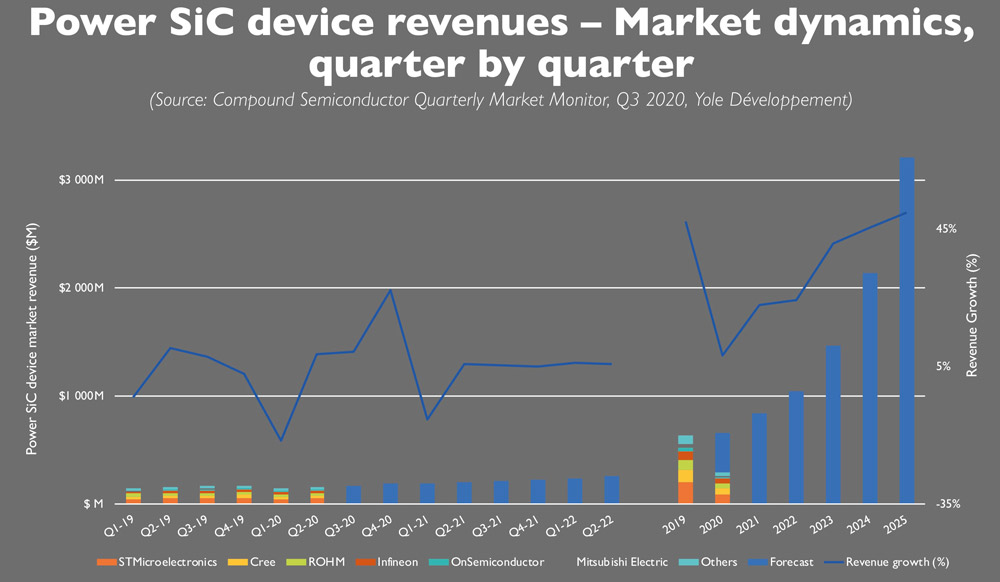

The silicon carbide (SiC) device market is estimated to be rising at a compound annual growth rate (CAGR) of 30%, from $225m in 2019 to more than $2.5bn in 2025, according to the report ‘Power SiC: Materials, Devices and Applications - 2020 edition’ by Yole Développement.

“SiC technologies are gaining the confidence of many customers and are penetrating various applications,” says Ezgi Dogmus PhD, team lead analyst Compound Semiconductor & Emerging Substrates at Yole. “Indeed, driven by EV-related applications, SiC for power electronics applications will for sure grow strongly in the next five years,” she adds.

Due to the COVID-19 pandemic, SiC device and materials market growth in the electric vehicle/hybrid electric vehicle (EV/HEV) sector slowed in first-half 2020 due to lockdown measures and lower production rates at the facilities of both original equipment manufacturers (OEMs) and SiC players. Nevertheless, the market outlook for SiC is positive. Numerous car makers continue qualifying SiC discrete devices or modules in the inverter, on-board chargers (OBCs) and DC/DC converters for their next-generation models. As one of the main drivers of the overall power electronics market, automotive applications are hence expected to remain one of the major markets in the SiC power sector. In this context, the SiC automotive market is expected to grow at a 38% CAGR to exceed $1.5bn in 2025.

Along with EV applications, SiC is of great interest to the charging infrastructure market, which is growing significantly. Indeed, high-power chargers can benefit from SiC’s higher efficiency and higher frequency by offering more compact solutions than silicon-based insulated-gate bipolar transistors (IGBTs). This market is growing at a 90% CAGR from just $5m in 2019 to $225m in 2025, reckons Yole.

Besides the automotive sector, applications such as photovoltaics (PVs), rail and motor drives will also show double-digit CAGRs in the 2019-2025 period.

Technical and commercial development

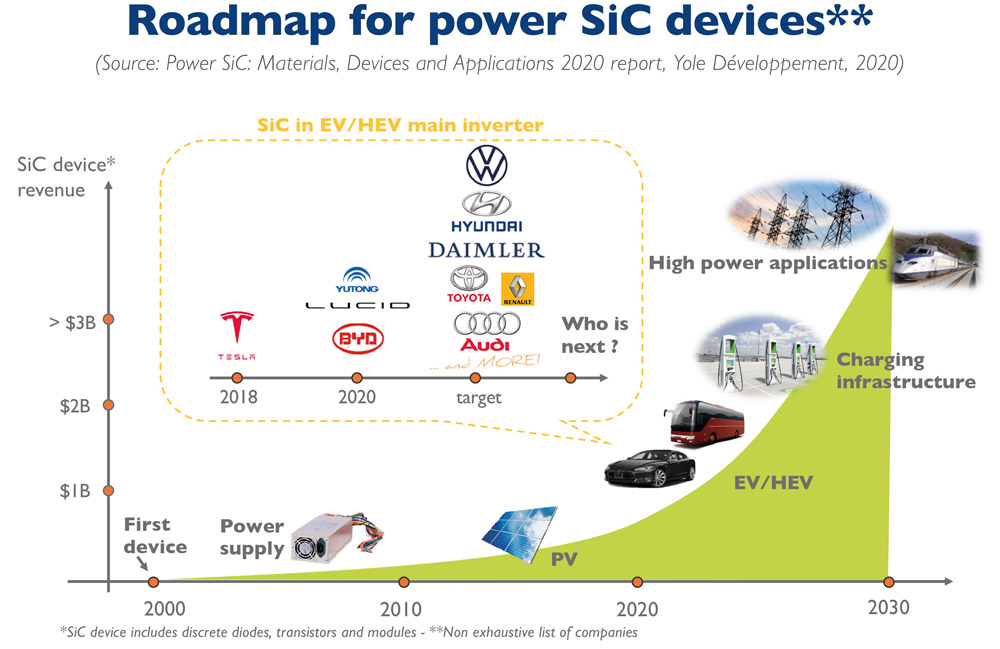

Since the commercialization of the first SiC devices in 2001, their performances and value have gradually been proven. Their price has also become increasingly attractive to end users.

“SiC transistors still have some technical and commercial challenges to face, despite the value they add,” comments Amine Allouche, technology & cost analyst at System Plus Consulting. “These include the wafer price and the complexity of some process steps, specifically SiC etching and high-temperature implantation. These challenges still hinder SiC adoption on a large commercial scale.”

In parallel, the performance and added value of SiC diodes have also been demonstrated. Now, their price has also become increasingly acceptable to end users.

The report ‘SiC Diodes Comparison 2020’ from System Plus Consulting gives a benchmark overview of the various SiC diodes available on the market and analyzes 11 of them from seven of the main SiC diode suppliers. “The 11 SiC diodes are spread across three voltage classes: 650V, 1200V, and 1700V,” explains Allouche. “Devices from Infineon Technologies, Wolfspeed, Rohm, STMicroelectronics, ON Semiconductor, Microsemi and UnitedSiC have been analyzed. They target different power applications, including two AEC-Q101-qualified SiC diodes.”

The report ‘SiC Transistors Comparison 2020’ from System Plus Consulting includes 29 SiC transistors: 25 SiC MOSFETs and four SiC JFETs, in five voltage classes. Developed by Rohm, STMicroelectronics, Wolfspeed, Infineon Technologies, Littelfuse, ON Semiconductor, Microsemi and UnitedSiC, they target various power applications, including two automotive-qualified devices.

Substrate supply

In 2018, the increase in SiC wafer demand as well as the transition from 4” to 6” diameters resulted in wafer shortages. Consequently, securing wafer supply has become the priority for device makers.

“Facing growing demand, wafer suppliers such as Cree, II-VI, SiCrystal (a ROHM company), Tankeblue, SiCC and many others have invested heavily to expand their capacity,” notes Poshun Chiu, technology & market analyst Compound Semiconductors & Emerging Substrates at Yole. “Numerous device manufacturers such as STMicroelectronics, Infineon Technologies and ON Semiconductor have signed several long-term wafer supply agreements with Cree, SiCrystal and GTAT. The value of long-term agreements in 2019-2020 amounted to more than $900m, notes Yole. In parallel, Korea’s SKSiltron acquired Dupont’s SiC wafer business and STMicroelectronics completed the acquisition of Norstel,” he adds.

Following US-China trade tensions, Chinese players have accelerated their plan to create a domestic SiC supply chain. More than $2bn has been invested by Sanan, Tankeblue, SICC and other Chinese suppliers spanning wafer and epiwafer fabs and packaging.

Silicon carbide module market

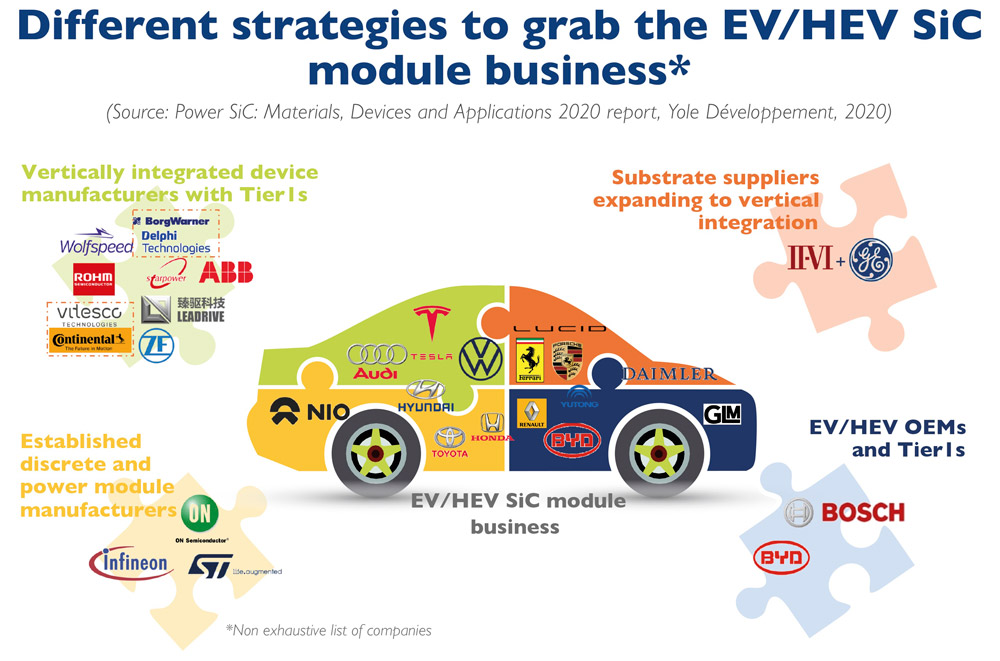

In 2020, substrate supplier II-VI made an important step toward vertical integration in the SiC module business. By acquiring Ascatron and Innovion and licensing GE’s SiC module technology, the firm has internalized the epi and device manufacturing steps. II-VI’s strategy was clearly to secure new business in the growing module market.

“The SiC market is very dynamic, with lots of investments as well as partnerships to accelerate the time to market,” concludes Ahmed Ben Slimane, technology & market analyst, Compound Semiconductors & Emerging Substrates at Yole.

Regarding the module business, during 2019-2020 Cree partnered with StarPower, ABB, ZF and Delphi on SiC-based powertrain systems for electric cars and e-buses, while ROHM teamed up with Vitesco and Leadrive Technologies to work on SiC powertrain solutions. Automotive tier-1 player Bosch is also internally developing SiC modules, Yole notes.

Silicon carbide power device market growing at 29% CAGR to $1.93bn in 2024, driven by EV market