| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

14 December 2009

Solar cell to return to high growth in 2010

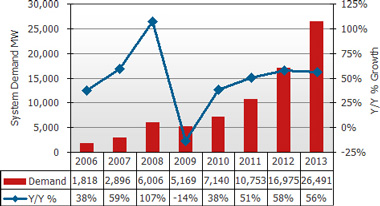

This year marked the photovoltaic industry’s first solar cycle, with end-market demand shrinking 14% year-over-year, according to the DisplaySearch’s fourth-quarter 2009 ‘Quarterly PV Cell Capacity Database & Trends Report’.

The contraction was caused by changes in Spain’s generous incentive policy, and was severely aggravated by the worldwide economic crisis and tight credit markets, explains the market research firm. Excess manufacturing capacity has helped to push average PV system prices down by more than 25%. However, these lower prices, diversification of the demand base, and positive incentive movement in multiple regions are now expected to drive substantially higher demand in 2010.

“Despite the long-term bright outlook for solar, 2009 demonstrated the industry’s cyclicality and that it is still highly dependent on incentives,” states Charles Annis, VP of manufacturing research. “During 2009, there has been nearly 60% over-supply in cell capacity, which means that average fab utilization rates have only been around 40% industry-wide,” he adds.

“In the first half of 2009, most solar cell manufacturers were under severe pressure and were losing money,” he continues. “However, because the PV industry is so broad-based and diverse, many of the leading producers have already returned to profitability and are running factories at high utilization and moving forward with expansion plans.” Demand in second-half 2009 is proving to be robust and setting the stage for 38% growth next year.

DisplaySearch predicts that solar cell manufacturing capacity will grow 56% to more than 17 GW in 2009, before slowing somewhat in 2010 and 2011 as demand starts catching up to capacity.

Figure: Solar cell end-market demand.

Due to the current cell overcapacity, some firms are shuttering older lines and delaying ramp-up and new investments. For example, Q-Cells is shutting down its first four lines in Germany, as they are not as productive as newer fabs, and adjusting its ramp-up at newer Malaysian lines. This leaves Q-Cells with 836MW of ramped capacity, causing it to slip to fourth place in the 2009 capacity ranking behind First Solar (the dominant cadmium telluride-based PV manufacturer), Suntech and Sharp, with cell capacities of 1,092MW, 950MW and 870MW, respectively.

On the other hand, many other firms clearly believe in the long-term, high-demand growth scenario and are moving forward with large-scale capacity projects, says DisplaySearch. In Japan, Japan’s Showa Shell Solar is expected to start construction next year on a 900MW copper indium gallium diselenide (CIGS) PV product factory in Miyazaki, and Sharp has just reiterated its plans to begin ramping its 480MW thin-film line in Sakai by March 2010, producing triple junction amorphous silicon (a-Si) modules with a conversion efficiency of 10%.

DisplaySearch says that supply/demand analysis in the report supports this outlook; by 2012/2013 solar cell manufacturers will likely need to be adding more capacity in order to keep up with forecast demand, it concludes.

See related item:

PV overcapacity to drive 32% drop in market in 2009

![]() Search: Photovoltaics Solar cells

Search: Photovoltaics Solar cells

Visit: www.displaysearch.com