| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

20 August 2009

LED backlight penetration in LCD TVs to reach 40% in 2013 and surpass CCFLs in 2014

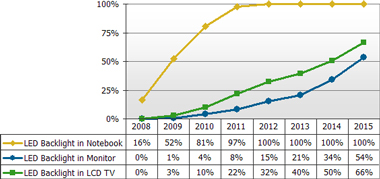

The LED backlight market has rapidly emerged in the TFT liquid-crystal display (LCD) industry and is expected to continue growing for the next five years, according to DisplaySearch’s most recent Quarterly LED & CCFL Backlight Report. Specifically, the penetration rate of LED backlights for LCD TVs should grow from less than 3% in 2009 to 40% in 2013 and more than 50% in 2014, surpassing CCFL backlights.

Figure: Large-area LED backlight unit penetration rate by application. Credit: DisplaySearch.

Meanwhile, large-area LED backlight shipments for all applications will grow from 84.9 million units in 2009 to 434.8 million units in 2013, when LED backlights will be used in 54.3% of 10”+ TFT LCD panels. LED backlights will thus become mainstream in the TFT LCD industry.

While LED backlights for LCD TVs are growing rapidly, notebook PCs are the leading application for large-area LED backlight units, and DisplaySearch forecasts that all new notebook models will have LED backlights by 2012.

Backlight units for LCD TV are expected to be the next growth opportunity for the LED industry, with leading brands such as Samsung, LG, Sharp and Philips all expected to mass produce LED backlit LCD TVs in 2010. As a result, LED backlight units for TVs are forecast to grow to 3.6 million units in 2009 and 15.1 million units in 2010.

Firms like Samsung are focusing on the development of edge-lit LED backlights, which can reduce the bill of materials by 30-40% compared to direct-lit models. “Edge-lit LED backlight units for LCD TV are a temporary solution to drive costs down to open market acceptance for ‘LED TV’ as a short-term marketing strategy,” notes DisplaySearch research director Luke Yao. “Consumers want a low-cost solution with acceptable picture quality, but aren’t always willing to pay a higher premium, making edge-lit LEDs an ideal near-term solution,” he adds.

For the monitor segment, cost and performance remain bottlenecks for panel manufacturers creating LED-backlit monitors. Taiwanese panel makers like AUO and Innolux have been the most aggressive in developing LED monitor panels. Because LED monitor panel sizes (18.5”, 21.5”, 23.6” and 24”) are also used for TV, DisplaySearch has refreshed its forecasted penetration rate for LED monitor backlight units to 21% in 2013. Currently, panel makers are putting effort into shrinking the LED backlight premium to $3-5 for 18.5” panels. From 2010, LED backlight monitors will be developed and supported by brand-name makers, expects DisplaySearch.

See related items:

LCD backlight LEDs to grow from 8bn in 2008 to 34bn in 2012

Large-area LED-backlit LCD panel shipments pass 10m units in Q1, reaching 12% penetration

Penetration of LED-backlit LCD-TVs to grow 13-fold by 2013

Backlighting demand produces 'flood of orders' for Taiwan's LED chip makers

![]() Search: LED backlighting

Search: LED backlighting

Visit: www.displaysearch.com