- News

28 November 2018

Mini-LED adoption driven by high-end LCD displays and narrow-pixel-pitch LED direct-view digital signage

© Semiconductor Today Magazine / Juno PublishiPicture: Disco’s DAL7440 KABRA laser saw.

Interest in micro-LEDs has grown exponentially since Apple acquired technology startup Luxvue in 2014. All major display makers have now invested in the technology and other semiconductor or hardware companies such as Intel, Facebook Oculus or Google have joined in, notes the report ‘MiniLED for Display Applications: LCD & Digital Signage’ by market research and strategy consulting firm Yole Développement.

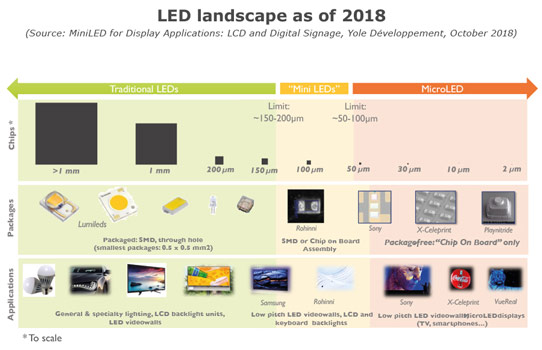

Amid this flurry of activity, a new term emerged in early 2017: mini-LED. The technology is often described as a stepping stone, bridging the technology and application gap between traditional LEDs and micro-LEDs. However, there is no commonly accepted definition of either term. Building on a consensus from the many companies surveyed, micro-LEDs are typical below 50µm along their sides, although the bulk of the activity is skewed toward the smaller dimensions, typically in the 3-15µm range. By default, mini-LEDs fill the size gap between micro-LEDs and traditional LEDs.

But apart from their size, there is clear differentiation between micro-LEDs and mini-LEDs in terms of technology and manufacturing infrastructure requirements and applications.

While micro-LEDs require major technology breakthroughs in assembly and die structure, as well as a significant overhaul of the manufacturing infrastructure, mini-LED chips are just scaled-down traditional LEDs, and can be manufactured in existing fabs with no or little additional investment.

On the application side, the promise of micro-LEDs lies in the realization of disruptive, high-pixel-density self-emissive displays, while mini-LEDs can be used to upgrade existing liquid-crystal displays (LCDs) with ultra-thin, multi-zone local dimming backlight units (BLU) that enable form factors and contrast performance close to or better than organic light-emitting diodes (OLEDs).

On the business-to-business side, mini-LEDs are promising for the realization of cost-effective, narrow-pixel-pitch LED direct-view displays used in digital signage applications such as in retail, corporate and control-room applications.

In this dynamic ecosystem, Yole’s new report provides analyses of mini-LED technologies in two major display applications: high-performance liquid-crystal display (LCD) and narrow-pixel-pitch light-emitting diode (LED) direct-view-display digital signage.

In terms of applications, the advantages of mini-LEDs are two-fold: (1) they bring new strength to LCD players in the battle against organic light-emitting diodes (OLEDs), and (2) they enable increased LED adoption for digital signage, says Yole.

Mini-LED adoption first driven by high-end LCD displays

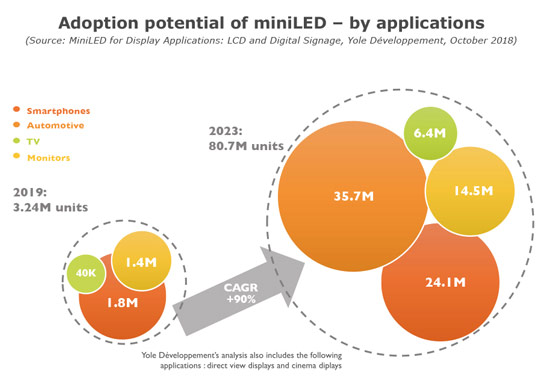

For smartphone applications, mini-LEDs are facing a strong incumbent in OLEDs, as the latter’s cost-to-performance ratio has already gained them a strong position in high-end/flagship segments. OLEDs are expected to further increase their share and become dominant as the number of suppliers and global capacity rise dramatically over the next five years and cost continues to drop.

However, mini-LEDs have a card to play in various small-to-mid-size high-added-value display segments, where OLEDs have been less efficient at overcoming their weaknesses such as cost, lack of availability and longevity issues such as burn-in or image retention. For example, in high-end monitors for gaming applications, mini-LEDs could bring excellent contrast, high brightness and thin form factors at lower cost than OLEDs.

“The automotive segment is especially compelling, first because of its strong growth potential in terms of volume and revenue, and also because mini-LEDs can deliver on every aspect auto-makers are aspiring to: very high contrast and brightness, lifetime, conformability to curved surfaces and ruggedness,” says senior market & technology analyst Eric Virey PhD.

Regarding the last point on ruggedness, mini-LED-based LCDs offer significant benefits over OLEDs since they only use proven technologies, LED backlights and liquid-crystal cells - not much different from already established LCDs. Automakers therefore do not have to make a leap of faith and hope that the new technology will meet the demanding lifetime, environmental and operating temperature specifications that they require.

On the TV side, mini-LEDs could help LCDs to bridge the gap and regain market share versus OLEDs in the highly profitable high-end segments. “This opportunity is all the more enticing to panel and display makers that have not invested in OLED technologies and see the potential to extend the lifetime and profitability of their LCD fabs and technologies,” notes technology & market analyst Zine Bouhamri PhD.

For direct-view LED displays, mini-LEDs used in conjunction with a chip-on-board (COB) architecture could enable higher penetration of narrow-pixel-pitch LED displays in multiple applications, increasing the serviceable market, says Yole. Die size will evolve continuously toward smaller dimensions, possibly down to 30-50µm in order to reduce cost, forecasts the firm. Adoption in cinema is still highly uncertain, but even modest adoption rates would generate very significant upsides, it adds.

Incremental innovations and limited investments – but supply chain disruptions

In contrast to micro-LEDs (which require sizable investments), mini-LEDs can easily be manufactured by established LED chip makers in existing fabs without major investment, even though they might require new equipment to enable cost-effective assembly. Yet they have the potential to create major disruptions by essentially eliminating LED packaging companies from the LCD as well as the large LED video-wall digital signage supply chains. For many major LED packagers, those applications represent a significant fraction of their revenue. The most exposed are reacting quickly by either moving up the supply chain and offering full mini-LED backlight modules (such as Refond and Lextar) or by developing innovative packages that still allow them to surf the mini-LED wave. For example, companies such as Harvatek or Nationstar’s new ‘4-in-1’ surface-mount device (SMD) packages allow LED direct-view display makers to alleviate a critical obstacle for mini-LED adoption: the need to re-tool and transition from an SMD to a direct die bonding assembly philosophy.

Mini-LEDs should benefit chip makers by increasing their available market. Some are trying to cash in on the opportunity and move up the supply chain by offering mini-LED packages and/or BLU modules. For example, Epistar is spinning off but keeping control of its mini-LED activities.

A remaining question is how fast equipment makers will develop a new generation of mini-LED-specific assembly tools that will help to speed up adoption by reducing manufacturing costs. Key attributes for such tools are much higher throughput and the ability to handle smaller dies (100µm or smaller). Various routes are being investigated, including the upgrade of traditional die assembly technology or more disruptive processes inspired from the vast body of work and technologies being developed for micro-LEDs. First to market is Kulicke & Soffa, which recently introduced a tool co-developed with startup Rohinni.

![]()

The availability of tools capable of efficiently handling smaller dies will in turn enable LCD and LED direct-view display makers to further reduce cost by reducing the die size to the smallest level required for each individual applications, says Yole.

Ultimately, for most of the targeted segments, mini-LEDs offer performance close to the incumbent technologies like OLEDs for high-end consumer displays and SMD LEDs for narrow-pitch digital signage. Cost will therefore be a major driver or showstopper for adoption, expects Yole.

K&S and Rohinni launch PIXALUX micro- and mini-LED die placement solution

www.i-micronews.com/report/product