| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

News

3 May 2010

Q1 handset shipments of 303 million show 3G eclipsing 2G

“Despite ash clouds over Europe, handset shipments globally for 1Q-2010 powered ahead to 303 million, up 19% year-on-year,” says Jake Saunders, VP for Forecasting at market analyst firm ABI Research. “This bodes well for 2010 as a whole: shipments could well reach 1.3bn,” he adds. “It is also notable that 3G handset shipments eclipsed 2G handset shipments.”

The strongest handset shipment growth was seen in the Middle East and Africa (20% year-on-year) followed by the Americas, particularly the US (11%). However, Europe is languishing with single-digit growth.

The strongest handset shipment growth was seen in the Middle East and Africa (20% year-on-year) followed by the Americas, particularly the US (11%). However, Europe is languishing with single-digit growth.

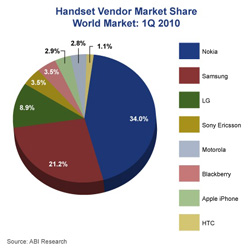

Graphic: Handset-vendor-market-share.jpg Handset vendor market share, Q1/2010.

Nokia’s market share was 34%. New smartphones such as the N8 are helping to shore up its handset portfolio, as its loss of traction in the smartphone sector hit sales hard. In response, revamped efforts with Symbian ^3 and ^4 are intended to help it regain momentum, says ABI. Nokia is counting on smartphones expanding into the mid-tier and low-tier segments where it believes it has strength.

Samsung had a strong quarter, securing 21% market share. Over the past year, Samsung has been cultivating deeper relationships with US and European carriers, which helped grow its shipments 40.2% year-on-year, says ABI.

LG’s market share (8.9%) has suffered from a weak smartphone portfolio in the North American market. The firm has been traditionally strong in the enhanced phone sector, and has been giving some of its older enhanced phones a smartphone twist (for example, its Chocolate phone has gone wide-screen). LG’s shipments grew 20% year-on-year.

Motorola (2.8%) is benefiting from its initial success with the Droid and is keen to back it up with new products such as the Quench, but the market is overtaking it. The firm is hoping that the strong social networking theme to its smartphone line-up will help it to curry favor with the youth and prosumer markets.

Q1/2010 proved to a strong quarter for Apple, with 8.75m devices shipped (giving it 2.9% market share), which is up a remarkable 130% year-on-year. iPhone OS release 4, which brings multi-tasking and in-app advertising capabilities, should help to maintain momentum. Nevertheless, Apple should diversify its lineup, says ABI.

See related item:

Handset semiconductor sales rebound in Q4/09

![]() Search: Handset shipments

Search: Handset shipments

Visit: www.abiresearch.com