- News

5 August 2019

Aixtron returns to positive free cash flow in Q2/2019 after 19.5% year-on-year equipment revenue growth

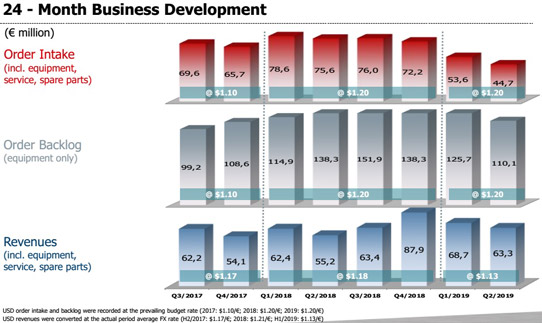

For second-quarter 2019, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €63.3m, down 8% on last quarter’s €68.7m but up 1.4% on €62.4m a year ago. Equipment revenue in particular was €50.3m (79% of total revenue), down 10.3% on €56.1m (82% of total revenue) last quarter but up 19.5% on €42.1m (76% of total revenue) a year ago.

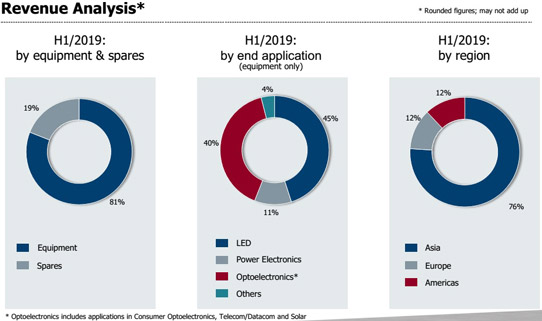

This contributed to first-half revenue rising by 12% from €117.6m in 2018 to €132m in 2019. In particular, equipment revenue grew by 15% from €92.9m to €106.5m (rising from 79% to 81% of total revenue), while sales of spare parts & services rose by just 4% from €24.6m to €25.5m (falling from 21% to 18% of total revenue).

On a regional basis, 76% of total revenue came from Asia (rebounding from just 50% in first-half 2018), while Europe has fallen back from 30% to 12% and the USA from 20% to 12%.

This corresponds to metal-organic chemical vapor deposition (MOCVD) systems for ‘LEDs’ accounting for the largest share of equipment revenue, at 45% (up from just 17% in first-half 2018). Systems for ‘Power Electronics’ have risen from 7% to 11% of revenue. MOCVD systems for ‘Optoelectronics’ (consumer optoelectronics, telecom/datacom and solar) fell to 40% of revenue (from 69% in first-half 2018), including just 32% for optoelectronics alone. This reflects “the expected customer reluctance to invest in new production capacity, which was further exacerbated in the short term by the US sanctions against Huawei,” notes president Dr Bernd Schulte.

Cost of sales rose from €66.9m (57% of revenue) in first-half 2018 to €79.4m (60% of revenue) in first-half 2019, also reflecting the higher share of LED systems (which are relatively low margin) in the revenue.

Due to the increased share of low-margin LED systems in the product mix, gross margin hence fell from 43% to 40%, although the advantageous $/€ exchange rate and lower product costs helped to offset the margin effects (achieving the upper end of the 35-40% forecast). Most recently, quarterly gross margin rose from 39% in Q1 to 41% in Q2/2019.

Due mainly to the lower project-related expenses, first-half operating expenses have been cut by 13% from €38.7m in 2018 to €33.5m in 2019 (including quarterly OpEx being cut from €17m in Q1 to €16.6m in Q2).

Due mainly to business and cost development, first-half operating profit (EBIT) has improved from €12m (EBIT margin of 10% of revenue) in 2018 to €19.1m (14% EBIT margin) in 2019. Despite quarterly EBIT falling slightly from €9.7m in Q1 to €9.3m in Q2, this still grew as a proportion of revenue from 14% to 15% EBIT margin (and is more than double the €4.1m a year ago).

Revenues, gross profit and operating result (EBIT) rose significantly year-om-year, while operating expenses continued to fall. Gross and EBIT margins reached the upper end of the ranges forecasted at the beginning of the year.

First-half net profit was €15.8m (12% of revenue) in 2019, roughly level with €16m (14% of revenue) in 2018 (remaining €0.14 per share), despite quarterly net profit falling from €8.5m (€0.08 per share) in Q1 to €7.3m in Q2 (€0.06 per share), remaining 12% of revenue (and double the €3.7m a year ago).

Capital expenditure (CapEx) was €6.7m in first-half 2019 (up from €4.5m in first-half 2018). First half free cash flow has hence improved from -€12.7m in 2018 to -€4.9m in 2019. Also, this was due mainly to -€17.5m in Q1 (resulting from supplier payments and additional inventories acquired in Q1), before returning to positive free cash flow of +€12.6m in Q2, reflecting the profitable course of business.

Although down by €4.8m on €263.7m at the end of 2018, cash including other financial assets (bank deposits with a maturity of at least three months) recovered during Q2/2019 from €247.9m to €258.9m.

First-half order intake (including spare parts and service) was €98.3m in 2019, down 36% (especially in the optoelectronics segment, as expected) from €154.3m in 2018. “Against the backdrop of the ongoing trade dispute between the USA and China, our customers were reluctant to invest in the expansion of their production capacities,” says Aixtron. “Despite this, the key figures for the first half of the year are fully in line with the annual guidance.” Most recently, the decline in quarterly order intake has slowed, with Q2’s €44.7m down 17% on Q1’s €53.6m.

Equipment order backlog has fallen further to €110.1m at the end of first-half 2019 (most scheduled for shipment in 2019), down by 12% on €125.7m at the end of Q1/2019 and by 20% on €138.3m at the end of first-half 2018.

However, the market developments of increasing use of lasers for 3D sensor technology and optical data transmission, a progressive expansion of the 5G network, and increasing use of energy-efficient power electronics remain positive and are only affected for a short time by the current geopolitical tensions, reckons Aixtron.

“We are optimistic that order intake will improve in the second half of the year, in particular due to an expected recovery in demand from Asia,” says Schulte. “In combination with our strong order backlog, we plan to meet our forecast for the year,” he adds.

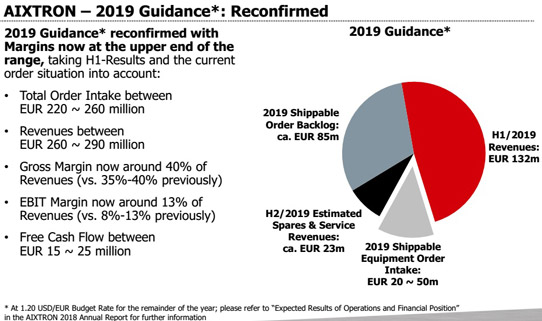

Based on the good first-half 2019 results and an assessment of demand development taking into account the current market environment and the budget exchange rate of 1.20$/€, Aixtron has confirmed its full-year 2019 guidance for sales and orders.

Aixtron now expects stable to growing revenue of €260-290m (compared with €268.8m in 2018). Also, margins and profit should be at the upper end of the previously forecast ranges, with gross margin of about 40% (previously 35-40%) and EBIT of about 13% of revenues (previously 8-13%). Free cash flow should be €15-25m (up from just €4.4m in 2018). Expectations for 2019 fully include the results of Aixtron’s organic light-emitting diode (OLED) subsidiary APEVA (including all necessary investments to continue the development of OLED activities).

Full-year 2019 orders should be €220-260m, including an order from its OLED customer for the next test tool as part of the ongoing qualification process for organic vapor phase deposition (OVPD) technology for the OLED display industry.

The Gen2 OLED system was installed in a pilot-production line at the customer’s facility and is operated jointly by engineers from the customer and APEVA. “The tool is currently undergoing an extensive evaluation program,” says president Dr Felix Grawert. In the coming months, the system is expected to confirm the efficiency of the OVPD technology, as part of another scheduled step towards qualification of the OVPD technology for this customer.

“In power electronics, we see a steadily rising demand for systems for gallium nitride (GaN)-based applications, driven among other things by the expansion of 5G mobile communication networks,” says Grawert. “In addition, we are making great progress in marketing our new silicon carbide (SiC) production system, for which we have already received initial orders in addition to positive customer feedback,” he adds.

“Especially in the areas of lasers, power electronics and special LEDs, we continue to see three strong growth drivers that are important building blocks for global megatrends such as the next generation of 5G wireless networks, 3D sensors for mobile phones and power electronics for electro-mobility and renewable energies, as well as next-generation micro-LED displays,” concludes Schulte.

Aixtron’s Q1 gross margin and earnings exceed expectations

Aixtron full-year revenue up 40% organically to €268.8m

Aixtron’s revenue grows 15% in Q3, driven by power electronics, laser and ROY LED applications