- News

21 February 2014

Veeco’s Q4 revenue falls by a third year-on-year

Epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue for full-year 2013 of $331.7m, down 36% on 2012’s $516m, with all of the firm’s businesses experiencing down cycles. LED & Solar revenues have fallen 31% from $363.2m to $249.7m. Data Storage revenue has fallen 46% from $152.8m to $82m.

Fourth-quarter revenue was $73.2m, down 26% on $99.3m last quarter and 32% on $106.8m a year ago (but at the high end of the $65-75m guidance range).

In particular, system shipments in both metal-organic chemical vapor deposition (MOCVD) and Data Storage were very low. Data Storage revenue was $16.7m (23% of sales), down 31% on $24.3m last quarter. LED & Solar revenues were $56.5m (77% of sales), down 25% on $75m. Of this, $50m was for MOCVD (down 26.5% on $68m) and $6m was for molecular beam epitaxy (MBE, down from $7m).

Margins were unusually low (falling from 31% to 21%) due to the depressed volumes, continuing weak selling prices and higher cost of goods sold (which included items such as higher-than-normal supply chain cost). In 2013, margins averaged about 31% over the course of the year.

Operating expenses (OpEx) spiked higher in Q4, rising from $39m last quarter to $48m. “We’re now carrying about $4m of additional R&D and administrative cost related to the new ALD [atomic layer deposition] business [Synos Technology], which was acquired in early October,” notes chief financial officer Dave Glass. “OpEx included a few non-recurring items such as a reserve for bad debt expense in Asia, acquisition-related legal and accounting fees, and special performance and retention bonuses,” he adds.

“Very weak gross margins and high operating expenses contributed to poor bottom line performance,” chairman & CEO John R. Peeler.

On a non-GAAP basis, adjusted EBITA (earnings before interest, taxes and amortization) has worsened further, up from -$5.1m last quarter to -$26.6m. Of this, -$16.5m was due to LED & Solar (up from -$1.7m) and just -$3.1m to Data Storage (compared with +$2.1m). Full-year adjusted EBITA has gone from +$61.1m in 2012 to -$49.6m in 2013. Of this, -$26.4m was due to LED & Solar (compared with +$41.6m in 2012) and just -$0.7m due to Data Storage (compared with +$24.4m in 2012). However, the new ALD business is now included in the LED & Solar segment. “Since it’s still pre-revenue, it represents a drag on adjusted EBITDA for that segment,” notes Glass. Net loss has risen from $3m ($0.08 per share) last quarter to $16.4m ($0.42 per share).

“A highlight for the quarter was our continued solid cash management in a challenging environment,” says Peeler. During Q4, cash and short-term investments have fallen from $573m to $495m. However, this is down only slightly after adjusting for $76m used for acquiring atomic layer deposition business Synos Technology Inc (now Veeco ALD Inc).

In the fourth-quarter, order bookings were $85m, down 7% on $91.5m last quarter. In particular, LED & Solar orders were $63.3m (74% of total bookings), down 14% on $73.5m. Of this, MBE orders rose by 56% from $7m to $11m, but MOCVD orders fell 22% from $67m to $52m. “While MBE did see some positive tractions with multiple GENxplor orders as well as one production system order, the weakness in MOCVD bookings continued in Q4 at what we are considering trough levels [for over two years now],” says Glass. This has counteracted a rise in Data Storage orders to $21.6m (26% of total bookings), up 20% on $18m last quarter (albeit still quite weak by historical standards).

Full-year bookings have fallen 15% from $392m in 2012 to $331.6m in 2013. This includes LED & Solar orders falling from $305.2m to $237.6m, counteracting a rise in Data Storage orders from $86.7m to $94m.

Total order backlog at the end of Q4/2013 was $143m. “We haven’t yet seen a recovery in business conditions,” comments Peeler.

“While not included in reported fourth-quarter bookings [since the revenue recognition timing for it is still uncertain], we received a purchase order from the world leader in mobile OLED displays for a next-generation Fast Array Scanning Atomic Layer Deposition (FAST-ALD) prototype system,” says Peeler. “While 2013 was a challenging year, we remain positive about trends in LED lighting and our new growth opportunity in flexible OLED encapsulation for mobile phones,” he adds.

“While it is too early to call a turn in our MOCVD business, we are seeing some encouraging signs,” comments Peeler. “LED fab utilization rates appear to be relatively stable and high at all key accounts, and solid-state lighting adoption is accelerating. Top customers in China and Taiwan have over 90% fab utilization and they did not shut down for the Chinese New Year,” he adds. “We are talking to leading customers about potential capacity expansions, and our orders are likely to improve this quarter… Some Korean customers are adding capacity by upgrading older systems and buying new tools to keep up with demand.”

For first-quarter 2014, with orders likely to increase, Veeco expects revenue to rebound to $85-95m (driven mainly by MOCVD).

Gross margin should rise to 33-35%. “We do see the likelihood of improvements as certain MOCVD deals with better ASP [average selling price] roll out of backlog and the impact of various cost improvements are first gaining traction,” says Glass. “For example, a new cost-down version of MaxBright will positively benefit our margin starting this quarter.”

Operating expenditure is expected to be back down to more normal levels of $42-43m. “With the accounting review now behind us, we expect significantly lower outside advisor and accounting cost,” says Glass. However, this lower spend will be largely replaced by new ALD business OpEx.

“R&D is front-end loaded in the first half of 2014, and this is likely to trend down in the second half of the year,” notes Glass. “As a result, we do expect OpEx to tick down in the second half. This, along with the expectation of better margins, should be effective in driving our quarterly breakeven revenue down to below $100m later in 2014,” he adds.

“Our priority for 2014 is to take the steps necessary to transition the company back to profitable growth,” says Peeler. “We are focused on four areas to improve our performance: (1) developing and launching game-changing new products that enable cost-effective LED lighting, flexible OLED encapsulation and other emerging technologies; (2) executing manufacturing cost reduction initiatives and lowering expenses wherever possible; (3) driving process improvement initiatives to make us more efficient; and (4) improving product differentiation, customer value and pricing to stem margin erosion,” he adds. “We anticipate that Veeco will run at a loss for a couple of quarters, but see a very bright future for the long run.”

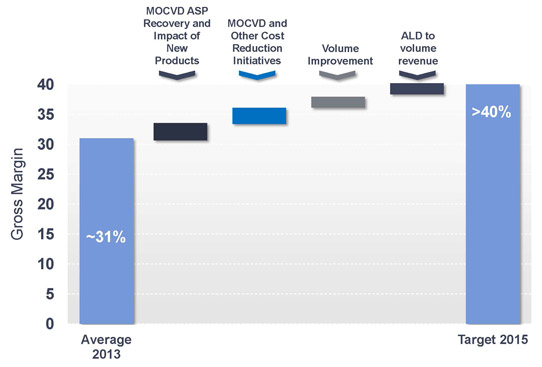

Graphic: Veeco’s plan for gross margin recovery.

Regarding Veeco’s plan for recovery in gross margin, Glass notes that it is likely to remain in the low- to mid-30s until the firm sees higher shipment volumes again and after MOCVD chamber ASPs return to a more normal level, aiding the ongoing incremental cost-reduction improvements that the firm is continually driving. However, achieving better margins for MOCVD will require new products to drive growth in lighting and power electronics, Glass adds. In addition, some wins in OLED and adjacent markets for the newly acquired ALD business should help to achieve the gross margin target of 40% or more in 2015, he reckons. “Except for the cost-reduction improvements which are ongoing, we see most of these factors starting to take shape in the second half of this year, but they are unlikely to be a strong force for margin recovery until 2015.”

Veeco’s Q3 revenue flat sequentially, down 25% year-on-year

Veeco’s orders rebound by 21% to $85m in Q2, driven by MOCVD orders rising 40%

Challenged Veeco sees MOCVD orders fall 42% in Q1

Veeco’s bookings rise 10% in Q4/2012, driven by MBE during MOCVD overcapacity