- News

8 February 2011

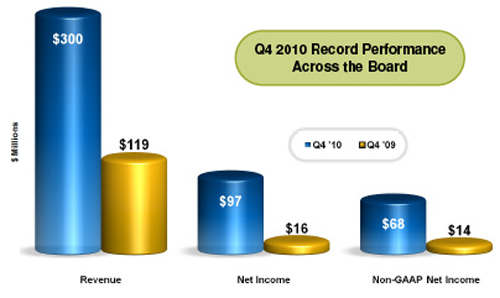

Veeco reports record quarterly revenue of $300m in Q4

For continuing operations in fourth-quarter 2010 (excluding the Metrology business, sold to Bruker Corp of Billerica, MA, USA on 7 October), epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported record revenue of $300m, up 8% on Q3’s $277.1m and up 152% on $119.1m a year ago.

Of this, 14% came from Data Storage revenue of $41.9m (the best since Q4/2008), up 21% on Q3’s $34.5m and double the $21m of a year ago.

The other 86% of total revenue came from record LED & Solar revenue of $258.1m, up 6% on Q3’s $242.6m and up 163% on $98.1m a year ago. In particular, MOCVD revenue was a record $240m, up 2% on $236m in Q3. MBE business also contributed to growth.

“The fourth quarter of 2010 was the best in our history,” says CEO John R. Peeler. Also, 2010 was the best year in Veeco’s history. For full-year 2010, revenue was a record $933m, up 230% on 2009’s $282.4m. In particular, Data Storage rose 75% to $135m. LED & Solar rose 289% to $798m, with MOCVD systems shipped to more than 40 LED customers worldwide. MOCVD market share rose from about 30% in 2009 to 46% in Q3, driven by the K465i (launched only in Q1/2010) becoming the industry’s best-selling MOCVD system, according to a market report by IMS Research.

Gross margin has continued to rise each quarter, from 44.9% a year ago and 48.9% in Q3/2010 to 50.9% in Q4 (at the high end of the expected 50–51%). This was due to higher volumes, good traction on driving down material cost, and higher-valued products in the mix. Full-year gross margin rose from 2009’s 39.4% to 47.6%.

On a non-GAAP basis, net income was a record $67.9m ($1.62 per share), up from $61.6m ($1.46 per share) in Q3 and just $13.6m ($0.36 per share) a year ago. Full-year net income was a record $188m ($4.42 per share), compared with 2009’s loss of $7m ($0.21 per share).

Including net proceeds of $225m from selling the Metrology business, during the quarter Veeco’s cash and short-term investments grew by $248.6m, from $466.8m to $715.4m. Also during the quarter, Veeco bought back about $6.5m of its stock at an average price of about $34.33 per share, bringing the total purchased so far under the year-long $200m buyback program (authorized on 24 August) to $38m (about 1.1 million shares).

Peeler attributes the firm’s results to its focus on high-growth market opportunities, operational excellence, and a flexible manufacturing strategy. “The total available market for MOCVD from 2011 through 2015 is greater than 5000 reactors,” he reckons. To capitalize on this opportunity, drive business, and continue to gain market share, Veeco has launched the TurboDisc MaxBright multi-reactor (cluster) MOCVD system. “By dramatically accelerating our new product roadmap to create MaxBright — the most productive MOCVD system on the market — Veeco will help enable the industry’s transition to LED lighting,” Peeler believes.

Picture: TurboDisc MaxBright GaN MOCVD multi-reactor system.

Q4 order bookings were $294.9m (up 6% on Q3’s $278.2m). Of this, 14% came from Data Storage ($42m, down 21% on the very strong $53.1m a year ago — which had represented a catch-up in customers’ capacity spending — but up 20% on Q3’s $35m as technology buys for new Veeco deposition systems continue). The other 86% of total orders came from LED & Solar ($252.9m, up 4% on Q3’s $243.2m and up 43% on a year ago). In particular, MOCVD system orders totaled $221m, coming from 20 customers across all regions (a record quarterly customer count). Bookings were again heavily concentrated in China (12 customers, with wins including multi-tool orders from EnRay-Tech, Shanghai Epilight and Focus Lighting). However, there were also key customer wins in the USA, Europe, Japan, Taiwan and Korea. MBE system orders also improved from the low level seen in Q3 to $32m, including several orders for production tools. For full-year 2010, orders of $1.12bn are more than double 2009’s $538.3m.

For first-quarter 2011, Veeco expects revenue to fall to $215–265m. “Revenues will be lower than Q4/2010 because we are planning to ship 12–20 MOCVD reactors in the new MaxBright ‘cluster’ format, and will not be recording any revenue on these systems in the first quarter,” notes Peeler. “Timing of revenue is also being impacted by the longer order-to-revenue cycle times associated with the high percentage of business currently coming from China, primarily due to customer facility readiness [since many are expanding or building new fabs],” he adds. “The average time to convert orders to revenue is currently several months longer in China than in other regions.”

However, while non-GAAP earnings per share should fall to $1.02–1.39 for Q1/2011, gross margin should rise further to 51–52%.

For first-half 2011, Veeco expects strong order bookings, as (i) Chinese government subsidies continue to drive LED fab expansion across a broad customer base, (ii) Korean customer utilization rates increase (with order rates improving in Q2–Q3 as customers are focused on LED backlight units and lighting), and (iii) Veeco continues to penetrate key accounts in the USA, Europe, Taiwan and Japan with the K465i (and now with the new MaxBright MOCVD systems expected to assist market share gain).

With starting order backlog of $555m at the beginning of 2011, for full-year 2011 Veeco therefore expects revenue to rise to more than than $1bn and non-GAAP earnings per share to rise to more than $5.00. “We are optimistic about the future and confident that we are well positioned from a technology, product and operational standpoint to grow our LED & Solar and Data Storage businesses in 2011 and beyond,” comments Peeler. In particular, Veeco expects 2011 to be a solid year for MOCVD tool demand, driven by LED back-light units and lighting (with a next-generation product already in development for 2012). In addition, the firm expects its CIGS (copper indium gallium diselenide) Solar business to begin to deliver revenue in 2011, as the firm is shipping tools to key customers.

Veeco grows a further 25% in Q3; on track for $1bn in 2010

Veeco’s record Q2 driven by LED & Solar revenues growing 66% from Q1

Veeco’s LED & Solar orders up seven-fold year-on-year as backlog reaches $0.5bn

Veeco’s MOCVD revenue more than doubles sequentially

Veeco investor fact sheet (632 KB)

Join Semiconductor Today's group on LinkedIn