- News

24 October 2013

Aixtron’s recovery program improves earnings, despite growth remaining subdued

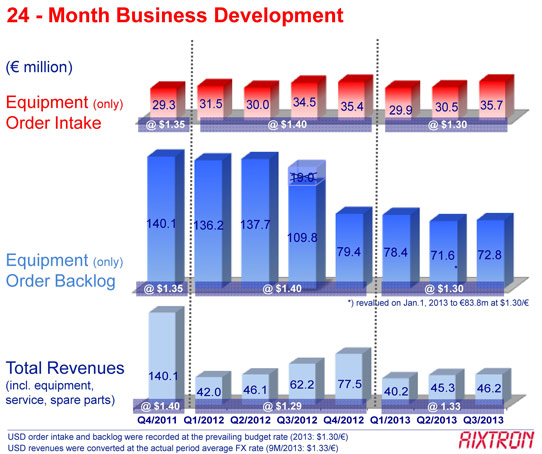

For third-quarter 2013, deposition equipment maker Aixtron SE of Aachen, Germany has reported revenue of €46.2m, down 26% on €62.2m a year ago but up slightly on €45.3m last quarter.

In spite of the lower percentage of final acceptances (which usually have a positive earnings effect) relative to Q2/2013 revenue, earnings before interest and taxes (EBIT) was +€2.9m (or -€9.2m, excluding provision revisions and re-categorization of insurance), an improvement on - €9.8m last quarter and - €78.3m a year ago. This is attributed particularly to the positive cost effects and efficiency gains from the 5-Point-Program initiated in Q1/2013. Thus, the firm is on track to cut its annual operating expenses by about 20%.

Net profit was +€1.6m (or -€10.6m, excluding provision revisions and re-categorization of insurance), an improvement on - €11.8m last quarter and - €78.3m a year ago.

Although free cash flow was negative at - €6.5m (due in particular to severance payments), this is an improvement on - €26m a year ago. Also, cash outflow for the first nine months of 2013 amounted to only -€0.9m (due to free cash flow of +€5.6m in first-half 2013). The free cash flow that was generated until the end of September demonstrates the specific focus on liquidity management, says Aixtron.

Despite continuously high capacity utilization rates at many LED chip makers, there were still no significant new investments in respective production equipment during Q3. Equipment order intake was €35.7m, up only slightly on €34.5m a year ago but up 17% on €30.5m in Q2. Total equipment order backlog at the end of September 2013 was €72.8m, down 34% on €109.8m a year previously but up slightly on €71.7m at the end of June.

5-Point-Program

As part of its ongoing 5-Point-Program (presented in May), in Q3 Aixtron started its ‘supply chain process’, an individual project related to point 3 (‘processes’). Aims of the project include an integrated planning process, in order to involve suppliers more closely in procurement and product development processes, allowing Aixtron to reduce inventory risk and improve lead times as well as allowing better management of a more defined supply chain.

Aixtron says that a thorough analysis of the firm’s technology fields has fundamentally confirmed the management's view on targeted future business opportunities, such as silicon applications, OLEDs and power electronics. Management has also identified other technology fields with attractive market potential. Consequently, R&D expenses and investments are being made in defined growth areas.

“Though the order situation is still subdued, we are using the time to adapt to the new market conditions,” says CEO Martin Goetzeler. “Our customers are currently in the course of optimizing their processes for the production of more powerful and cost-efficient devices. We are actively supporting the industry in this development with our newly implemented technical key account structure and our product roadmap,” he adds. “Moreover, we want to reduce both our lead times and the timeframe from the conception of a product to its volume production.”

Aixtron says that high capacity utilization rates at leading LED makers give reasons to believe that the overcapacity of MOCVD deposition equipment is further diminishing. However, there has still been no significant pick-up in demand for new Aixtron equipment, even in Q3/2013. As a result, it remains difficult to give a precise forecast of revenue and EBIT margin, says the firm. However, management thinks that Q4 revenue will be higher than in Q3.

Capital increase

With the consent of the supervisory board, Aixtron’s executive board has agreed to increase the firm’s share capital by partially utilizing its authorized capital of up to €10,223,133 to issue up to 10,223,133 new no-par value registered shares (corresponding to about 10% of the current share capital) for cash. Shareholders’ subscription rights will be excluded.

The new shares will be admitted for trading without a prospectus in the regulated market of the Frankfurt Stock Exchange, with a simultaneous listing in the Prime Standard segment of the Frankfurt Stock Exchange, which requires additional disclosure obligations. They will have full dividend entitlement as of 1 January 2013.

The new shares will be offered to qualified investors in Germany and internationally via an accelerated book building process.

Proceeds from the issue will be used to further strengthen the company’s technology by investing in additional growth areas, including projects related to the manufacturing of power electronics, organic LEDs (OLEDs) and silicon semiconductor applications. Additionally, the capital increase is expected to strengthen Aixtron’s financial flexibility by reinforcing its balance sheet and cash position.

Aixtron cuts losses as revenue rebounds 13% in Q2

Aixtron outlines 5-Point Program to return to sustainable profitability

Aixtron’s revenues and orders continue to struggle in Q1

Aixtron reports loss of €132m for 2012 as sales fall 63%

Aixtron’s Q3 upturn not enough to avoid heavy 2012 loss