News: Suppliers

14 March 2022

Aixtron grows revenue 59% and orders 65% in 2021, driven by power electronics

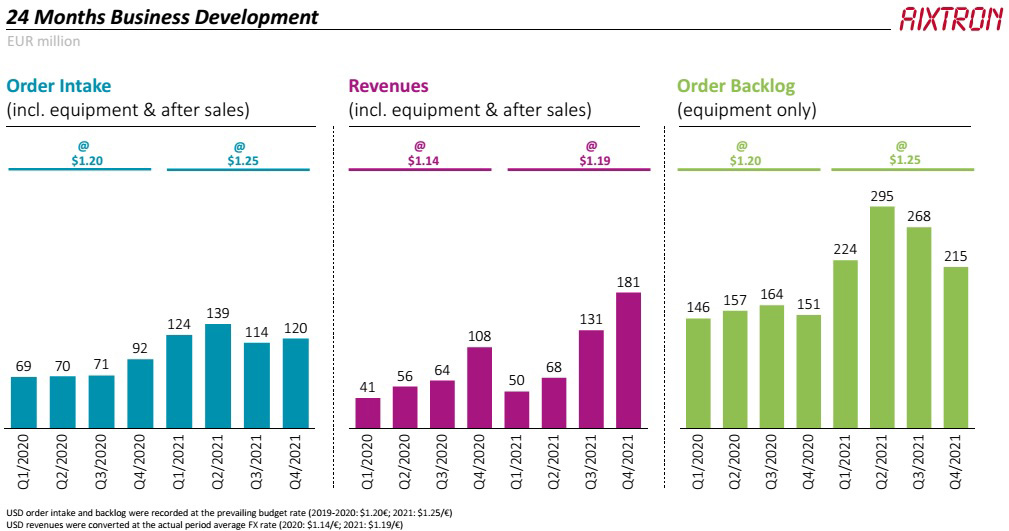

For fourth-quarter 2021, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €180.9m (the highest for 10 years), up 38% on €130.8m in Q3 and up 67% on €108.1m a year ago.

Full-year revenue grew 59% from €269.2m in 2020 to €429m in 2021 (the highest since 2011), within the revised guidance range of €400-440m (which had been raised last June far above the initial guidance of €320-360m).

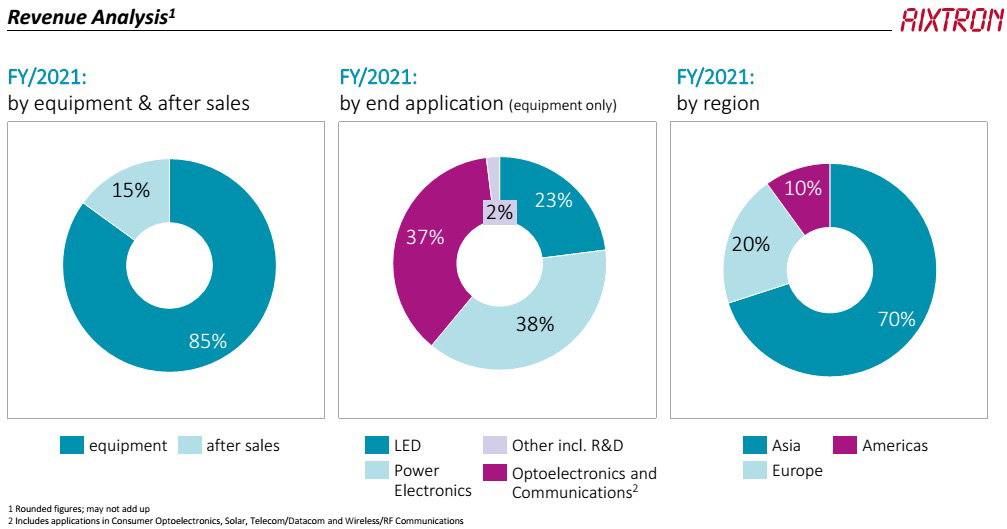

On a geographic basis, Asia fell from 73% to 70% of revenue and the Americas from 12% to 10%, while Europe rose from 15% to 20%.

“Given the constrained global supply chain and logistics, our team did a fantastic job in achieving exception output and results,” comments CEO & president Dr Felix Grawert.

Of total revenue, €366.5m (85%) came from equipment sales (up 64% from €223m in 2020), while €57.6m came from spares sales (up 39.5% from €41.3m) and €4.8m from services.

“Demand growth is fueled by a broad base of application segments coming from the global mega-trends of sustainability, electrification, and digitization,” says Grawert. “In some areas such as power electronics, compound semiconductors are moving from being specialty and niche material to become the workhorse in some of these segments of the semiconductor volume market.”

Of the equipment revenue of €366.5m, metal-organic chemical vapor deposition (MOCVD)/chemical vapor deposition (CVD) equipment for making gallium nitride (GaN)- and silicon carbide (SiC)-based power electronics devices doubled year-on-year to €139.7m, now comprising the largest share of equipment revenue (at 38%, up from 31% last year).

MOCVD equipment for making optoelectronics devices (telecoms/datacoms and 3D sensing lasers for consumer electronics, solar, and wireless/RF communications) grew by 87% year-on-year to €137m (37% of equipment revenue, up from 33% last year).

MOCVD equipment for making LEDs rose by 39% (although the share of equipment revenue fell from 27% in 2020 to 23% in 2021).

Quarterly gross margin has grown further, from 42% a year ago and 43% in Q3/2021 to 44% in Q4, due mainly to a higher mix of better-margin products. Full-year gross margin rose from 40% in 2020 to 42.3% in 2021 (exceeding the expected 40%, due mainly to the strong increase in the US$ exchange rate in Q4).

Quarterly operating expenses rose only slightly from €21m in Q4/2020 to €22m in Q4/2021, but full-year operating expenses rose from €73.5m in 2020 to €82.5m in 2021, due partly to higher variable-compensation expense plus €3.9m in one-time expenses for the restructuring and wind-down of Aixtron’s South Korea-based organic light-emitting diode display (OLED)-focused subsidiary APEVA. In particular, sales, general & administrative (SG&A) expenses rose by €7.7m from €27.7m to €35.4m. In 2021, it became apparent that the market will choose micro-LED technology for the development of next-generation displays even faster than originally expected, says Aixtron. APEVA’s shareholders hence decided not to invest further.

Aixtron maintained its R&D spending at a high level of €56.8m (13% of revenue) in 2021, as the lower development expenses for APEVA’s OLED technology were largely offset by increased spending for the development and completion of Aixtron’s next-generation MOCVD equipment (for applications including power electronics and micro-LEDs).

Also as a result of restructuring APEVA, during 2021 Aixtron’s total staffing fell from 728 to 718, despite strong growth in the number of employees in the core MOCVD business.

The quarterly operating result (EBIT, earnings before interest and taxes) has more than doubled year-on-year (up by 136%) from €24.5m (EBIT margin of 23% of revenue) in Q4/2020 then €36.2m (28% margin) in Q3/2021 to €57.9m (EBIT margin of 32%) in Q4/2021. Full-year EBIT rose almost threefold (by 184%) from 2020’s €34.8m (EBIT margin of 13%) to €99m for 2021 (EBIT margin of 23.1%, exceeding the 20-22% guidance range, which had been raised last June from 18%). “The 184% higher EBIT at 59% higher revenue in 2021 proves the strong operating leverage effect we have on higher revenues, translating over proportionately into bottom-line earnings,” says chief financial officer Dr Christian Danninger.

Quarterly net profit has more than doubled from €24.9m (23% of revenue) a year ago and €31.4m in Q3/2021 (23% of revenue) to €51.9m (29% of revenue) in Q4/2021. Full-year net profit hence grew by 175% from €34.5m (13% of revenue) in 2020 to €94.8m (22% of revenue) for 2021.

Operating cash flow was €25.2m in Q4/2021. Full-year operating cash flow was €66.4m (up from just €23.3m in 2020). Capital expenditure (CapEx) was €4.3m in Q4 (making €17.7m for full-year 2021), largely comprising investments in next-generation MOCVD equipment for Aixtron’s laboratories.

Free cash flow was hence €20.9m in Q4/2021. Full-year free cash flow was €48.7m (up from just €14m in 2020), due mainly to the increase in net income and a near doubling in trade receivables (from €41.3m to €81m, following the high volume of deliveries made in Q4).

Cash and cash equivalents (including financial assets) have hence still risen further, from €309.7m at the end of 2020 and €330.7m at the end of Q3/2021 to €352.5m at the end of Q4/2021, despite a €12m dividend payment in May.

Inventories rose from just €79.1m at the end of 2020 to €120.6m at the end of 2021 in preparation for the high number of deliveries planned in 2022.

Dividend payment raised for 2022

In view of the successful 2021 results, at the annual general meeting (AGM) of shareholders on 25 May Aixtron’s executive board and supervisory board will propose to pay a dividend of €0.30 per share (up from €0.11 per share in 2021), a payout ratio of 35% of the firm’s net income.

Order growth of 30% year-on-year driven by power electronics

Quarterly order intake has grown further, to €119.7m in Q4/2021, up 4.8% on €114.2m in Q3/2021 and 30% on €92.2m in Q4/2020, driven mainly by GaN and SiC power electronics applications tripling year-on-year to almost 45% of order intake. Demand for SiC deposition equipment developed positively, particularly in Q4 (when it comprised 15% of equipment orders, compared with GaN power comprising about a quarter of equipment orders). In addition, there was continued strong demand for the wireless and optical data communications sectors as well as LED display sectors (both fine-pitch and micro-LED). Full-year order intake was hence up by 65% from 2020’s €301.4m to €497.3m for 2021 (the highest since 2011). This exceeds the revised guidance, which had previously been raised in June from €340-380m to €420-460m then again in late July to 440-480m.

Equipment order backlog has hence risen by 42% during 2021, from €150.9m to €214.6m.

Double-digit growth expected in 2022

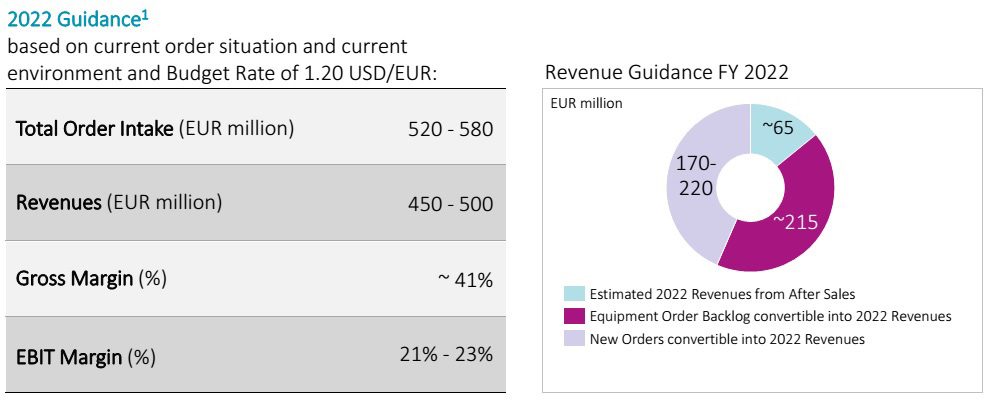

Based on the order situation and the budget rate of $1.20/€ (versus $1.25/€ in 2021), Aixtron expects double-digit growth in full-year order intake to €520-580m for 2022.

Based on the equipment order backlog (convertible into 2022 revenue) of €215m as of 1 January, joined by a forecasted €170-220m in new order intake that should be convertible into revenue during 2022, plus a forecasted €65m in after-sales revenue, Aixtron expects double-digit growth in full-year revenue to €450-500m in 2022.

Full-year gross margin should be about 41% and EBIT margin 21-23% for 2022.

“This guidance include our R&D spending from the completion of the development of our next-generation products, as well as our activities that strengthen our organization in anticipation of further growth ahead of us,” notes Grawert. “We had made our guidance based on the assumption that our business will not be impacted by any global crisis or pandemic,” he adds.

Aixtron ships AIX 2800G4-TM and AIX G5+ C MOCVD systems to HC Semitek

Nexperia using Aixtron equipment as it enters silicon carbide power electronics market

Aixtron’s revenue almost doubles in Q3/2021

Aixtron doubles EBIT in first-half 2021 as revenue grows 21% year-on-year

Aixtron’s Q1 revenue up 21% year-on-year, driven by optoelectronics