News: Suppliers

6 August 2020

Veeco returns to positive operating cash flow as it completes restructuring

For second-quarter 2020, Veeco Instruments Inc has reported revenue of $98.6m, down 5.6% on $104.5m last quarter but up slightly on $97.8m a year ago.

“We are seeing broad strength across our product lines, with notable activity in 5G-related RF filter applications with our wet etch and clean products,” CEO Bill Miller Ph.D. “Our Scientific & Industrial market continues to perform well,” he adds.

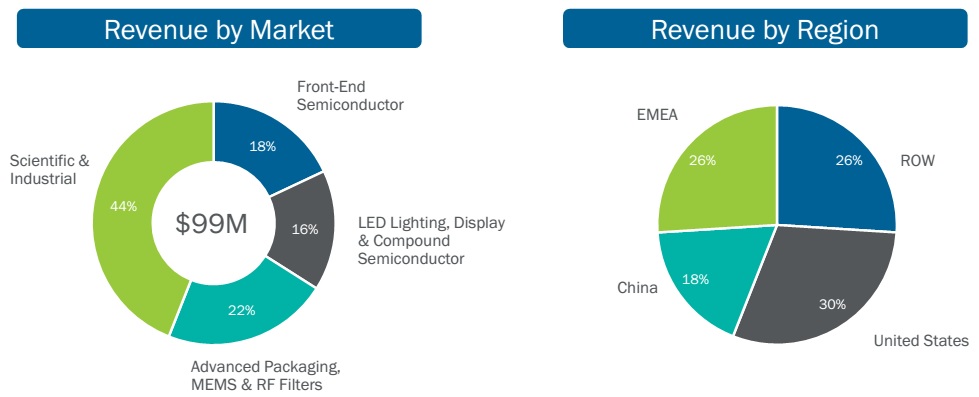

The Scientific & Industrial segment comprised 44% of total revenue, led by ion beam system shipments to data-storage customers.

The Advanced Packaging, MEMS & RF filter segment – including lithography and Precision Surface Processing (PSP) systems sold to integrated device manufacturers (IDMs) and outsourced assembly & test firms (OSATs) for Advanced Packaging in automotive, memory and other areas – comprised 22% of total revenue (rebounding from just 8% last quarter), driven by a recovery in sales of advanced packaging lithography systems and upgrades to OSATs and device manufacturers.

The Front-End Semiconductor segment (formerly part of the Scientific & Industrial segment, before the 2017 acquisition of lithography, laser-processing and inspection system maker Ultratech) contributed 18% of total revenue (down from 30% last quarter), resulting from shipments of laser spike annealing (LSA) systems as customers ramped their advanced technology nodes.

The LED Lighting, Display & Compound Semiconductor segment – which includes photonics, 5G RF, power devices and advanced display applications – comprised 16% of total revenue, with metal-organic chemical vapor deposition (MOCVD) and wet etch and clean products sold to a variety of customers.

By region, China has rebounded to 18% of revenue, mainly from MOCVD system and service revenue. Europe, the Middle East & Africa (EMEA) has rebounded further to 26% of revenue, driven by sales to data-storage customers. The rest of the world (including Japan, Taiwan, Korea and South-east Asia) has fallen back further to 26% of revenue (mainly sales of LSA, lithography, and wet etch and clean products). The USA has fallen back to 30% of revenue (including sales of several technologies to a variety of customers).

“Despite the pandemic, we have been executing well thanks to our dedicated global team. All of our sites have been operating at or near normal capacity throughout the quarter,” comments Miller.

On a non-GAAP basis, gross margin has fallen back from 44.9% last quarter to 43%. However, this is still up on 37.8% a year ago, aided by manufacturing efficiency improvements, along with a better product mix.

Operating expenditure (OpEx) was $34.4m, roughly level with $34.2m last quarter but cut from $38.5m a year ago. Less travel and other variable expenses were reduced as a result of COVID-19-related restrictions. “We are ahead of schedule on our expense reduction target, and our restructuring activities are now complete,” notes chief financial officer John Kiernan.

“Comparing to our financials from a year ago, we significantly improved operating results due to steps taken over the past several quarters such as de-layering the organization to improve accountability and reduce cost, right-sizing the manufacturing footprint, and divesting a non-core product line,” says Miller.

Veeco finalized the sale of a non-core product line in April for $11.4m (of which $9.7m was paid on closing the transaction, with the balance to be paid 18 months later). The divestment is part of Veeco’s two-phase business transformation (begun last year) that aims to: (1) return the company to profitability (reducing costs and de-layering the company, involving eliminating over 30% of VP-level and above positions – including the chief operating officer role and promoting John Kiernan to chief financial officer at the beginning of this year – while trimming about 7% of staff); and (2) drive growth.

Net income was $5.5m ($0.11 per diluted share), halving from $10.9m ($0.22 per diluted share) last quarter but a big improvement on a loss of $3m ($0.06 per diluted share) a year ago.

“We again posted solid financials driving non-GAAP profitability and strong cashflow from operations, contributing to significant improvements in year-over-year profitability,” notes Miller.

Cash flow from operations was $20m, recovering from outflow of -$2m last quarter and up on +$14m a year ago. Capital expenditure (CapEx) has been cut further, from $4m a year ago and $1.1m last quarter to $900,000.

From a working capital perspective, accounts receivable fell from $84m (higher than normal, due to the timing of when some payments were due flowing just outside the quarter) to $67m, reducing days sales outstanding (DSOs) from 73 to 61 days. This was partially offset by accounts payable falling from $36m to $26m, driving down days payable outstanding (DPO) from 57 to 42 days. Inventories rose from $130m to $137m – raising days of inventory (DOI) from 204 to 211 days – resulting from investments made in adding safety stock related to COVID-19 supply-chain actions and in preparation for higher shipments in second-half 2020.

The firm’s original convertible debt, issued in 2017, had a face value of $345m, a coupon of 2.7% and is due in January 2023. In May 2020, Veeco issued $125m of new convertible notes with a coupon of 3.75% due in June 2027. The firm hence retired $88m of the January 2023 notes. After transaction fees and the cost of the cap call, Veeco added about $30m of cash to its balance sheet, improving liquidity. Convertible debt is now $382m, comprising two tranches of notes with a weighted average coupon of 3% and a carrying value on the balance sheet of $317m (up from $303m last quarter). Annual cash expense on this debt is $11.6m.

Overall, after raising $10m from the sale of the non-core product line plus $30m in net proceeds from the convertible debt offering, plus the $20m operating cash flow minus the $900,000 CapEx, Veeco’s cash and short-term investments rose during the quarter by $59m, from $242m to $301m.

“Despite the challenges facing the global economy, we are continuing along our transformation path to improve profitability and grow the company,” says Miller. “Looking at our 2020 progress to date, we put appropriate actions in place and maintained our resiliency during the global pandemic.”

“We executed Phase 1 of our company transformation, which included reducing our expenses, improving gross margin, optimizing R&D spending, and strengthening our foundational businesses which fund our opportunities for growth. We are continuing to work on growing the company, which is the second phase of our transformation,” he adds. “We have new products, which are enabling us to grow market share in our existing markets, and we are also extending our core technologies into front-end semi, photonics, and RF applications.”

“The market drivers where we participate - such as 5G RF, the cloud, and high-performance computing - are all trending positively,” says Miller. “We have strong customer engagements across multiple product lines and have a healthy backlog. Q2 revenue appears to be a low point, and we are optimistic about the second half of the year,” he adds.

For third-quarter 2020, Veeco expects revenue to grow to $100-120m. “We are experiencing challenges closing new orders in China due to the current trade restriction environment, and have lost several orders that we were anticipating,” notes Kiernan. “As a result, in the near-term we expect revenue from China customers to decrease as a percentage of our overall revenue.

Gross margin should be 42-44%. OpEx is expected to rise to $35-37m. “On a go-forward basis, we expect to keep SG&A [sales, general & administrative expenses] as low as possible, but plan to strategically increase R&D in certain areas to support our growth initiatives,” says Kiernan. Net income should be $5-12m ($0.10-0.26 per diluted share).

“Based on our backlog and strength we are experiencing in data storage and 5G RF filters, we see Q4 revenue trending slightly higher than Q3,” forecasts Kiernan.

“In compound semiconductor markets, we continue to make investments in our MOCVD product portfolio,” says Miller. “Our latest product, the Lumina system, deposits arsenides and phosphides and is based on our TurboDisc technology, providing excellent film uniformity, yield and low defectivity over long campaigns. The Lumina system is designed for applications such as indium phosphide lasers for datacom and telecom, 3D sensors for facial recognition and world-facing applications, LiDAR for autonomous vehicles, and red LEDs for micro-LED displays. This system is performing well and we have received excellent feedback from our top tier-1 customer,” he adds.

“Our Propel platform is a 300mm-capable, fully automated, single-wafer reactor also based on our TurboDisc technology for best-in-class film quality, and it can be clustered with multiple chambers for high-volume manufacturing. The Propel system deposits gallium nitride for applications such as 5G RF GaN power amplifiers, power electronic devices used in wireless charging, and micro-LED. We see opportunity in the compound semiconductor markets where our Lumina and Propel systems would be an ideal fit,” Miller continues.

Despite this, near-term visibility remains limited, especially in China where the regulatory environment is providing headwinds. “Customers are weighing options between buying equipment from US suppliers like Veeco or alternative non-US suppliers when available,” Miller notes.

Veeco prices private offering of $125m of 3.75% convertible senior notes

Veeco announces governance and diversity improvements to board

Veeco’s Q1 revenue at high end of revised guidance range

Veeco’s revenue rebounds in Q4, as cost cutting yields a second quarter of profit

Veeco launches Lumina As/P MOCVD platform

Veeco’s revenue rebounds in Q3 as 300mm GaN MOCVD cluster system accepted for pilot production