| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

18 December 2009

LED market to nearly double to $14.3bn by 2013

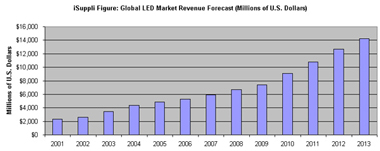

The use of LEDs for general illumination in the coming holiday season is paving the way for double-digit LED market growth in 2009 followed by a near doubling in revenue by 2013, according to iSuppli Corp in its report ‘Solid State Lighting: Backlighting of LCD TVs and General Illumination Drive a Bright Market for LEDs’.

Graphic: Market for standard-brightness, HB and high-power through-hole, surface-mount device (SMD) and display LED lamps.

Multiple retailers around the world are actively promoting LED lights for indoor and outdoor decorative illumination applications. Meanwhile, LED lights with Edison sockets used for replacing conventional light bulbs are starting to appear on the shelves of many of these stores, making them a viable choice for general illumination applications, iSuppli says.

“The LED industry is on the threshold of a new expansion phase — a phase that will be characterized by growth rates in the high double digits during the next three years,” says Dr Jagdish Rebello, director & principal analyst. “This growth will be driven by the increased adoption of high-brightness (HB) and high-flux [high-power or ultra-high-brightness (UHB)] LEDs into a new range of next-generation lighting applications,” he adds. LED revenues were $6.7bn in 2008, and will grow by 10.9% in 2009 to $7.4bn (in stark contrast to the overall semiconductor market, which is expected to contract by 12.4% because of the slowdown in the global economy). By 2013, the LED market will reach $14.3bn, nearly double from 2009.

Beyond general illumination, this growth is being driven by the rising penetration of LEDs as the lighting source of choice for many existing lighting applications, including automotive, traffic and street lighting, the backlighting of small LCD displays and keypads in mobile handsets, personal navigation devices, digital picture frames and cameras. The market is also being boosted by the emergence of new applications, such as backlighting of large-sized LCDs in TVs, notebooks and computer monitors and personal illumination.

As predicted by iSuppli in 2007, LEDs have now started to penetrate the general illumination market for residential dwellings and enterprise offices. Also, while the retail prices for LED light bulbs are still about an order of magnitude higher than those of traditional incandescent lamps, customers are increasingly becoming aware of the power savings and long-life benefits of solid-state LED lights, says the market research firm.

As expected, the solid-state lighting market for HB and high-flux devices will outpace overall LED market growth through 2013. Over these next three years, the traditional market for standard-brightness LEDs will fall by about 2.5%, while the market for HB-LEDs will grow by 6.7% to about $5.4bn and the market for high-flux LEDs will grow by almost 53% to reach $7.8bn.

For general illumination, the development of high-flux LED light bulbs with luminous efficacy exceeding 100 lumens per watt — and designs that allow LEDs to run on AC current without the need for an inverter — are pushing LEDs closer to adoption in the mainstream general illumination market, says iSuppli.

LEDs are already being used in various indoor and outdoor decorative illumination applications and are just starting to target the market for general lighting in homes and enterprises, the firm continues. In addition to the performance advantages offered by solid-state lighting, legislation around the world is increasingly seeking to ban the use of incandescent light in favor of more energy-efficient light sources, pushing LEDs rapidly into mainstream general illumination.

Even in the near term, the advantages of solid-state lighting are beginning to outweigh the cost differential between LEDs and compact fluorescent lamps (CFLs), says iSuppli. As progress is made in LED performance, the cost differential will continue to narrow.

“iSuppli projects that LED light bulbs will address the residential and enterprise general illumination market in earnest in 2010,” says Rebello. “Without a doubt, the long-term future of general illumination is LEDs.”

See related items:

HB-LEDs to drive doubling of MOCVD sales to 415 systems in 2011

HB-LED market to grow at 24% to 2013 after 3.7% dip in 2009

![]() Search: LED backlighting

Search: LED backlighting

Visit: www.isuppli.com