News: Photovoltaics

24 July 2020

CIGS surpasses 2% of PV market

Estimates vary but the booming photovoltaic market is certainly in $100bn/100GW territory, according to IDTechEx’s report ‘Electronics Reshaped 2020-2040’, which reveals solar market growth through new capabilities opening previously impossible applications. Massive Chinese investment is likely to see single-crystal silicon usurp polycrystalline silicon due to its extra electricity output. Amorphous silicon, dye-sensitized solar cells and cadmium telluride (CdTe) photovoltaic technology have improved little, and cadmium has complications associated with its toxicity, as has lead in the emerging perovskite-based solar technology.

It is copper indium gallium diselenide (CIGS) solar cells whose sales have grown 50-fold in only ten years. Leading manufacturer Solar Frontier of Japan now has 1% of global PV output, and CIGS overall has passed 2% by “redefining the battleground”. Flexible photovoltaics so often only means heavy and just slightly bendable, but not so with CIGS: the 300kW version of Renovagen of the UK unrolls like a carpet to act as a complete microgrid. CIGS is the lowest cost of ownership on a building façade because no strengthening is needed (unlike much of the competition) and it lasts. Also, other lightweight technology usually has a life issue. MIT used CIGS for mobile desalinators in Puerto Rico citing, “Waterproof, thin, and extremely durable, good even at sunrise and sunset, high-power output even when part shaded, keeps working even if penetrated by tree branch”.

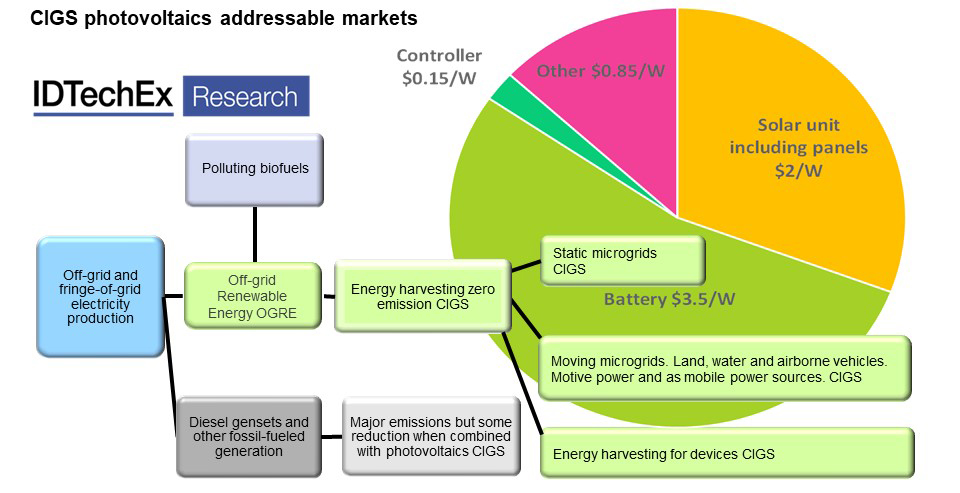

Graphic: CIGS photovoltaics addressable markets. Source: IDTechEx Research.

CIGS also has a route to improvement, with research efficiencies now mixing it with the best of heavy, thick, brittle silicon-in-glass. Its efficiency is three times that of flexible organic photovoltaics (OPV). Indeed, lightweight polymer CIGS substrates (Flisom with EMPA of Switzerland, and now further improvements by Korea Institute of Energy Research) are gaining favour. Semi-transparent CIGS has been demonstrated. Problematic indium tin oxide (ITO) transparent conductive electrode (TCO), accompanied by its brittleness and price hikes, is usually unnecessary. Although there is a small amount of cadmium in today’s versions, the element will not appear in the next generation of CIGS PV.

CIGS will not take over the world, notes the report, but it is contributing to solar power beating wind power because of faster cost reduction and absence of moving parts. It is not winning the battle for solar vehicle bodywork: single-crystal silicon has grabbed most of that, leaving CIGS some retrofit business, but CIGS may fight back with similar efficiency and lighter weight in due course.

CIGS is powering the trend to go off-grid with microgrids, as analysed in IDTechEx’s report ‘Distributed Generation: Off-Grid Zero-Emission kW-MW 2020-2040’. There are expansion plans for multiple gigawatts of extra CIGS production, notes the firm. Chinese construction materials and engineering company CNBM, electricity equipment supplier Shanghai Electric, and subsidiaries of mining and generation giant China Energy Investment Corporation (formerly Shenhua Group) have just made strategic investments in CIGS technology and production equipment, the report adds.