News: Markets

31 January 2022

Smartphone shipments down 3.2% year-on-year in Q4, but full-year 2021 still up 5.7%

In fourth-quarter 2021, global smartphone shipments declined year-over-year for a second consecutive quarter. However, despite a challenging second half of the year, full-year shipments still grew due to a strong first half, according to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. Smartphone vendors shipped a total of 362.4 million phones during the holiday quarter (Q4/2021), which was down 3.2% year-on-year but slightly better than IDC’s forecast. On an annual basis, the market grew 5.7% in 2021, with 1.35 billion smartphones shipped.

“The second half of 2021 failed to meet expectations, with volumes declining 4.5% compared to the second half of 2020,” says Ryan Reith, group vice president with IDC’s Worldwide Mobile Device Trackers. “The supply chain and component shortages started to have meaningful impact on the smartphone market as we entered the second half of the year, and this continues to be the case as we’ve now entered 2022,” he adds. “We expect to see supply and logistical challenges continue through the first half of this year, but we currently believe we’ll return to growth in the second quarter and second half of 2022. There is no question that demand is still strong in many markets, and to some extent we are seeing increasing consumer interest in 5G and new form factors like foldables.”

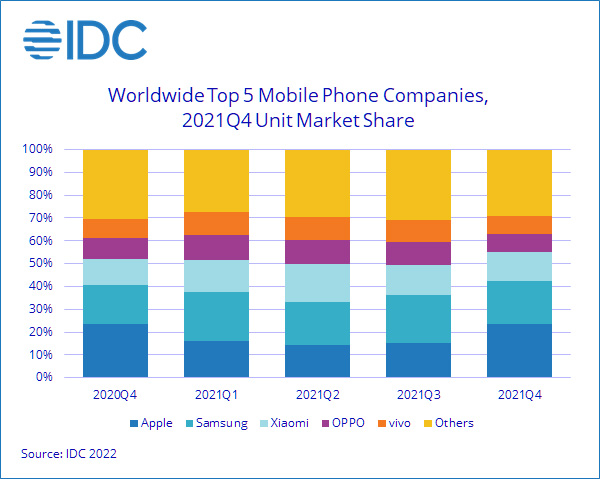

Despite a slight year-over-year decline in shipments, Apple had a good holiday quarter, once again jumping above Samsung into the top spot. Its supply chain strength was on display more than ever in fourth-quarter 2021. iPhone 13 SKUs were an impressive portion of volumes in the holiday quarter, driving strong growth in overall iPhone average selling prices (ASPs).

Samsung and Xiaomi followed with the second and third spots. These were the only vendors of the top five that grew shipments year-on-year in Q4/2021, IDC notes. OPPO and vivo rounded out the top five.

For full-year 2021, all five vendors grew shipments year-over-year, with four out of five achieving double-digit growth. While Xiaomi had the highest annual growth (reaching almost 30%), Samsung had the lowest (just 6% growth). This contrast clearly illustrates which vendor benefitted the most from the massive decline of Huawei this year.

Apple too had healthy annual growth of 15.9% in 2021 for reasons already mentioned as well as due to the 40% growth in China in 2021.

“The fact that 2021 would have come in drastically higher if it were not for the supply constraints adds even more positivity to the healthy 5.7% growth we saw for 2021,” comments Nabila Popal, research director with IDC’s Mobility and Consumer Device Trackers. “There is significant pent-up demand in almost all regions. Even in China, where there are some challenges around weakening consumer demand, the market performed much better in the fourth quarter than expected – 5% better to be exact – albeit still a year-over-year decline. With channel inventory low in almost all regions and as supply constraints ease up towards the middle of the year, IDC expects this pent-up demand to drive the market toward healthy growth in 2022.”

Smartphone market to fall 7.9% from $458.5bn in 2019 to $422.4bn in 2020