News: Suppliers

8 April 2021

IQE’s revenue grows 27% to a record £178m in 2020

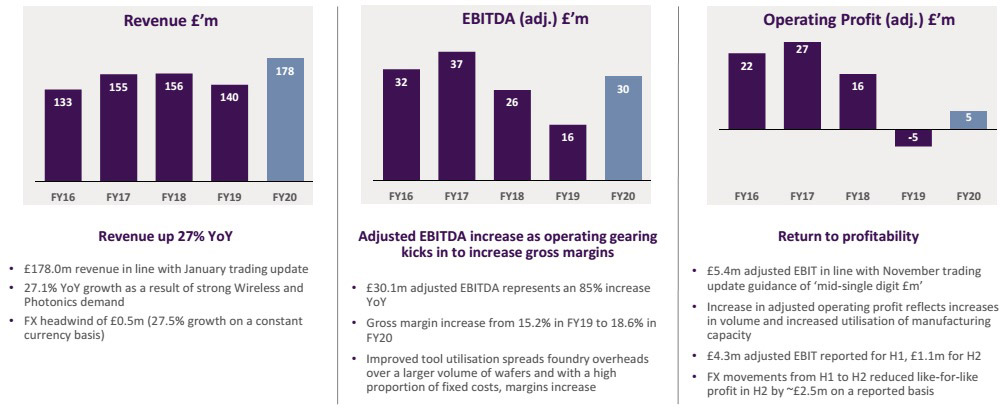

For full-year 2020, epiwafer foundry and substrate maker IQE plc of Cardiff, Wales, UK has reported record revenue of £178m (exceeding both September’s initial guidance of “at least £165m” and November’s revised guidance of “at least £170m”). Compared with 2019’s £140m, this is up 27.1% (or 27.5% on a constant-currency basis, taking into account a US$/£ foreign exchange headwind of £0.5m). Growth was driven by the start of the 5G mega-cycle, says the firm.

Business continuity was maintained at all global sites during the COVID-19 pandemic, with no interruptions to production. “Despite the global uncertainty that we encountered, the strength and diversification of our business enabled us to deliver record revenues,” notes CEO Dr Drew Nelson. There was strong growth in each of the firm’s primary business segments.

Wireless wafer revenue rose by 38% from 2019’s £68.2m to £94.2m (up from 48.7% to 52.9% of total revenue). Growth was driven by: 5G infrastructure deployments in Asia, in particular gallium nitride on silicon carbide (GaN-on-SiC) for mMIMO (massive multiple-input, multiple-output) base stations; and increased demand for gallium arsenide (GaAs) wafers for 5G handset power amplifiers (PAs) fuelled by growing end-market demand for ‘5G ready’ smartphones (in which there is increased GaAs content versus 4G phones). Of Wireless revenue, GaAs comprised 63% and GaN 37%.

Photonics wafer revenue rose by 17% from 2019’s £69.8m to £81.6m (going from 49.8% to 45.8% of total revenue). Growth was driven by: consistently high demand for GaAs vertical-cavity surface-emitting laser (VCSEL) wafers for 3D sensing applications throughout the year; and continuing strong demand for high-performance gallium antimonide (GaSb) wafers for advanced infrared sensing applications, in particular epiwafers for direct time-of-flight (DToF) camera modules that are enabling augmented reality (AR). Of Photonics revenue, VCSELs comprised 56%, infrared 29%, and indium phosphide (InP) 15%.

CMOS++ segment revenue rose from £2.09m to £2.2m (though falling from 1.5% to 1.2% of total revenue).

Adjusted gross margin rebounded from 14.9% in 2019 to 18.7% in 2020, as IQE has benefited from greater tool capacity utilization (spreading foundry overheads over a larger volume of wafers).

Adjusted selling, general & administrative (SG&A) expenses rose from £25.8m to £27.8m, primarily reflecting an increase in investment in corporate functions and employee headcount as IQE continues to grow. By end-2020, the firm had 650 staff across nine manufacturing locations in the UK, USA, Taiwan and Singapore.

Restructuring costs were cut further, from £0.813m in 2019 (comprising £226,000 of final costs from closure of IQE’s manufacturing facility in New Jersey plus £587,000 in site-specific employee severance costs) to £0.16m in 2020 (related to employee retention bonuses associated with the announced closure of the firm’s manufacturing facility in Pennsylvania, as IQE is consolidating US molecular beam epitaxy manufacturing at its North Carolina site by 2024).

Compared with 2019’s patent dispute legal cost of £4.3m, 2020 yielded patent dispute income of £1.7m related to a settlement with the plaintiff of a multi-faceted intellectual property (IP) legal dispute, following an arbitration panel ruling on 17 January 2020 in favour of IQE that resulted in £1.825m (US$2.5m) cash being received in February. Patent dispute income also includes insurance income of £410,000 received from IQE’s insurers in relation to relevant costs incurred as part of the dispute, offset by £546,000 of legal costs.

Compared with the adjusted operating loss of £4.7m in 2019, there was a return to profitability in 2020, which yielded an adjusted operating profit of £5.4m.

By segment, adjusted operating profit (and operating margin) improved for Wireless from £6.6m (9.7% margin) in 2019 to £11.4m (12.1% margin) in 2020 and for Photonics from just £1.3m (1.9% margin) in 2019 to £9.1m (11.1% margin) in 2020, primarily reflecting increases in volume and increased utilization of manufacturing capacity. For CMOS++, adjusted operating loss was cut from £1.3m to £0.714m.

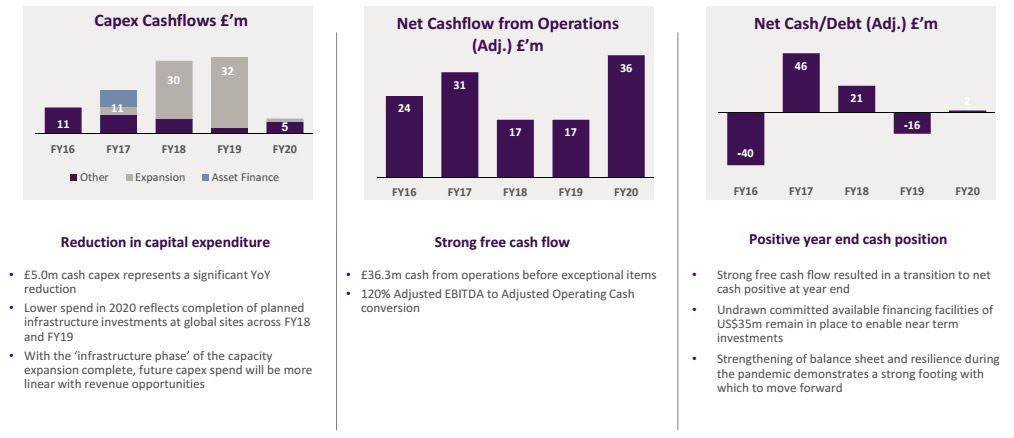

As a result of the strong trading performance, capital spending controls and careful working capital management, adjusted net cash flow from operations has more than doubled from £16.5m in 2019 to £36.3m in 2020, representing 120% adjusted EBITDA to adjusted operating cash conversion.

Capital expenditure was slashed from 2019’s £31.9m to £5m following completion of the infrastructure phase of IQE’s capacity expansions during 2018-2019 in Massachusetts USA (for wireless GaN), Hsinchu Taiwan (for wireless GaAs) and at its Newport Foundry in South Wales, UK (focused on 3D sensing applications). Future CapEx spending will be more linear with revenue opportunities, notes IQE.

Free cash flow was £23.6m, compared with free cash outflow of -£25.4m in 2019.

During 2020, cash and cash equivalents rose by £15.9m, from £8.8m to £24.7m (compared with 2019’s decline of £12m).

Due to the strong free cash flow, net cash (excluding lease liabilities) turned positive, at £1.9m at the end of 2020, compared with net debt of £16m at end-2019. Including bank loans of £22.74m (repayable over a period to 29 August 2024), net funds are hence £24.66m.

“We have made positive progress against our strategy and recorded strong growth across our Wireless and Photonics divisions, despite the external pressures,” says Nelson. “This progress, combined with the return to a cash positive position and the range of unique materials solutions for high-performance devices in our development pipeline, ensures we are well placed to maintain our leadership position as the 5G mega-cycle gathers pace in the coming years,” he adds.

In particular, strong progress has been made in new product development, including IQepiMo template technology for RF filters, IQGeVCSEL 150 technology for 6” VCSELs on germanium (a critical step in the pathway to 8” VCSEL technology), and (post year-end) IQDN-VCSEL technology for advanced sensing applications at longer wavelengths on 150mm GaAs substrates.

Current trading and first-half 2021 outlook

After a consistently strong year in 2020 across IQE’s broad portfolio of products, trading has continued positively in 2021. In particular, revenues for Wireless GaAs epiwafers are strong as a result of continued 5G handset market penetration and increased GaAs content. In addition, demand for 3D sensing, advanced sensing applications and communications products continues to remain positive.

IQE reckons that it is well positioned for further 5G-related GaN-on-SiC growth over the multi-year replacement cycle. In first-half 2021, GaN-on-SiC revenue is expected to be lower than in first-half 2020 amid lower market estimates for mMIMO deployment in Asia. But, beyond the near term, the opportunities for this and other GaN-on-Si technologies are very strong as global roll outs of 5G gather pace.

IQE notes that it is experiencing a foreign exchange headwind in 2021 on a reported basis, as the firm’s revenues are predominantly earned in USD but are reported in GBP.

Nevertheless, IQE expects revenue and adjusted EBITDA in first-half 2021 to be similar to first-half 2020 on a constant-currency basis.

Capital expenditure for 2021 is expected to be £20-30m as IQE resumes investment in capacity for specific growth platforms. This includes three new Aixtron G4 metal-organic chemical vapor deposition (MOCVD) systems ordered in Q1/2021 to support volume growth for Wireless GaAs in Taiwan (in order to underpin further growth in 2022). On 5 October 2020, IQE acquired the remaining 9.82% minority stake in Taiwanese subsidiary IQE Taiwan ROC (raising its equity ownership from 90.18% to 100%) for £1.4m, subject to an ongoing statutory Court process regarding valuation.

Capitalization of development costs are expected to be £7-10m for full-year 2021, as IQE continues to invest in future products to meet anticipated growing demand for compound semiconductors driven by the macro trends of 5G and connected devices.

IQE reaches milestones with IQDN-VCSELs for long-wavelength sensing on 150mm GaAs

IQE's IQepiMo delivers improved BAW filter performance for 5G

IQE’s revenue grows 25% in 2020, exceeding guidance of 20%

IQE develops IQGeVCSEL 150 technology

IQE acquires outstanding stake in IQE Taiwan