News: Markets

25 January 2021

Mini-LED chip revenue to reach $270m in 2021 amid battle over backlight TV specs

As various TV manufacturers such as Samsung, LG and TCL announced their new models equipped with mini-LED backlights at the All-Digital Consumer Electronics Show (CES 2021) on 11-14 January, TrendForce’s ‘2021 Mini LED New Backlight Display Trend Analysis’ report shows that total mini-LED chip revenue from mini-LED backlight TVs could reach $270m in 2021, as manufacturers gradually overcome technological bottlenecks and lower their overall manufacturing costs.

Mini-LED backlight costs for entry-level just 50% higher than LCD equivalents

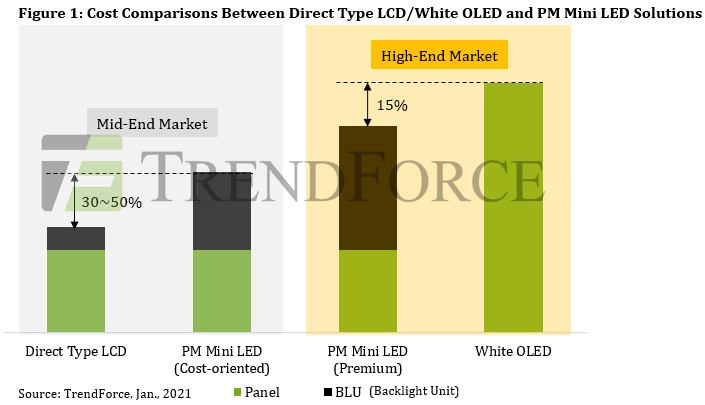

Regarding TV backlight technologies, the cost of mini-LED solutions is 2-3 times lower than that of white organic light-emitting diode (OLED) and entry-level direct-lit LCD solutions, reckons TrendForce. This cost difference therefore serves as mini-LED technology’s competitive advantage over its competitors in display backlight adoption.

High-end TVs currently contain about 16,000 mini-LED chips per TV, divided into 2000 local dimming zones. In this market segment, passive-matrix (PM) mini-LED TV panels with a BLU (backlight unit) still cost about 15% less than OLED TV panels and therefore hold a cost advantage. On the other hand, in the mid-range TV segment, each TV contains 10,000-12,000 mini-LED chips and 500 local dimming zones, so the cost of mini-LED backlight integration in this market segment is approximately just 50% more than entry-level direct-lit LCD backlight units, making mini-LEDs a viable alternative to traditional LCD solutions in this segment too. Given the high cost-effectiveness of mini-LED backlight units, TV manufacturers are therefore likely to adopt them as a viable technology and initiate an industry-wide competition over mini-LED TV specs this year, forecasts TrendForce.

HDR and 8K resolution will be the two mainstream features of high-end TVs this year. Regarding Korean brands, Samsung’s Neo QLED mini-LED TV and LG’s QNED mini-LED TV, both unveiled at CES 2021, are equipped with mini-LED backlights as a performance-enhancing technical feature. These TVs feature not only 8K resolution but also mini-LED backlight units, which require more than 20,000 mini-LED chips (divided across more than 1000 local dimming zones, with more than 1000 nits in peak brightness), in addition to passive-matrix FALD technology, which allows for contrast ratios of 1,000,000:1, which is a significant improvement that puts these TVs on almost equal footing with OLED TVs in terms of image quality. At the same time, China-based TCL is also set to release its OD Zero mini-LED TV, which has comparable specs with Korean offerings and is also equipped with mini-LED backlight units. Going forward, more and more TV manufacturers, such as Hisense and Xiaomi, are expected to participate in the burgeoning mini-LED backlight TV market.

Pace of optimizing mini-LED chips, backplanes and driver ICs key to rapid growth

As various manufacturers successively release their mini-LED backlight TVs this year, related companies in the supply chain are expected to benefit as a result. Currently, there are multiple major suppliers of mini-LED components on the market: Chip suppliers include companies in Taiwan (Epistar and Lextar), China (San’an and HC SemiTek) and Korea (Seoul Semiconductor). Testing and sorting companies include FitTech, Saultech and YTEC. SMT companies include Taiwan-based Lextar and China-based Hongli Zhihui. Driver IC suppliers include Taiwanese (Macroblock, Elan, Parade, Himax, and Novatek) and Chinese (Chipone). Backplane suppliers include companies in Tawan (Apex and Zhen Ding Tech) and Korea (Young Poong Group). Panel suppliers include SDC, LGD, AUO, Innolux, BOE and CSOT.

TrendForce believes that mini-LED backlight displays currently possess a competitive advantage over OLED displays due to the former’s 15% lower cost, comparatively. Ultimately, the future development and profitability of the mini-LED backlight market in the long run will depend on the continued optimization of components that account for a relatively higher allocation of backlight costs, including mini-LED chips, mini-LED backplanes, and driver ICs, concludes TrendForce.