- News

29 July 2014

Aixtron's orders rise for fifth consecutive quarter

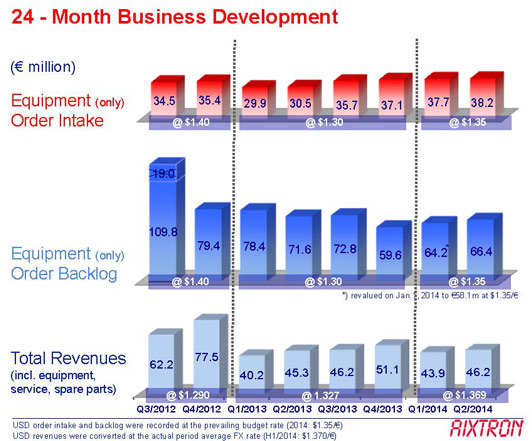

For second-quarter 2014, deposition equipment maker Aixtron SE of Aachen, Germany has reported revenue of €46.2m, rebounding by 5% from €43.9m last quarter (which had been down 14% on the previous quarter) and up 2% on €45.3m a year ago.

Global demand for LEDs continues to increase, driven by the growing adoption of LEDs in the general lighting market. Utilization rates of most leading LED chip makers also remain high, says the firm. However, the increasingly positive market sentiment has not yet translated into substantially increased order levels for Aixtron’s LED manufacturing capacity. Nevertheless, Aixtron generated increased revenues sequentially and year-on-year.

Operating expenses have risen slightly from €22m a year ago and €21.7m last quarter to €23.2m. This is due mainly to R&D costs rising by 22% from €12.7m a year ago and by 13% from €13.7m last quarter to €15.5m, largely as a result of Aixtron’s next-generation metal-organic chemical vapor deposition (MOCVD) system being in the qualification phase at key customers. At 34% of revenue, R&D spending remained at a relatively high level, underlining the important strategic significance of internal R&D capabilities, says Aixtron. In contrast, selling, general & administrative (SG&A) expenses have been reduced further, by 13% from €9.1m last quarter to €7.9m.

Consequently, although still worse than -€9.8m a year ago, EBIT (operating loss) has been cut slightly, from -€10.9m last quarter to -€10.6m. Due mainly to the operating loss and a scheduled increase in inventories for new MOCVD tools and spares, free cash flow is down further, from -€3.7m a year ago and -€13.8m last quarter to -€17.5m. Cash and cash equivalents (including bank deposits with a maturity of more than three months) have fallen further, from €306.3m at end-December 2013 and €292m at end-March 2014 to €275.6m at end-June.

Order intake has improved by 25% from €30.5m a year ago to €38.2m, representing a fifth consecutive quarter of sequential growth, including €37.7m last quarter (reflecting an improving market sentiment in first-half 2014). Total equipment order backlog was €66.4m at the end of June, up on €64.2m at the end of March and up 14% on €58.1m at the start of 2014.

“Demand for LEDs is growing partially due to a wide range of new LED lighting products being sold into the warehouses and stores, especially into regions such as China,” comments president & CEO Martin Goetzeler. “A successful sell-out to consumers would represent the next stage of the transition away from traditional to LED lighting,” he adds.

“Evidenced by positive feedback from our customers, we have made good progress in the qualification process and are preparing for the market launch of our new MOCVD tool generation later this year,” notes Goetzeler. “Furthermore, we continue to push the development of our other technology areas. These include MOCVD for power electronic and logic applications, ALD for memory, OVPD for OLED applications and PECVD for carbon nanomaterials including graphene. Here we continue to see substantial market potential,” he adds.

In parallel, Aixtron has now entered Phase Two of its 5-Point-Program for returning to sustainable profitability. The focus is on lowering material costs, discretionary spending and the optimization of processes, preparing the ground for a return to sustainable profitability.

Aixtron reiterates its original full-year 2014 guidance (made at the end of February) for revenue to be in line with last year’s (which was €182.9m). The firm is not expected to be profitable on an EBIT basis over the course of this year. Nevertheless, management continues to expect a year-on-year improvement in earnings due to progress made in cost savings and restructuring.

Aixtron's quarterly orders the highest in over two years

Aixtron's quarterly revenue rises 10% in Q4/2013, but demand remains subdued

Aixtron raises €101m from capital increase

Aixtron’s recovery program improves earnings, despite growth remaining subdued

Aixtron cuts losses as revenue rebounds 13% in Q2

Aixtron outlines 5-Point Program to return to sustainable profitability