News: Markets

7 April 2022

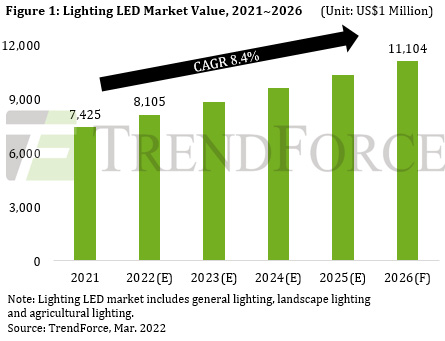

LED lighting market growing at 8.4% to $11.1bn in 2026

According to TrendForce’s ‘Global LED Industry Data Base and LED Player Movement Quarterly Update’ report, demand for high-standard LED products in the lighting market is entering a growth stage. Generally speaking, the price of lighting LED products is stable. However, due to the recent rise in global raw material prices, the unit price of products looks to be trending higher. Coupled with high demand for energy conservation from governments around the world, the output value of the lighting LED market in 2022 is forecast grow by 9.2% year-on-year to $8.11bn. In the next few years, the scale of the lighting LED market will continue growing due to the promotion of human-centric lighting (HCL), smart lighting and other factors, and is estimated to be rising at a compound annual growth rate (CAGR) of 8.4% from 2021 to $11.1bn in 2026, adds the report.

TrendForce further states that, despite the continuing impact of the COVID-19 pandemic in 2022, the pervasiveness of vaccines and the recovery of economic activity coupled with the rigid demand associated with the lighting market as a daily necessity, global ‘carbon neutrality’, and the growing requirements of the energy conservation agenda, have moved numerous major powers to realize net-zero emission through measures such as energy efficiency and low-carbon heating in recent years.

However, lighting is a leading energy consumer in buildings, accounting for 20-30% of total building energy consumption. LED penetration will hence deepen, driven by high demand for energy conservation and policies and regulations requiring the upgrade of aging equipment. In addition, smart lighting can also achieve the purpose of timely energy conservation. Therefore, there is strong demand for the introduction of LED lighting and smart lighting upgrades in commercial lighting, residential lighting, outdoor lighting and industrial lighting, which further drives demand for high-standard LED products including high light efficiency, high color rendering and color saturation, low blue-light human-centric lighting and smart lighting devices.

The gradual recovery of the lighting market is clearly reflected in the 2021 manufacturer revenue rankings. Lighting LED manufacturers including Samsung LED, ams OSRAM, Cree LED, Lumileds, Seoul Semiconductor, MLS, and Lightning have all posted revenue growth. MLS is still the leading manufacturer of lighting LEDs, ranking first in revenue, with an annual revenue growth rate of 34% in 2021. ams OSRAM, Lumileds, Cree LED and Samsung LED primarily took advantage of orders for industrial, outdoor and horticultural lighting last year, posting annual revenue growth of 26%, 18% and 8%, respectively.

In terms of pricing, as demand in the lighting industry gradually recovered in 2021, facing demand for higher-specification terminal application products and the impact of rising overall costs in raw materials and operations, LED packaging factories no longer adopted pricing strategies to capture additional market share, allowing lighting LED product pricing to stabilize and rebound in 2021.

In terms of product categories, the average market price of medium- and low-power lighting LED products (less than 1W, excluding 1W) such as 2835 LED, 3030 LED and 5630 LED, posted an annual growth rate of 2.1-4.4%. For high-power lighting LED products (above 1W) such as ceramic substrate LEDs and 7070 LEDs, average annual market price growth was as much as 3-6%. TrendForce expects lighting LED pricing to further stabilize in first-half 2022.