- News

20 December 2017

LED chip market to achieve supply-demand balance in 2018 due to Chinese suppliers’ production capacity expansions

© Semiconductor Today Magazine / Juno Publishing

Major Chinese LED chip suppliers including San’an Optoelectronics and HC SemiTek have lowered their product prices recently, indicating the end of LED chip undersupply and the hike in LED chip price that had lasted a year and a half, according to LEDinside (a division of TrendForce). The next year will see a balance in LED chip supply and demand, it adds.

“However, as the major LED chip makers continue to carry out capacity expansion plans, we do not exclude the possibility of temporary oversupply in the next two years,” says senior analyst Figo Wang.

Wang also points out that prices of LED chips in China fell sharply during 2015, resulting in a surge of orders going to Chinese LED chip suppliers in 2016. To meet the demand, Chinese chip suppliers decided to raise their capital expenditure (CapEx). In comparison, other chip makers worldwide have lowered their investment in production, and some have even withdrew from the LED market. In 2017, Chinese LED chip makers continued their active investment in the industry, and this year’s new metal-organic chemical vapor deposition (MOCVD) expansion plans come mainly from San’an Optoelectronics, HC SemiTek and Aucksun.

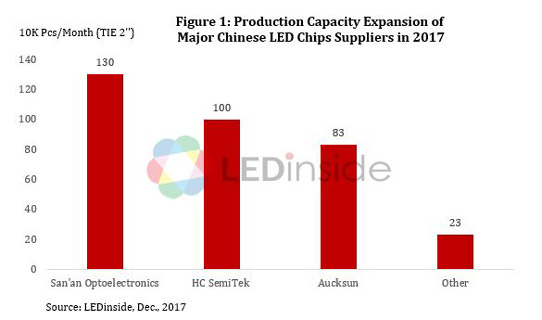

Regarding 2”-equivalent epitaxial wafers, San’an Optoelectronics, HC SemiTek and Aucksun have increased their monthly production capacity by 1.3 million, 1 million and 0.83 million epiwafers respectively, making them the top three LED chip suppliers in China. Due to the chip makers’ capacity expansions at the end of 2017, the market is expected to enter a balance in supply and demand. Suppliers like San’an Optoelectronics and HC SemiTek have therefore strategically adjusted their chip prices for lighting applications and digital displays, which are always a focus of competition in the industry. Prices, which have been pushed up for a year and a half, now have a chance to enter a period of stability or slight fluctuation, reckons LEDinside.

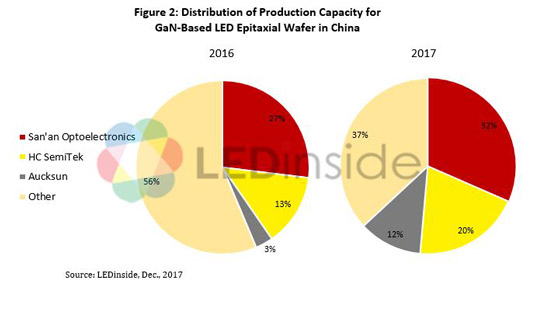

After this round of large-scale expansion, the production capacity of the three industry leaders will exceed 1 million epiwafers per month, increasing the concentration of industrial production. LEDinside adds that this can also improve the supply structure and prevent excessive price competition. In addition, new MOCVD systems have higher production efficiency than the previous generation, lowering costs by 30%. As a result, major players like San’an Optoelectronics and HC SemiTek will enhance their cost competitiveness while other suppliers that cannot afford the production expansion will be marginalized in the market, LEDinside concludes.