News: Markets

10 May 2021

GaN power market to reach $1.1bn in 2026, after doubling in 2020

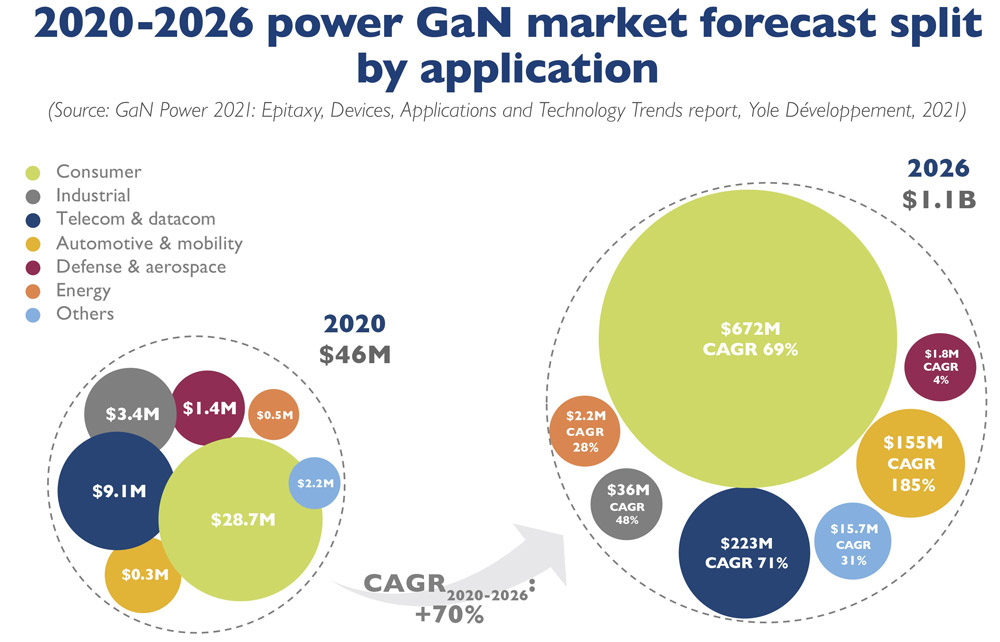

The gallium nitride (GaN) power market doubled during 2020 and will reach $1.1bn in 2026, driven by the consumer applications segment, forecast market analyst firm Yole Développement in its report ‘GaN Power 2021: Epitaxy, Devices, Applications and Technology Trends’.

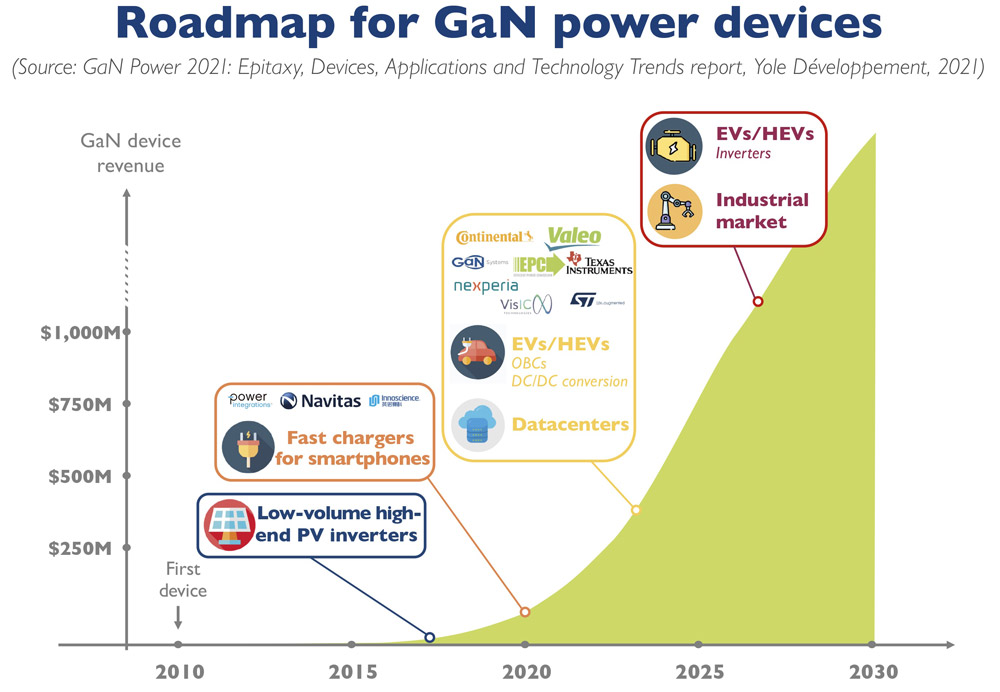

In 2020, the power GaN market doubled due to penetration of GaN devices into smartphone fast-charger applications. The adoption of GaN in the smartphone market is fueled by system compactness, high efficiency, and adapter multi-functionalities, says Yole. Fast charging is likely to be the killer application for the GaN power device market, it adds.

“Following Oppo’s adoption of GaN in its 65W inbox fast chargers for its Reno Ace flagship model in late 2019, several phone original equipment manufacturers (OEMs) and accessory charger providers released GaN-solution design wins for their fast chargers in 2020,” notes Ahmed Ben Slimane PhD, technology & market analyst, Compound Semiconductors and Emerging Substrates.

In 2020 several companies, such as Xiaomi, Lenovo, Samsung, Realme, Dell and LG (as well as other Chinese after-market companies), adopted GaN technology. So far, at least 10 smartphone OEMs have launched more than 18 phones with an inbox GaN charger. This growth will continue in the after-market as well, with companies like Apple, Xiaomi, and Samsung opting for an out-of-the-box charger solution, says the report.

Yole hence expects the consumer power supply segment to be the main market driver, growing at a compound annual growth rate (CAGR) of 69% from almost $29m in 2020 to about $672m in 2026 (61% of the total GaN market).

“While GaN continues its ascension in the mass consumer market, the markets for telecom & datacom and automotive & mobility will benefit from the ‘economy of scale effect’ and price erosion,” says Ahmed Ben Slimane. “Indeed, in these markets where reliability and cost are paramount, Yole expects that GaN penetration will see increasing volumes starting from 2023–2024 [contributing to overall market growth in the mid- to long-term].”

“In the telecom & datacom market, which requires more efficient, smaller power supplies amidst tighter regulations for energy consumption, data-center and telecom operators are already interested in GaN devices,” notes Poshun Chiu, technology & market analyst specializing in Compound Semiconductor and Emerging Substrates. Following the first small-volume adoption of GaN-based power supplies by Eltek, Delta and BelPower in recent years, Yole expects greater penetration by GaN, driving the telecom & datacom segment to grow at a 71% CAGR from just $9.1m in 2020 to over $223m in 2026.

“The automotive & mobility market is also paying lots of attention to GaN, following big incentives for the electrification of cars and the interest in increasing driving range through system efficiency optimization,” says Chiu.

In the long term, in cases where GaN has proven its reliability and high-current capabilities at a lower price, it can penetrate the more challenging EV/HEV (hybrid electric vehicle) inverter market and the conservative industrial market, which could create remarkable high-volume opportunities for GaN, says the report.

Players such as EPC, Transphorm, GaN Systems, Texas Instruments and Nexperia are AEC qualified. In particular, Nexperia and VisIC are working on GaN solutions for xEV inverters to compete with silicon carbide (SiC) and silicon. Also targeting GaN for EVs is major integrated device manufacturer (IDM) STMicroelectronics, which has strengthened its position and product portfolio through its collaboration with TSMC plus the acquisition of a majority stake in Exagan.

Starting from 2022, GaN is expected to penetrate in small volumes into applications such as on-board chargers (OBCs) and DC/DC converters, mainly related to sampling by OEMs and tier-1s. Yole hence expects that the automotive & mobility market will rise at a 185% CAGR to more than $155m in 2026.

Technology trends

In terms of technology trends, more new players have entered the market with GaN-on-silicon (GaN-on-Si) enhancement-mode (E-mode) high-electron-mobility transistor (HEMT) technology, targeting the booming fast-charger segment. GaN-on-Si is considered to be the platform to expand capacity for foundries in the coming years. Notable investments have hence been made in GaN epitaxy and fabs to increase GaN device fabrication capacity. However, challenges remain in the epitaxial deposition for larger wafer size.