- News

12 March 2013

UV LED market to grow at 43% CAGR from $45m in 2012 to nearly $270m by 2017

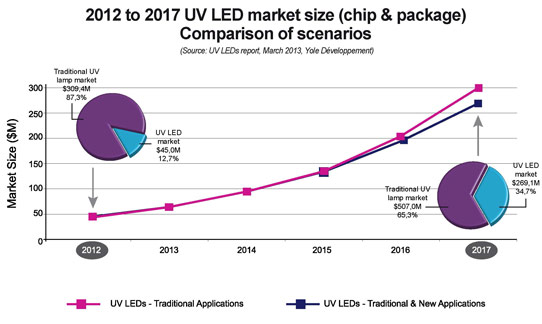

Due to UV curing, UV LEDs should become a $270m business by 2017, and could hit $300m if new applications boom, according to a report ‘UV LEDs: Technology & Application Trends’ from market research firm Yole Développement that presents new UV LED applications and associated market metrics for 2012-2020 as well as an analysis of UV LED technology and the UV LED lighting industry.

Due to their compactness, low cost of ownership and environmentally friendly composition, UV LEDs continue to replace incumbent technologies like mercury. Hence, the UV LED market is expected to rise at a compound annual growth rate (CAGR) of 43% from $45m in 2012 to nearly $270m by 2017, while the traditional UV lamps market grows at just 10%.

In 2012, UVA/UVB applications represented 89% of the overall UV LED market. Amongst these applications, UV curing is the most dynamic and most important market, due to significant advantages offered over traditional technologies (e.g. lower cost of ownership, system miniaturization etc). This trend is reinforced by the whole supply chain, which is pushing for the technology’s adoption: from UV LED module and system manufacturers to ink formulators and the associations created to promote the technology. Also, with Heraeus Noblelight’s acquisition in January of Fusion UV, all major UV curing system manufacturers are now involved in the UV LED technology transition.

Regarding UVC, applications are still in their infancy and sales are mainly for R&D purposes and analytic instruments such as spectrophotometers. However, given some newly published results - e.g. an increase in external quantum efficiency (EQE) over 10%, etc - and commercialization in 2012 of the first UVC LED-based disinfection system, the market should kick into gear within the next two years, says Yole.

In addition to traditional applications (UV lamps replacement), and due to their unique properties (compactness, higher lifetime, robustness, etc), UV LEDs are also creating new applications that are not accessible to traditional UV lamps, i.e. applications that are miniaturized and portable. “In 2012, several new UV LED-based products were launched, including cell-phone disinfection systems, nail gel curing systems and miniaturized counterfeit money detectors - and this is likely to continue,” says Pars Mukish, Technology & Market Analyst, LED, at Yole. “We estimate that if new UV LED applications continue emerging, the associated business could represent nearly $30m by 2017, which would increase the overall UV LED market size to nearly $300m,” he adds.

Once UVC LED performance is sufficient, the supply chain battle will intensify

The booming UVA/UVB market (mostly UV curing) has attracted several new players from different backgrounds over the past few years: traditional UV lamp suppliers, traditional UV system suppliers, pure UV LED system suppliers, and others. Each player employs a different strategy for capturing the maximum value created by this disruptive technology: horizontal integration (from UV lamp to UV LED), vertical integration (from UV LED device to UV LED system and vice-versa) or both (from UV lamp to UV LED system). Yole notes that traditional UV lamp manufacturers are under the most pressure since they have to compensate for the waning lamp replacement market by diversifying their activities to higher levels of the supply chain.

In the end, each UV LED device/system maker faces the same technical issues when it comes to integrating UV LEDs into a system (thermal management, optics, etc), but experience is gained with each passing year. Once UVC LEDs achieve sufficient performance, no manufacturer will allow the opportunity to pass it by, reckons Yole. When that moment comes, the whole supply chain will become a mess due to an increasingly competitive environment, and consolidation will be necessary, it adds.

Yole’s analysis covers the entire UV LED industry, detailing: the main players & associated strategies/business models, 2012 industrial value & supply chains, revenues and market shares of key players, etc.

Bulk AlN vs AlN-on-sapphire templates: no current winner

AlN-on-sapphire templates are definitely the substrate of choice for UVA applications, notes Yole, as they provide the right mix between cost and performance. However, for UVC applications (and some UVB applications) the competition with bulk AlN substrate is strong, since such material could allow for improvements at the device level in terms of lifetime, efficiency - internal quantum efficiency (IQE) and external quantum efficiency (EQE) - and power output.

Just now, the debate is still on. And, even if bulk AlN’s superior performance has been demonstrated by companies such as Crystal-IS and HexaTech, the associated cost (2.5-4x more compared to AlN-on-sapphire template) remains an obstacle to developing UVC LEDs at a reasonable price.

Indeed, such a situation has already occurred with GaN substrate for visible LEDs. Bulk GaN was the ideal technical candidate, but its cost was too high and sapphire was widely adopted instead. Will UV LEDs meet the same fate?

In addition to substrate issues for UVC LED development, epitaxy represents another challenge for increasing device performance, notes Yole. Such barriers will have to be overcome before we see commercialized UV LED-based disinfection/purification systems, it concludes.