- News

28 July 2011

China developing supply chain after its LED sector grows 33.8% in 2010

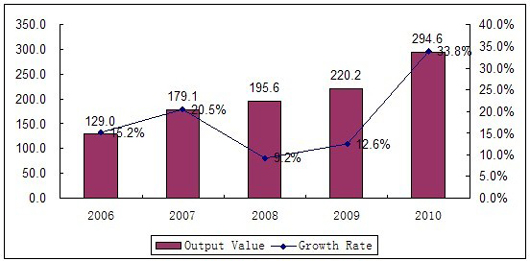

China’s LED industry has seen significant development after the initiation of the National Semiconductor Illuminating Project in 2003, says Beijing-based CCID Consulting Co Ltd. In 2008, the industry’s growth rate was affected by sluggish downstream demand resulting from the global financial crisis. However, in 2009, due to the state’s various supporting policies, the industry’s growth rate began to pick up. In 2010, driven by rapid development of the downstream full-color LED display, LED backlights, LED lighting and other applications, the size of China’s LED industry (including substrates, epitaxy, chips and packaging) surged by 33.8% to RMB29.46bn. Meanwhile, the compound annual growth rate (CAGR) of China’s LED industry was 18.7% from 2006 to 2010.

Figure 1: Size of China’s LED industry (2006–2010).

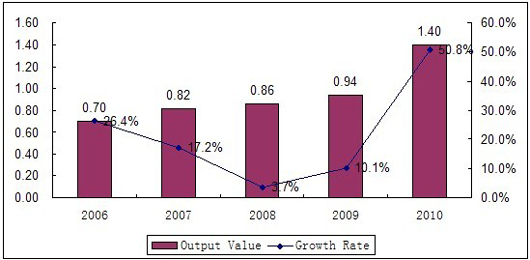

In recent years, the development of China’s substrate sector has been relatively slow compared with the epitaxy, chip, and packaging sectors due to its lagging technology and fierce market competition. In 2010, as various sapphire substrate projects were still under construction or in the process of equipment testing (retarding production capacity from significant expansion), the substrate sector still featured low-end products with limited production capacity for sapphire substrate. Nevertheless, in 2010, China’s substrate sector grew in capacity by 34.4% to 3.525 million square inches, and in output value by 50.8% to RMB140m.

Figure 2: Size of China’s LED substrate sector (2006–2010).

Supported by the National Semiconductor Illuminating Project and the State 863 Program, China’s GaAs/InP/GaP substrate technologies (used for red and green LED production) have made great progress, says CCID. Mass production of the materials has been realized in enterprises including Compound Crystal Technology Co Ltd, Guorui Electronic Materials Co Ltd, Shanghai Pujia Optoelectronic Materials Co Ltd, and the 46th Research Institute of CETC. Their total LED substrate output accounts for about 30% of the country’s total, making China self-sufficient in such substrates.

In 2010, driven by rapid development of the downstream LED backlight and LED illumination sectors and rapid expansion of GaN epitaxy and chip production capacity, the supply of upstream sapphire, silicon carbide (SiC) and gallium nitride (GaN) substrates used for blue and white LEDs became tight, with prices continuing to rise. Despite the still immature technologies for such materials and a shortage of qualified talent, in 2010 many domestic enterprises began to enter the sapphire substrate field in pursuit of the high profits available, as they continued to increase investment and introduce key technologies. Most of those enterprises are located in the eastern coastal area and in the southwest, along with a few in inland areas.

Among them, Tianjin Sapphire, Qingdao iStarWafer and Peter Stone Love have begun to supply sapphire substrate products, while Silian Group (which entered the sapphire substrate sector in 2008 by acquiring Honeywell’s sapphire substrate factory in Canada and its technologies) is constructing a sapphire substrate base in Chongqing Municipality. By the end of 2010, the first phase of Silian Group’s sapphire substrate project had been commissioned, and production had begun at partial capacity.

Meanwhile, Yunan Crystaland, Harbin Aurora Optoelectronics Technology Co Ltd and other enterprises with independent crystal boule technology have been producing sapphire substrate on a small scale. Xiexin Optoelectronics, Eurasian Rainbow Optoelectronics Technology and TDG Holding began to enter the sapphire crystal boule and substrate sector in 2010, while Zhejiang Crystal-Optech and Xi’an Shenguang Anrui Optoelectronics Technology are preparing to enter in 2011, and the first phase of ZheJiang East Crystal Electronic Co Ltd’s upgrade project to produce 7.5 million sapphire wafers for LEDs is planned to start mass production by the end of 2012.

Generally speaking, judging from the capacity expansion rate, the supply of sapphire substrates will remain tight for the next three years at least, reckons CCID. However, as the sector starts to absorb massive investment in 2011 to expand production capacity, sapphire substrate output as a proportion of total LED substrate output is sure to surge and overtake substrate output for quaternary system products, the firm adds.

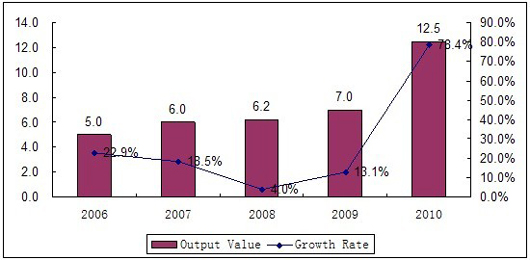

Driven by rapid development of China’s downstream application market, GaN metal-organic chemical vapor deposition (MOCVD) has seen explosive growth in China since 2009, providing great momentum for the epitaxy sector of China’s LED industry. In 2010, the number of MOCVD systems being installed and commissioned was nearly 300 (more than 200 of which had begun mass production) and the output value of China’s LED epitaxy sector rose by 78.4% to RMB1.25bn.

Figure 3: Size of China’s LED epitaxial sector (2006–2010).

Regarding specific products, AlGaInP epitaxy (used mainly in red LEDs) is a leading product in China due to its stable growth mechanism and material properties. However, the growth rate is far behind that for GaN epitaxial wafers because demand from its relatively mature application market is growing more slowly.

In 2010, output of AlGaInP/AlGaAs/GaAsP/GaP epiwafers accounted for 60.2% of total epiwafer output, down 15.8% from 2009. In contrast, supported by the rapidly expanding application market for blue and white light LEDs in landscape lighting and backlighting (as well as technical breakthroughs), GaN epiwafer output accounted for 39.8% of China’s total epiwafer output in 2010. It is expected that GaN epiwafer output will exceed that of AlGaInP epiwafers in 2011.

China is basically self-sufficient in epiwafer supply for normal-brightness red light LEDs, but still relies on imports of quality AlGaInP epiwafers from Taiwan and Korea for super-bright red light LEDs, says CCID. In addition, the country also has to import GaN epiwafers due to the small production capacity and inferior quality of domestic products.

As the production of LED epitaxial products requires massive investment, advanced technologies and experienced professionals, most epiwafer manufacturers are located in China’s wealthy areas in the east and the south, notes CCID. But with the expansion of epi market demand, new enterprises will continue to enter this sector, while existing enterprises will aim to expand capacity. For example, Sanan Optoelectronics has started to establish LED facilities in Tianjin and Anhui Provinces’ Wuhu City in addition to its existing plants in Xiamen. Meanwhile, apart from the favored locations of Shanghai, Xiamen and Yangzhou, newcomers are also beginning to locate their facilities in central China, notes CCID.

LED fab equipment spending triples in 2010, driven by China

LEDs LED backlighting LED lighting China LED market LED substrates LED epitaxy GaN SiC Sapphire GaAs/InP/GaP