News: Suppliers

21 February 2022

Veeco grows revenue 28% in 2021

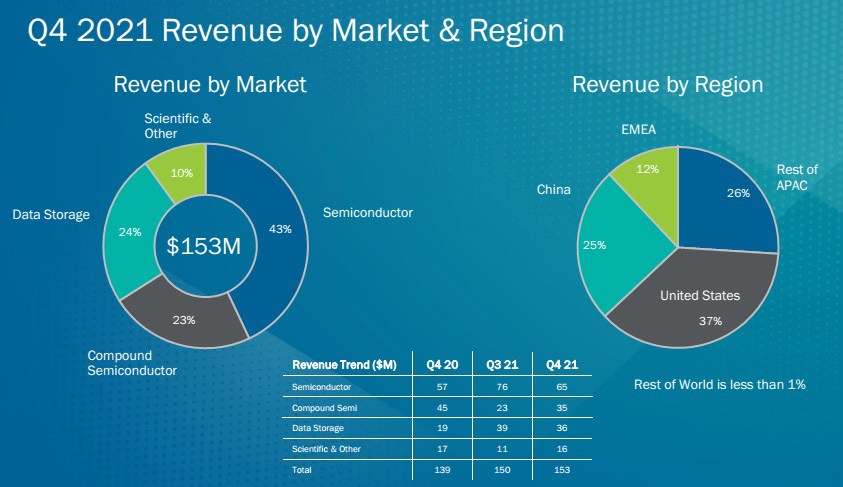

For fourth-quarter 2021, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $153m, up 1.8% on $150.2m last quarter and 10.2% on $138.9m a year ago, driven primarily by strong performance in the semiconductor market.

Semiconductor (Front-End and Back-End, as well as EUV Mask Blank systems and Advanced Packaging) contributed $65.4m (43% of total revenue), up 13.9% on $57.4m a year ago. This is driven by (1) multiple multi-tool orders from a variety of customers for laser annealing (to add capacity for advanced nodes as well as trailing-node applications) and (2) advanced packaging lithography systems (since demand remains high for applications such as flip-chip bumping, fan-out wafer-level packaging and heterogeneous integration).

Compound Semiconductor (Power Electronics, RF Filter & Device applications, and Photonics including specialty, mini- and micro-LEDs, VCSELs, Laser Diodes) contributed $34.7m (23% of total revenue), up 48.9% on $23.3m (15% of revenue) last quarter, driven by multiple shipments of wet-processing systems to photonics customers as well as 5G RF customers adding filter and power amplifier capacity.

Data Storage (equipment for thin-film magnetic head manufacturing) contributed $36.5m (24% of total revenue), down 7.1% on $39.3m last quarter.

Scientific & Other (research institutions and other applications) contributed $16.3m (10% of total revenue), up 43% on $11.4m last quarter.

By region, the Asia-Pacific region (excluding China) comprised 26% of revenue (down on 48% a year ago) driven by semiconductor system sales, the USA 37% (up on 26%) driven by data storage customers, China 25% (up on 14%) driven primarily by semiconductor systems (with particular strength in trailing-node laser annealing) as well as compound semiconductor systems (led by wet-processing and ion-beam systems for RF power amplifiers), and Europe, Middle-East & Africa (EMEA) 12% (level year-on-year), with the rest of the world remaining less than 1%.

“I think of 2021 as an inflection point at Veeco, where we completed our transformation, and we’re now squarely executing our growth strategy,” says CEO Bill Miller. “We continued our focus on innovation with R&D projects supporting laser annealing, ion-beam deposition for semiconductor applications, and MOCVD [metal-organic chemical vapor deposition] for power electronics and photonics applications.”

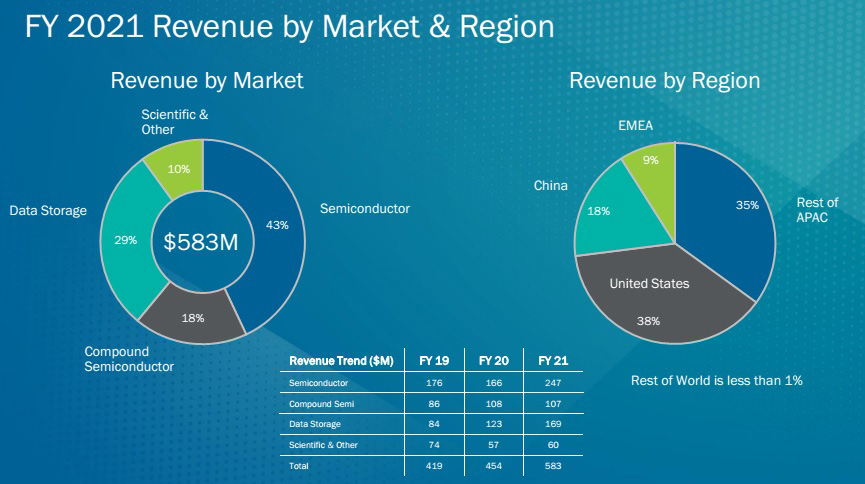

Full-year revenue grew by 28% from $454.2m in 2020 to $583.3m for 2021 (exceeding the revised guidance of $580m, and the initial guidance of just 10% growth), driven by Semiconductor and Data Storage performance.

Semiconductor contributed $247.1m (43% of total revenue), up 49% on 2020’s $165.9m (36% of revenue). “We had a record year in our semiconductor market, and we had a record year with our wet-processing systems,” says Miller.

Compound Semiconductor contributed $107m, roughly flat on 2020 (although shrinking from 24% to 18% of total revenue). However, normalizing for about $20m of one-time commodity LED-related MOCVD system sales of slow-moving inventory in 2020, this represents underlying growth in the areas where Veeco is now focused.

Data Storage contributed $168.8m (29% of total revenue), up 37% on 2020’s $123.3m (27% of revenue), as hard-disk-drive customers continued adding capacity for their thin-film magnetic head manufacturing.

Scientific & Other (research institutions and other applications) contributed $60.5m (10% of total revenue), up 6% on 2020’s $57m.

By region, the Asia-Pacific (excluding China) comprised 35% of revenue (down from 39% in 2020) due mainly to semiconductor customers, the USA 38% (up from 32%) driven by data storage customers, EMEA 9% (down from 16%), and China 18% (up from 13%), with the rest of the world remaining less than 1%.

On a non-GAAP basis, full-year gross margin has fallen from 43.3% in 2020 to 42% for 2021. However, despite falling from 42.6% last quarter, Q4/2021 gross margin was 42.4%, still up on 41.3% a year ago.

“We were able to maintain this level of gross margin in spite of the challenging supply chain environment while continuing to invest in service capabilities and supporting our evaluation systems in the field,” chief financial officer John Kiernan. “Throughout 2021, we saw increasing challenges as the year progressed and experienced higher logistics costs, inflationary pressures on materials and longer lead-times. Our supply chain team has done a fantastic job of mitigating most issues they encountered,” he comments. “For the year, there was about a one percentage point impact to our gross margin. We expect the situation to be similar for a few more quarters, the impact of which has been incorporated in our previously provided guidance for 2022.”

Operating expenses were $40m, roughly level with $39.6m last quarter and $39.7m a year ago (and below the expected $41-43m). Full-year operating expenses rose from $144m in 2020 to $158.5m for 2021, reflecting R&D investments made to drive future growth as well as higher variable SG&A expenses associated with an increase in revenue and order intake. However, OpEx as a percentage of revenue was reduced year-on-year from 32% to 27%, providing operating leverage to the company.

Net income has risen further, from $15m ($0.30 per diluted share) a year ago and $20.5m ($0.40 per diluted share) last quarter to $22.6m ($0.43 per diluted share), near the top end of the guidance of $14-23m ($0.27-0.45 per diluted share). Full-year net income has grown from $42.3m ($0.86 per diluted share) in 2020 to 2021’s $73.6m ($1.43 per diluted share, up 66%, and exceeding the $1.35 guidance).

CapEx during the quarter fell back to $9.2m (including $8m used for the build-out of the new facility in San Jose), bringing full-year CapEx to $41m (including $31m used for the expansion). “We made great progress on our capacity expansion and shipped first systems from the new San Jose facility [expecting to be fully transitioned into the new space by the end of Q3/2022, providing twice the manufacturing output of the existing San Jose facility], and we enhanced both our service capability and our service offerings, focusing on our customers’ needs for system uptime and spare-parts availability,” says Miller.

Cash flow from operations was $17m in Q4, and $68m for full-year 2021 (up 58% year-on-year).

However, cash and short-term investments fell by $111m from $336m to $225m, due mainly to convertible notes repurchased during the quarter.

In Q4, Veeco repurchased $112m of convertible notes (due in January 2023) for $117m in cash (leaving just $20m of 2023 notes remaining, together still with $133m and $125m of convertible notes due in 2025 and 2027, respectively). With long-term debt cut by $102m to $229m (represents the carrying value of the total $278m of convertible notes remaining), annual cash interest expense has hence been cut from $12.9m to $9.9m.

In 2021, Veeco also entered into a $150m revolving credit facility. “With our improved balance sheet, along with our credit facility, we have the flexibility and capital to focus on driving long-term growth across the business,” believes Kiernan.

“We successfully advanced our product innovation and penetrated new customers, enhanced our service capabilities, increased our manufacturing capacity, improved our capital structure, solidified our governance and commitment to corporate responsibility,” summarizes Miller.

“Demand in our semiconductor and compound semiconductor markets is exceptionally strong and we exited 2021 with order momentum, increased backlog and exciting opportunities that will support our growth strategy,” he adds.

Order intake grew faster than revenue throughout the year, with order bookings of $661m in full-year 2021, yielding a book-to-bill ratio of 1.13.

Order backlog is hence $440m, up 20% year-on-year. By market segment, Semiconductor backlog more than doubled and Compound Semiconductor backlog grew by 47%, while Data Storage backlog fell by 51% as customers slowed the pace of new orders for capacity additions.

“With Q4’s performance, we exit 2021 on a positive note with strong order momentum, increased backlog and focus on execution,” says Miller.

For first-quarter 2022, Veeco expects revenue of $145-165m, gross margin of 42-44%, operating expenses of $42-44m, and net income of $15-26m ($0.28-0.44 per diluted share).

“We’re currently experiencing strong demand from laser annealing, EUV mask blank production and advanced packaging, and expect this demand to continue and drive significant semiconductor growth in 2022,” says Miller.

“We expect significant growth in the compound semiconductor market in 2022, which is based on our backlog and visibility of MOCVD and other systems selling primarily into photonics applications and, secondarily, GaN power,” notes Kiernan. “We’re beginning to see traction in the photonics market with a recent announcement for a multi-system order for our Lumina platform,” says Miller. “Longer term, we believe we’re well positioned for the micro-LED and 8-inch GaN power opportunities with both our Lumina and Propel platforms.”

Based on the improved backlog and current visibility (expecting slightly higher revenue in second-half 2022 than first-half 2022), Veeco is reaffirming its recently provided full-year 2022 revenue outlook of $640-680m. This would be up 13-14% year-on-year, driven mainly by 35% growth in both the Compound Semiconductor market and the Semiconductor market (including nearly 50% growth for laser annealing systems, which will be Veeco’s largest business in 2022), more than offsetting a 35% drop for Data Storage. Also, Veeco continues to target diluted EPS of $1.50-1.70 per share.

“We expect to grow revenue in 2022, while improving our gross margin as we make progress toward our long-term target model [of 45%],” concludes Miller.

Veeco announces new $150m senior secured credit facility

Veeco’s Q3 revenue up 34% year-on-year to $150m

Veeco repurchasing $111.5m of 2.70% convertible senior notes due 2023

Veeco receives multi-system order for new dual-technology platform

Veeco’s Q2 revenue up a more-than-expected 48% year-on-year to $146.3m