- News

12 November 2013

Veeco’s Q3 revenue flat sequentially, down 25% year-on-year

For third-quarter 2013, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $99.3m, down 25% on $132.7m a year ago but up just 2% on Q2’s $97m (albeit a significant improvement from Q1’s $62m).

Data Storage revenue was $24.3m (24% of sales), down 28% on $33.8m a year ago but up 13% sequentially. LED & Solar revenues were $75m (76% of sales), down 24% on $98.9m a year ago. Of this, metal-organic chemical vapor deposition (MOCVD) contributed $68m (flat sequentially) and molecular beam epitaxy (MBE) $7m.

“Third-quarter 2013 results were impacted by persistent overcapacity and weak business conditions in our MOCVD and Data Storage businesses,” says chairman & CEO John R. Peeler. In addition to low volumes, gross margin remains under pressure from intense pricing pressure in MOCVD (falling further, from 37% in Q1 and 36% in Q2 to 31% in Q3). “While we continue to take manufacturing costs out of MOCVD and other products, it is too difficult to swim against the tide of dramatically lower prices coming from the competition,” comments Peeler. “Due to our MOCVD systems’ market leadership and cost of ownership advantage, we do generally command a premium pricing in the market. Nonetheless, our selling prices for both single-chamber and cluster systems are much lower than historic levels.”

Operating expenses (OpEx) has been flat all year ($42m in Q1, $41m in Q2, $40m in Q3), but that has included the cost of the firm’s accounting review (about $3-4m per quarter - about $15m in total through Q3/2013).

On a non-GAAP basis, adjusted EBITA (earnings before interest, taxes and amortization) has deteriorated further, from +$14.2m a year ago and -$2.2m last quarter to -$5.1m, with LED & Solar making a loss of $1.7m (compared with profits of $3.1m last quarter and $9.5m a year ago), due mainly to the low volumes and weaker MOCVD selling prices. Net loss has grown to $3m, compared with $1.3m last quarter and net income of $11.7m a year ago. Nevertheless, Veeco’s cash balance (cash and short-term investments) has fallen by just $6m from year-end 2012 to $573m at the end of Q3, as losses have been offset by strong working capital management.

Order bookings rose to $91.5m, up 7.6% on $85m last quarter and 9.3% on $83.7m a year ago. LED & Solar orders were $73.5m, up 8.4% on $67.8m a year ago and 27% on $58m last quarter.

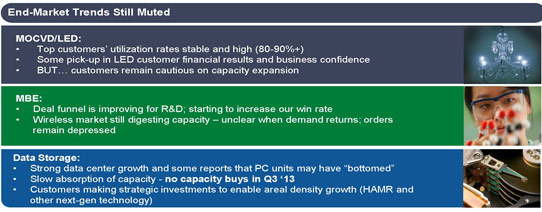

Of this, MOCVD bookings rose 28% from $52m last quarter to $67m (80% of total bookings), up on $63m a year ago but still at ‘trough’ levels. However, “this continues to represent incremental capacity adds from just a handful of customers,” says Peeler. “LED fab utilization rates appear to be relatively stable and high at all of our key accounts [80-90%+]. Many of our top customers are reporting improved profitability and are optimistic about the future of the LED market. But overall, they are cautious about expanding capacity,” he adds. “In Q3, we won key MOCVD deals from a top Taiwanese customer for one of their Chinese factories and from the global GaN-on-silicon leader in Japan. … We are winning the most important deals, but we have not yet seen a recovery in MOCVD demand,” says Peeler.

“Production orders for MBE and Data Storage systems also remain elusive,” Peeler adds. MBE bookings were $7m (up just 12% on $6m last quarter and up on $5m a year ago). “Production orders remained low due to manufacturing overcapacity, but we're doing well in the R&D applications.” Data Storage bookings were $18m, up on $15.9m a year ago but down by a third on $27m last quarter (and falling to 20% of total bookings).

For Q4/2013, Veeco expects revenue to fall to $65-75m due to the low level of system shipments in both MOCVD and Data Storage. “Bookings are currently expected to be weak,” notes chief financial officer & executive VP David D. Glass. “In MOCVD, there are a couple of factors that are contributing to the weak quarter. About 35-40% of backlog is coming from service contracts, which often take longer to turn into revenue than tool shipments. There are a couple of China deals in our backlog that are converting to revenue slowly,” he adds. “We continue to focus on winning the key strategic deals, which we have done very successfully so far.”

Given the low revenue expectation and continuing pressure on selling prices, margins should be weaker. OpEx will rise, as Veeco sees some continuing tail costs related to the accounting review completed in Q3, while beginning to bring on new costs related to the acquisition of Synos Technology Inc - now Veeco ALD Inc, which makes Fast Array Scanning Atomic Layer Deposition (FAST-ALD) systems for the production of flexible organic light-emitting diode (OLED) displays for mobile devices - at the beginning of October. “Unfortunately, we do expect to see losses for the next few quarters,” cautions Glass.

“While business conditions have remained challenging throughout 2013, we remain positive about long-term trends in LED lighting and our new opportunity in flexible OLED encapsulation for mobile phones,” says Peeler. “Success will come from top-line revenue growth. We are willing to run Veeco at a loss for a few quarters to seize on the market opportunities.

“Chinese customers like Sanan Optoelectronics and HC SemiTek, who were formerly relegated to the low-power LED world, have become established players in the mid-power space. Top Korean and Taiwanese customers are also improving their brightness and cost efficiency and are making significant inroads into the high-power market,” he adds. “Many of Veeco’s top customers are reporting strong demand for mid-power LEDs for indoor replacement bulbs and for high-power LEDs for outdoor lighting. All this movement up the LED food chain will have a disruptive effect on supply and demand dynamics, and it will drive down residential light bulb prices and will ultimately drive the tipping point for lighting,” Peeler forecasts.

“We also think GaN power electronics has great potential for energy efficiency, electric vehicles and other applications,” says Peeler. “We recently created a new core R&D group and staffed it with some of our best talent. This group will work with our business unit R&D teams to explore and execute on initiatives that penetrate adjacent markets such as new ALD applications,” he adds.

“Our strong R&D capability, technology leadership position, world-class sales & support organization, flexible manufacturing approach and solid balance sheet provide a strong foundation for the future,” believes Peeler. “We will continue to look for businesses and technology acquisitions to accelerate our growth.”

Veeco completes accounting review; reports 2012 and first-half 2013 revenues

Veeco has also filed its delayed financial reports on Form 10-Q for the quarters ended 30 September 2012, 31 March 2013 and 30 June 2013 as well as its annual report on Form 10-K for 2012.

The documents could not be filed on time previously because the firm was reviewing the timing of the recognition of revenue and related expenses on the sale of certain products (MOCVD systems and related upgrades to these systems). “The accounting review [announced on 15 November 2012] is complete and no restatement is required,” says chairman & CEO John R. Peeler. “All major issues of accounting principle and application of GAAP have been analyzed, addressed and documented.”

For 2012, revenue fell by 47.3%, to $516m from $979.1m in 2011. LED & Solar revenues fell 56.1% from $827.8m to $363.2m. Data Storage revenue rose 1% from $151.3m to $152.8m.

As sales volumes declined and selling prices fell through the year, gross margin fell from 48.4% to 41.7% (specifically, from 48.0% to 40.9% for LED & Solar and from 50.7% to 43.7% for Data Storage).

“Additionally, we had a declining number of high-profit acceptances left in the backlog,” says Peeler. “This combination of pricing pressure, low volumes and low levels of acceptances moved us to a loss in the fourth quarter of last year.” Non-GAAP net income in 2012 was $41.6m, down from $206.2m in 2011. Adjusted EBITA fell from $296m to $61m. “While business [revenue] was down nearly 50%, we're very proud that we were able to stay profitable,” says Peeler.

“Veeco moved quickly last year to lower OpEx by about 10%, from nearly $200m down to $178m,” says Peeler. “We did this by aggressively going after SG&A items first, while focusing our R&D spending on only the most strategic projects.” Selling, general & administrative (SG&A) expenses fell from $95.1m to $73.1m (though still rising from 9.7% of net sales to 14.2%). R&D expenses have been cut only slightly, from $96.6m to $95.2m (almost doubling from 9.9% of net sales to 18.4%). “Last year’s performance has proven that our variable costs business model works, even in an extreme case, to protect our profitability,” comments chief financial officer & executive VP David D. Glass.

Orders fell by 52.1%, from $817.9m in 2011 to $391.9m in 2012.

For first-half 2013, revenue was $159.2m, down 42.4% on $276.5m in first-half 2012. Of this, LED & Solar fell 35.2% from $182.4m to $118.2m; Data Storage fell 56.5% from $94.1m to $41m.

Gross margin fell from 45.8% to 35.9% (LED & Solar falling from 45.1% to 34.1%; Data Storage falling from 47.0% to 41.1%). SG&A expenses fell from $40.7m to $39.4m (rising from 14.7% of net sales to 24.8%). R&D expenses were cut from $47.2m to $41.6m (though rising from 17.1% of net sales to 26.1%). Net loss was $14.2m in first-half 2013, compared to net income of +$27.5m in first-half 2012.

Orders fell by 28.1%, from $215.9m in first-half 2012 to $155.2m in first-half 2013.

Veeco’s orders rebound by 21% to $85m in Q2, driven by MOCVD orders rising 40%

Challenged Veeco sees MOCVD orders fall 42% in Q1

Veeco’s bookings rise 10% in Q4/2012, driven by MBE during MOCVD overcapacity