| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

News

6 April 2010

Optoelectronics, sensors and discretes to hit record sales in 2010

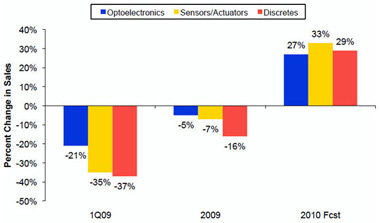

After a horrific first-quarter 2009, semiconductor sales of optoelectronics and solid-state sensor devices staged dramatic turnarounds and finished the full year with declines of just 5% and 2%, respectively, from record revenues in 2008, according to market research firm IC Insights Inc’s ‘2010 Optoelectronics, Sensors, and Discretes (O-S-D) Report’ (which excludes integrated circuit sales).

Picture: Q1 sales slumps and full-year performance in 2009, and 2010 forecast for O-S-D market segments.

In particular, the optoelectronics market was aided by continued double-digit growth of LED sales throughout the 2009 downturn year due to strong demand for high-brightness devices in LCD-TVs and new solid-state lighting applications. Consistently higher growth rates enabled optoelectronics sales to exceed discretes by more than $3bn in 2009, after exceeding them for only the first time in 2008 (and being only a quarter to a half the dollar volume of discretes in the 1980s and 1990s).

Recoveries in discrete semiconductors and actuator devices were also impressive in the final three quarters of 2009, but those market segments still fell by 16% and 12%, respectively, in 2009.

The turnaround in 2009 was driven mostly by the replenishment of inventories at systems manufacturers once their markets stabilized following the sharp falloff in product demand in the depth of the 2008–2009 recession. In almost all O-S-D product categories, sequential quarterly sales growth rebounded in Q2/2009 by 20–40% from the economically depressed levels in Q1/2009. Those increases continued through the rest of the year, turning 2009 into a modest setback for optoelectronics and the sensor/actuator markets. However, the discretes market segment—including power transistors—faced a greater uphill climb out of the early slump in 2009 and finished the year with a decline of 16%—its second worst drop in 25 years behind the 25% plunge in the 2001 semiconductor recession. In particular, power transistors now account for 55% of revenues generated by discretes, with 42% coming from MOSFET and IGBT products in 2009.

Strong recovery momentum is expected to continue in 2010 with optoelectronics, sensors/actuators, and discretes markets all reaching record revenues, with combined O-S-D revenues rising 29%—the highest one-year increase since early last decade. Optoelectronics will rise 27% to $23.3bn, sensors/actuators 33% to $6.8bn, and discretes 29% to $19.7bn. Within the sensors/actuators segment, sales of devices made with micro-electro-mechanical systems (MEMS) technology are forecast to grow fastest of all, at 34% to $5.6bn in 2010, after declining 5% in 2009 to $4.2bn.

In 2010, the strong sales growth in optoelectronics, sensors/actuators, and discretes will be driven by the ongoing recovery in demand for portable electronics, consumer products, high-speed networks, notebook PCs, cell phones, industrial & medical equipment, and automotive systems, according to the report. During the 2009–2014 forecast period, combined O-S-D sales are expected to rise at a compound annual growth rate (CAGR) of about 13%, compared to just 12% for IC sales, driven by the greater growth rates for MEMS-based accelerometers, gyroscope devices, actuators, pressure sensors, high-brightness LEDs, CMOS image sensors, and optical-network laser transmitters.

By 2014, optoelectronics sales are expected to exceed discrete revenues by nearly $10bn, with strong growth being driven by image sensors, LED-based solid-state lamps, and laser transmitters for fiber-optic networks. In particular, CMOS image sensors have overtaken CCDs in total revenue and are forecast to represent 71% of units in the image sensor market by 2014.

Overall, O-S-D revenues will account for 17% of the total $419bn semiconductor market in 2014, it is forecast, compared to 16% of $238bn in 2009 and about 13% a decade ago.

See related items:

LED-backlit TVs to reach 20% of 180m-unit LCD TV market in 2010

LEDs to surpass CCFL in large-area TFT LCD backlights in 2011

LED-backlit LCD-TV shipments to rise eight-fold in 2010

Visit: www.icinsights.com/prodsrvs/osdreport