- News

7 May 2013

Electric vehicle go-slow hits SiC power devices

Uncertainty hangs over the market for power devices made with the wide-bandgap semiconductor silicon carbide (SiC), due to a lack of clarity over whether and when electric vehicles will adopt them, according to the latest study on the SiC industry released by market analyst firm Yole Développement. “We have no firm estimate of when it will come,” says Philippe Roussel, business unit manager compound semiconductors, power electronics, LED & photovoltaics. “It’s still questionable.”

Automotive qualification can take up to five years, Roussel notes. So, even if qualification for use in electric and hybrid electric vehicles (EV/HEV) is on-going, it most likely will not be clear if SiC has been successful until 2015. Also, although qualification for EV/HEV charger inverters would be quicker, SiC faces a greater challenge there from silicon superjunction MOSFETs, IGBTs (insulated-gate bipolar transistors), and also wide-bandgap gallium nitride (GaN) devices.

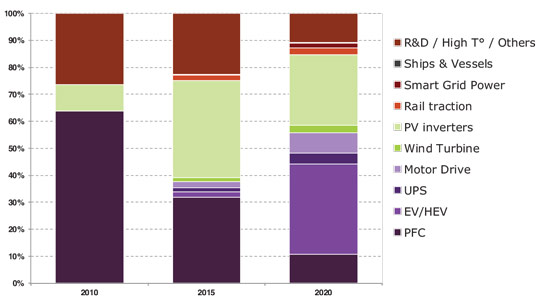

As a result, in its latest analysis on the SiC industry Yole describes two scenarios for the evolution of the SiC industry. Its more optimistic scenario sees SiC devices (transistors and diodes) used commercially in EV/HEV from 2015 onwards, taking 11% of the market from silicon IGBT devices by 2020. In the pessimistic scenario, EV/HEV implementation does not start until 2017/2018, making PV inverters the number-one SiC application in 2020.

Graphic: Distribution of SiC device market over time for main applications: PV inverters will dominate by 2015.

Currently, there remains much room for increasing SiC device usage in PV inverter applications, Roussel underlines. “Each inverter manufacturer’s product line-up has just one or two models with SiC in them, among dozens,” he says. “But it’s a very positive starting point.” That has helped SiC power device industry revenue to reach $76m in 2012 (including R&D but excluding military use). PV inverter producers are the second industry to broadly adopt SiC devices, after manufacturers using SiC for power factor correction (PFC) in high-end server power supplies.

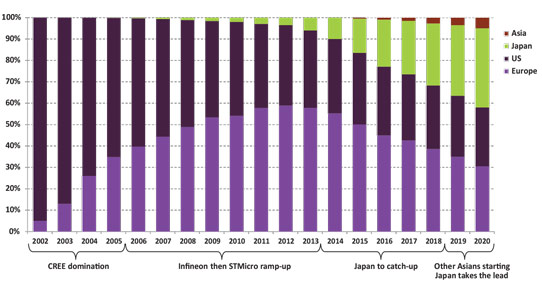

Graphic: Percentage of SiC revenue by location of company headquarters.

Some PV inverter manufacturers use a SiC diode and a silicon IGBT or MOSFET, and some offer full SiC inverters. “They’re just the first attempt, as inverter makers have limited their SiC development investment,” Roussel says. “They are doing a simple replacement for silicon devices, taking the minimum extra work.” But that means that inverter producers are selling more expensive SiC products on their efficiency, without fully exploiting the material’s benefits. “The next step will definitely be a full re-design within the inverter that should fit with SiC’s high-frequency and -temperature capabilities, reducing the number of capacitors and inductors needed,” Roussel says

.

.

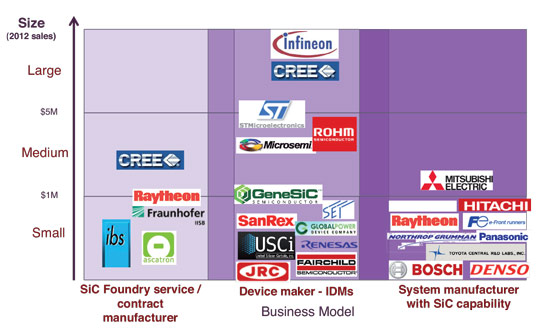

Graphic: Main players and related business models in the SiC device industry.

Working with reverse costing specialist System Plus Consulting, Yole has modelled the benefits of increasing the standard PV inverter switching frequency from 12kHz to 32kHz. That shortens the payback time on the SiC investment, and would make large 50kW SiC inverters cheaper than their silicon equivalents by 2020, it is reckoned. Such benefits will help to boost annual revenue for SiC devices sold into PV inverters to $200m by 2020, Yole predicts.

However, even though PV inverters are currently better established, EV/HEV inverter producers could still be more advanced in making full use of SiC. “Efficiency drives adoption, but putting SiC in any system could also make it smaller and lighter,” Roussel stresses. “For EV/HEV, that is just fantastic.”