- News

13 January 2017

GaAs component market to grow at over 4% to $9.13bn in 2021

The global gallium arsenide (GaAs) components market will grow at a compound annual growth rate (CAGR) of over 4% to $9.13bn by 2021, with over 54% of the revenue being generated from the mobile devices segment, according to the report 'Global Gallium Arsenide Devices Market 2017-2021' by Technavio. The high growth of this market segment is being driven by rapidly developing 3G and 4G networks.

The rising adoption of smartphones and tablets is acting as a major impetus, with the number of smartphone shipments expected to reach 2 billion by 2020. This growth will drive demand for GaAs components used in mobile handsets, particularly GaAs power amplifiers.

APAC: largest GaAs component market segment

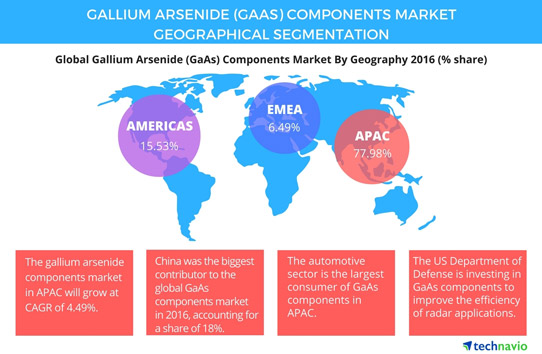

The Asia-Pacific region accounted for almost 78% of total market revenue in 2016, notes the report. "The market dominance is primarily because of the high demand for GaAs components from communication device manufacturers in the region," says Sunil Kumar Singh, a lead analyst at Technavio for embedded systems research. "Also, increasing demand for power applications, along with high-growth economies, is a major driver of the GaAs components market in the region," he adds.

Increasing smartphone penetration in developing countries and rapidly developing wireless infrastructure are driving the high adoption of GaAs components in the region. Companies such as Samsung, LG, HTC and Sony are investing heavily to launch better smartphones, compatible with 3G/4G technologies. These new-generation mobile phones integrate 3-4 times more power amplifiers compared with previous-generation smartphones, which means increased demand for GaAs components.

Americas: expansion of 4G networks driving GaAs components market

Technavio forecasts that the Americas will exhibit a CAGR of 4.31% during the forecast period, driven mostly by the expansion of 4G networks. North America is seeing a rapid expansion of its 4G network to make an easier transition to the upcoming 5G network. Apple and Skyworks Solutions are among the biggest consumers of GaAs components, for application in mobile power amplifiers.

GaAs components also find wide application in radar and defense systems. Currently, the US Department of Defense (DoD) is investing significantly in GaAs components to improve the efficiency of its existing radar applications. GaAs components are also expected to attract demand from the military sector, boosting the revenue contribution from the region.

EMEA: high demand from the automotive industry

In Europe, the Middle East and Africa (EMEA), GaAs components saw maximum adoption from the thriving automotive industry, says the report. "The region will also invest in the adoption of LEDs for the general lighting and automotive sectors, all of which consume GaAs components," notes Sunil. "In the defense sector, UMS, an MMIC solution provider from the UK, creates a significant demand for GaAs components," he adds.

The various domains of defense (radar, communication, and smart ammunition) are supplied with designs created by UMS or their customers and are based on the UMS technology platform. However, this region will grow more slowly than the other two regions as most semiconductor foundries and manufacturing units are in APAC and the Americas.

The top vendors in the global GaAs component market highlighted in the report are: Skyworks Solutions, Qorvo, and Broadcom. Other prominent vendors include Advanced Wireless Semiconductor Co (AWSC), Analog Devices, MACOM, and Murata Manufacturing.