News: Suppliers

16 November 2020

Aixtron’s Q3 up 21.9% year-on-year

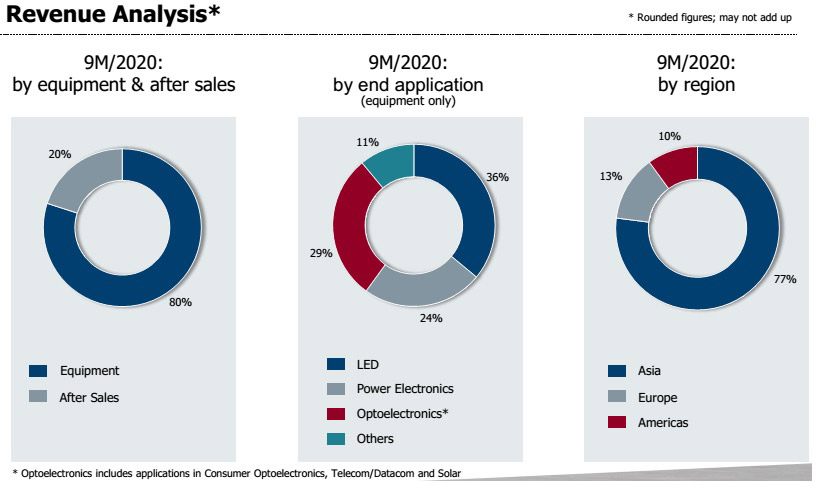

For the first nine months of 2020, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported total revenue (equipment plus after-sales) of €161.1m, down 13% on €184.6 a year previously. Of this, equipment fell from €148.1m to €129.5m (remaining 80% of total revenue), while services & spare parts fell from €36.5m to €31.7m. The COVID-19 pandemic had only a limited impact on business development, says the firm.

On a regional basis, revenue from Europe fell by 19% from €25.6m to €20.7m (falling from 14% to 13% of total revenue) and the Americas fell by 48% from €30.2m to €15.6m (falling from 16% to 15.6% of total revenue). However, Asia fell year-on-year by just 3% from €128.8m to €124.9m (rising from 70% to 78% of total revenue).

“Operations continue to be not significantly affected by the course of the pandemic,” says Aixtron. It adds that it took early preventive measures against the pandemic and strengthened these measures in third-quarter 2020.

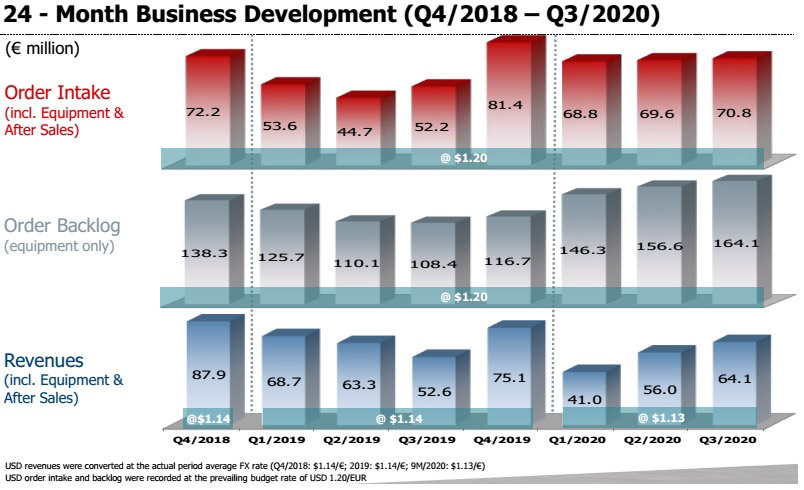

Q3 revenue was €64.1m, up 14% on €56m last quarter and 21.9% on €52.6m a year ago, driven by high demand for gallium nitride (GaN)-based power electronics and laser technology for optical data transmission and 3D sensor systems.

Gross margin for the first nine months of 2020 was 39%, down from 40% the prior year. This is largely due to Q1/2020 gross margin of just 36%, although quarterly gross margin has since fallen back from 41% in Q2 to 40% in Q3. However, this was mainly because of a less favorable dollar exchange rate. Had the exchange rate been the same as in Q2, gross margin would have recovered further, to 42%. Just under 50% of sales were denominated in US dollars (compared with less than the 70% in the past) because customers in China are less willing to use dollars.

Operating expenses in the first nine months of the year were up by 5.6% from 2019’s €50.2m to €52.9m for 2020. This included R&D expenses rising from €40m to €41.2m (from 22% to 26% of revenue), while Aixtron invests in the ongoing development of next-generation metal-organic chemical vapor deposition (MOCVD) equipment.

Operating expenses in Q3 were €17.6m, cut from €19.6m last quarter. Specifically, selling expenses fell by €0.9m from €2.8m to €1.9m (due mainly to lower external sales commission). R&D project costs fell by €1.6m from €14.2m to €12.6m, reflecting the current status of the organic light-emitting diode (OLED) project at South Korea-based subsidiary APEVA, where qualification of the Gen2 deposition system with the South Korean customer is nearing completion and a follow-up project has not yet started.

Due to the revenue growth and lower operating expenses, Aixtron more than doubled its operating result (earnings before interest and taxes) from €3.3m in Q2 (EBIT margin of 6% of revenue) to €8.2m (13% EBIT margin) in Q3, exceeding €5.5m (10% EBIT margin) a year ago.

Likewise, net income of €7.1m (11% of revenue) more than doubled from Q2’s €3.3m (6% of revenue).

Because a lot of the trade receivables expected in the early part of 2020 were collected in Q4/2019 and because of the planned further build-up of inventory during Q3/2020 (from €91.2m to €101.6m, up from just €79m a year previously) ahead of increased shipments in Q4/2020, free cash flow worsened to -€3.3m for the first nine months of 2020, compared to -€2.4m a year previously.

Excluding the movements in and out of various investments, free cash flow was €5m in Q3 (an improvement on -€11.3m in Q2). During Q3, cash, financial investments & deposits hence rose from €288.6m to €292.8m, comprising €263m in short-term assets and €30m of cash on deposit within non-current assets.

Strong order growth year-on-year

Order intake (equipment plus after-sales) in the first nine months of 2020 were €209.3m, up 39% on €150.6m the prior year. This included €70.8m in Q3, up 35.6% on €52.2m a year ago and up 2% even on the strong €69.6m in Q2/2020, driven mainly by demand for power electronics and laser applications.

Order backlog (equipment only) at the end of September was €164.1m, up 5% on €156.6m at the end of Q2/2020 and up 51% on €108.4m a year previously. During Q3, customer deposits (contract liabilities for advance payments) rose further, from €61.1m to €63m, representing 38% of order backlog.

“In power electronics, we see solid demand for tools to produce GaN power devices. Adoption of these devices is growing in more and more applications, starting from mobile phone and laptop chargers. We also see applications in server and telecom power supplies as well as in automotive on-board chargers,” notes president Dr Felix Grawert. “Furthermore, our customer base is growing as more and more players are entering the GaN power market. For example, we are now serving all of the tier-1 foundries with our GaN products. In addition, and despite the high market share Aixtron has in GaN, we continue to convert customers from other vendors to our platform. In this quarter, we have been able to win Siltronic, one of the top five wafer makers, as a customer,” he adds.

“In SiC, we see continuous demand from our long-term existing customer [a very major customer for the whole market] and we are making good progress with our qualification programs at our other customers. We have achieved the first full customer acceptance and, with this, an additional customer [targeting the automotive market… is the biggest volume market, and expected also to ramp very fast] in volume production on our SiC tool,” Grawert continues. “We very shortly expect a repeat purchase order from this second customer because this customer is already now in full production with our tool and has just secured additional orders from its automotive customers… There is clearly a ramp planned based on our tool, as we are also the only vendor in this customer,” he adds. “We have our tool in other customers, where the qualification is ongoing. We are expecting to complete those qualifications within the next 1-2 quarters... We expect follow-on orders to come also from these other customers within the year 2021.”

Overall, power electronics comprised about 50% of Aixtron’s order intake in Q3.

“We also recorded continued good demand for our laser solutions, driven to a large degree by the need for optical data communications,” says Grawert. For example, in October Finland-based laser maker Modulight ordered an AIX 2800G4-TM MOCVD system to scale up its epiwafer production. Overall, lasers comprised about 35% of Aixtron’s order intake in Q3.

“We continue to see a healthy pipeline for our LED equipment, in particular for the production of LEDs for fine-pitch or mini-LED displays and mini-LED backlighting units,” adds Grawert.

“We’re in our year-end push,” says president Dr Bernd Schulte. “Aixtron’s business development in the third quarter has shown that the demand for our innovative deposition systems remains at a high level. Not only should our revenues continue to grow dynamically in the final quarter, but also our profits accordingly.”

For fourth-quarter 2020, Aixtron expects strong growth in both revenue (to €100-120m) and operating results. The firm hence expects inventories to fall substantially by the year end.

Full-year 2020 guidance

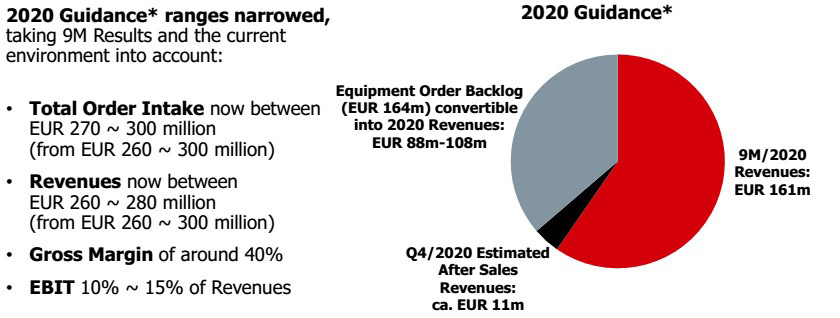

Based on (1) the order backlog, (2) the currently estimated low impact of the COVID-19 pandemic and (3) the budget exchange rate of $1.20/€, for full-year 2020 Aixtron now expects order intake to be in a tightened range of €270-300m, within the original guidance range of €260-300m (up from €231.9m in 2019).

Aixtron reckons that €88-108m of its €164m equipment order backlog is convertible into revenue by end-2020. It also forecasts €11m in after-sales spares & services revenue in Q4. Added to the €161.1m in revenue from the first nine months of 2020, for full-year 2020 Aixtron now expects revenue of €260-280m (narrowing from the prior guidance of €260-300m), level to up on 2019’s €260m. Guidance remains unchanged for gross margin of about 40% (down from 2019’s 42%) and EBIT margin of 10-15% (compared with 2019’s 15%). “We have not amended our EBIT guidance as some upcoming external events such as US elections and Brexit might lead to significant currency fluctuations, with the respective influence on our margins,” says Grawert. “Nevertheless, we believe that the mid-point of the EBIT range can be seen as our base case.”

Aixtron says that its executive board is monitoring the impact of the COVID 19 pandemic and ongoing trade disputes on the global economy and the movement of goods, in order to be able to assess any potential effects on its own supply chain and production as well as on customer demand and thus on the firm’s business development at any time and - if necessary - to initiate corrective actions.

“Aixtron’s strength is also reflected in our continued high level of investment in the further development of our leading-edge technology,” says Grawert. “This allows us to make progress in continuing to align our product portfolio with the growing demands of our customers’ future markets such as 5G mobile network expansion and e-mobility.”

Modulight adds Aixtron AIX 2800G4-TM MOCVD system

Siltronic orders Aixtron system to ramp GaN-on-Si epi production

Azur orders Aixtron MOCVD system for entry into GaN high-power electronics & RF epi market

Aixtron’s revenue rebounds by 37% in Q2

Aixtron’s Q1 revenue falls 40% year-on-year to €41m

Aixtron year-to-date revenue grows despite export license delays hitting Q3