News: Markets

30 June 2021

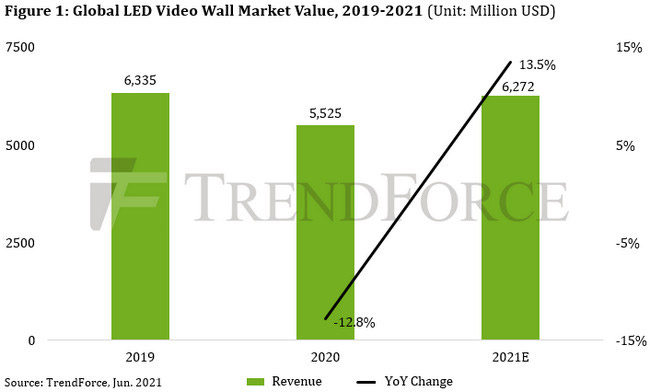

LED video wall revenue to rebound by 13.5% from $5.53bn in 2020 to $6.27bn in 2021

Affected by the emergence of the COVID-19 pandemic, global LED video wall revenue fell by 12.8% year-on-year in 2020 to $5.53bn, with the European and US markets suffering the most significant declines, according to market rsearch firm TrendForce. However, in 2021, as overall market demand recovers and certain components in the upstream supply chain undergo price hikes due to shortages, LED video wall manufacturers have raised their product prices in response, so revenue is expected to grow by 13.5% to $6.27bn.

Overall demand for LED video walls has been gradually recovering due to increased vaccinations worldwide, which have enabled a gradual easing of border restrictions as well as the resumption of major commercial and sporting activities, including the delayed UEFA Euro 2020 soccer tournament and Tokyo 2020 Olympics, notes TrendForce. In addition, due to the rising prices of materials in the upstream LED video wall supply chain (such as driver ICs, PCBs and LED components), LED video wall manufacturers such as Leyard, Unilumin and Absen are gradually raising their product prices in order to maintain product profit.

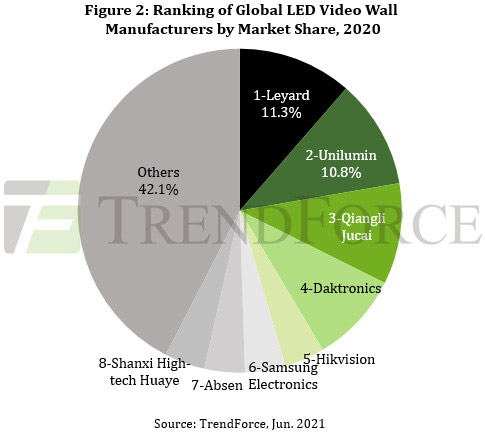

While demand in Chinese market was first to recover, the top eight suppliers comprised 60% market share

Regarding the ranking of LED video wall suppliers in 2020, Leyard took the leadership position with a market share of 11.3% even though its overall revenue fell due to the pandemic’s impact on Leyard’s overseas businesses. Likewise, Unilumin saw declines in its overseas businesses, which caused only a slight drop in its revenue because it had placed a greater focus on sales in the Chinese market. Unilumin took second place with 10.8% market share. Qiangli Jucai, on the other hand, primarily conducted business in domestic China. By aggressively strengthening its distribution channels, Qiangli Jucai was able to increase its revenue, contrary to the overall downtrend, and take third place. Daktronics, Hikvision, Samsung Electronics, Absen, and Shanxi High-tech Huaye took fourth to eighth places, respectively.

On the whole, most LED video wall manufacturers, especially companies (including Leyard, Unilumin and Absen) whose primary markets were Europe and the USA, saw declines in their revenues for 2020 due to the pandemic last year. Conversely, companies with a primary focus on the Chinese market, such as Qiangli Jucai and Shanxi High-tech Huaye, benefitted from the recovering demand that began ramping up in third-quarter 2020 and peaked in fourth-quarter 2020. These companies were able to propel the combined market share of the top eight LED video wall manufacturers to 58% in 2020, which was four percentage points higher compared with 54% in 2019.